UAE Medication Access Programs Market Analysis

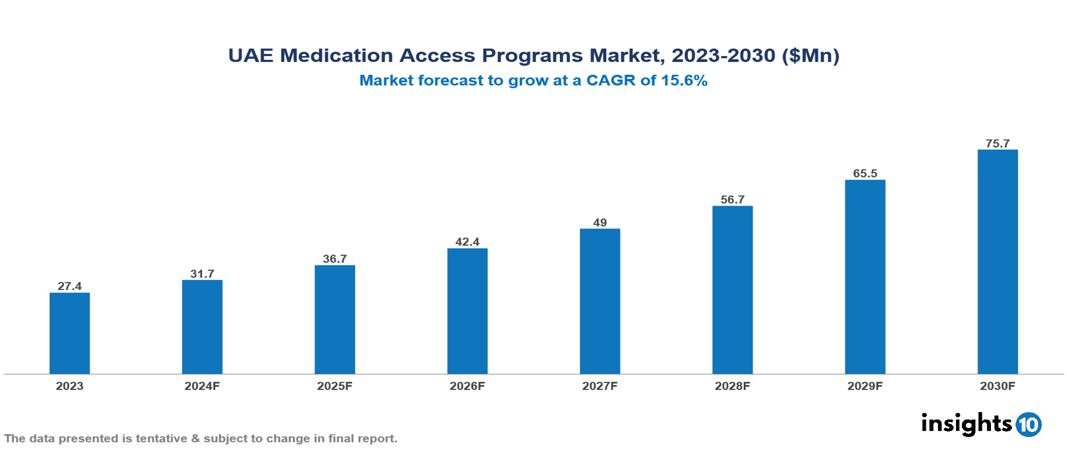

The UAE Medication Access Programs Market was valued at $27.4 Mn in 2023 and is predicted to grow at a CAGR of 15.6% from 2023 to 2030, to $75.7 Mn by 2030. The key drivers of this industry include increasing healthcare expenditure, government initiatives, and the rising prevalence of chronic disease. The industry is primarily dominated by players such as Gilead Sciences, Takeda Pharmaceuticals, Pfizer, and Novartis among others.

Buy Now

UAE Medication Access Programs Market Executive Summary

The UAE Medication Access Programs Market was valued at $27.4 Mn in 2023 and is predicted to grow at a CAGR of 15.6% from 2023 to 2030, to $75.7 Mn by 2030.

Patient Support Programs (PSPs) are initiatives launched by pharmaceutical companies to improve patient access, utilization, and adherence to prescribed medications. These programs typically include financial assistance, clinical guidance, educational resources, or a combination of these components. Within PSPs, Medication Access Programs (MAPs) play a critical role as they facilitate essential connections between patients and the medications they require. Managed Access Programs specifically focus on providing early access to investigational medicines or treatments for patients facing serious or life-threatening conditions who have exhausted other treatment options and are ineligible for clinical trials. MAPs offered by pharmaceutical firms aim to alleviate financial obstacles to accessing crucial medications. Implementing a centralized, pharmacy-driven MAP can lead to enhanced patient outcomes, reduced unnecessary healthcare expenses, increased satisfaction among patients and healthcare providers, smoother patient management processes, and potentially higher revenue through improved prescription fulfillment.

Worldwide, 32% of pharmaceutical and biotechnology companies provide over five varieties of patient support programs. Healthcare expenditures in the UAE are projected to increase to $34 Bn by 2027, with $28.3 Bn allocated to the public sector and $5.98 Bn to the private sector. The market is driven by significant factors like increasing healthcare expenditure, government initiatives, and the rising prevalence of chronic disease. However, limited awareness, supply chain issues, and data privacy concerns restrict the growth and potential of the market.

Prominent players in this field include Gilead Sciences and Takeda Pharmaceuticals which provide Medication Access or Access to Medicine Program. Pfizer, Novartis, Merck, and AstraZeneca among others are some of the pharmaceutical companies providing patient support programs and are potential players for the Medication Access Program in UAE.

Market Dynamics

Market Growth Drivers

Increasing Healthcare Expenditure: Healthcare spending in the UAE is increasing, with projections indicating it will reach $34 Bn by 2027. This financial growth supports the expansion and implementation of Medication Access Programs. As a market driver, this increased spending enhances the resources available for MAPs, facilitating better access to essential medications and improving overall healthcare delivery.

Government Initiatives: The UAE government is actively advancing healthcare reforms and policies to improve access to medications and healthcare services, creating a supportive environment for Medication Access Programs. This serves as a market driver because government initiatives provide the regulatory and infrastructural support necessary for the successful implementation and growth of MAPs, ensuring broader access to essential medications for the population.

Rising Prevalence of Chronic Disease: A study conducted among UAE University students revealed that 23.0% of them reported having at least one chronic disease, with obesity, diabetes, and asthma being the most prevalent. This is a market driver for Medication Access Programs because the high prevalence of chronic diseases increases the demand for consistent and reliable access to medications, making MAPs essential for managing these conditions and improving patient health outcomes.

Market Restraints

Limited Awareness: Limited awareness among patients and healthcare providers about the existence and advantages of Medication Access Programs can lead to lower participation and utilization rates. This acts as a market restraint because it hampers the effectiveness and reach of MAPs, preventing them from fully addressing the medication access needs of the population.

Supply Chain Issues: Interruptions in the pharmaceutical supply chain, including importation or distribution delays, can impact the timely availability of medications. This is a market restraint for Medication Access Programs (MAPs) in the UAE because it can lead to medication shortages, compromising the reliability and effectiveness of these programs in providing essential treatments to patients.

Data Privacy Concerns: Maintaining the privacy and security of patient data within Medication Access Programs (MAPs) is a major concern, which can potentially limit patient enrollment and participation. This is a market restraint because concerns about data privacy and security can deter patients from joining MAPs, thereby reducing their overall effectiveness and reach in providing necessary medications.

Regulatory Landscape and Reimbursement Scenario

In the UAE, the federal healthcare authority is the Ministry of Health and Prevention. Within their respective emirates, the Department of Health - Abu Dhabi, the Dubai Health Authority (DHA), and the Sharjah Health Authority perform similar regulatory functions. These regulatory organizations implement programs and campaigns to enhance community health by offering comprehensive and innovative healthcare services and raising public health awareness. The UAE permits special access programs to provide patients with medicines not yet registered or available in the country. Patients or healthcare providers can apply to the Ministry of Health and Prevention (MOHAP) for permission to import unregistered medicines for personal or compassionate use.

Additionally, health insurance is mandatory for employers in Abu Dhabi and Dubai, and it is a nationwide requirement starting on 1 January 2025. This policy ensures that all residents have health insurance coverage, guaranteeing access to healthcare services and reimbursement for medical expenses.

Competitive Landscape

Key Players

Here are some of the major key players in the UAE Medication Access Programs Market:

- Gilead Sciences

- Takeda Pharmaceuticals

- Pfizer

- Novartis

- Merck

- AstraZeneca

- Bristol-Myers Squibb

- Sanofi

- Eli Lilly

- AbbVie

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Medication Access Programs Market Segmentation

By Disease Type

- Chronic

- Acute

By Therapeutic Areas

- Oncology

- Cardiology

- Rheumatology

- Others

By Patient Type

- Geriatric

- Pediatric

- Adult

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.