UAE Lung Cancer Drugs Market Analysis

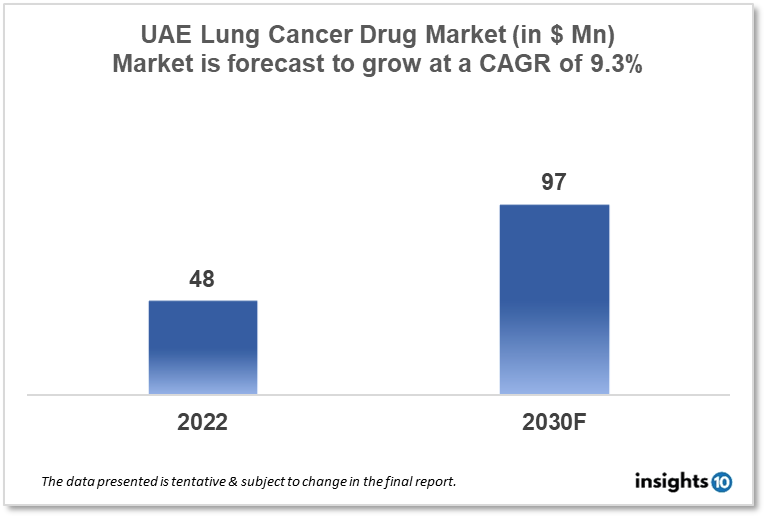

The UAE Lung Cancer Drug Market is projected to grow from $48 Mn in 2022 to $97 Mn by 2030, registering a CAGR of 9.3% during the forecast period of 2022 - 2030. According to the World Health Organization (WHO), lung cancer is the second most common cancer in both men and women in the UAE, accounting for 13% of all cancer cases. Some of the major local players in the UAE lung cancer drug market include Emirates Pharmaceutical Industries, Gulf Pharmaceutical Industries, and Julphar.

Buy Now

UAE Lung Cancer Drug Market Executive Summary

The UAE Lung Cancer Drug Market is projected to grow from $48 Mn in 2022 to $97 Mn by 2030, registering a CAGR of 9.3% during the forecast period of 2022 - 2030.

The pharmaceutical market in the United Arab Emirates (UAE) is one of the most developed in the Middle East and North Africa (MENA) region. The market is valued at around $3 billion and is expected to continue growing at a steady rate in the coming years. The UAE government has been actively promoting the development of the pharmaceutical industry and has implemented various initiatives to support the growth of domestic production and attract foreign investment. The government has also implemented regulations to ensure the quality and safety of pharmaceutical products in the country. The main players in the UAE pharmaceutical market include local and international companies, with a significant presence of generic drug manufacturers. The market is primarily driven by factors such as a growing population, increasing healthcare expenditure, and a rise in chronic diseases.

Lung cancer is one of the most common types of cancer in the United Arab Emirates (UAE). According to the World Health Organization (WHO), lung cancer is the second most common cancer in both men and women in the UAE, accounting for 13% of all cancer cases. The incidence of lung cancer in the UAE is relatively high compared to other countries in the region and is likely due to a combination of factors such as high rates of smoking, exposure to environmental pollutants, and genetic predisposition.

Tobacco use is one of the main risk factors for lung cancer in the UAE, with smoking rates being higher among men than women. According to a study conducted by the UAE Ministry of Health and Prevention, around 22% of adult men in the UAE smoke tobacco. The study also found that the prevalence of smoking among men decreases with age, but increases with education level and income.

The UAE government has implemented various measures to reduce the incidence of lung cancer in the country, such as implementing a nationwide tobacco control program, raising taxes on tobacco products, and increasing public awareness about the dangers of smoking.

In terms of treatment, lung cancer patients in UAE have access to advanced diagnostic and therapeutic options, including surgery, radiation therapy, and chemotherapy. The country has well-equipped cancer centers and hospitals to provide cancer treatment.

Overall, lung cancer is a major public health concern in the UAE, and more efforts are needed to reduce the incidence of the disease and improve the outcomes of patients.

Market Dynamics

Market Drivers

There are several key drivers of the lung cancer drug market in the United Arab Emirates (UAE):

- Increasing incidence of lung cancer: The high incidence of lung cancer in the UAE, driven by factors such as high rates of smoking and exposure to environmental pollutants, is a major driver of the lung cancer drug market.

- Government initiatives: The UAE government has implemented various initiatives to reduce the incidence of lung cancer in the country, such as implementing a nationwide tobacco control program, raising taxes on tobacco products, and increasing public awareness about the dangers of smoking. These initiatives have led to an increased demand for lung cancer drugs in the UAE.

- Advancements in treatment options: The development of new and more effective treatments for lung cancer, such as targeted therapies and immunotherapies, has led to an increased demand for these drugs in the UAE.

- Growing healthcare expenditure: The UAE government is investing heavily in the healthcare sector and increasing healthcare expenditure, which is expected to drive the growth of the lung cancer drug market in the country.

- Rising prevalence of chronic diseases: The rise in chronic diseases such as lung cancer, due to factors like lifestyle, diet, and environmental pollution, is also driving the growth of the lung cancer drug market in the UAE.

- Availability of advanced technology: The availability of advanced technologies and well-equipped cancer centers and hospitals to provide cancer treatment in UAE also helps to drive the growth of the lung cancer drug market in the country.

Competitive Landscape

Key Players

The key players in the UAE lung cancer drug market include a mix of local and international pharmaceutical companies. Some of the major players in the market include:

- Pfizer: Pfizer is one of the leading pharmaceutical companies in the UAE, and has a significant presence in the lung cancer drug market. The company offers a range of lung cancer drugs, including Xalkori, Ibrance, and Alectinib

- Novartis: Novartis is another major player in the UAE lung cancer drug market. The company offers a range of lung cancer drugs, including Tafinlar and Mekinist, which are used to treat non-small cell lung cancer (NSCLC)

- AstraZeneca: AstraZeneca is a major player in the UAE lung cancer drug market, and offers a range of lung cancer drugs, including Tagrisso and Imfinzi, which are used to treat NSCLC

- Bristol-Myers Squibb: Bristol-Myers Squibb is a major player in the UAE lung cancer drug market, and offers a range of lung cancer drugs, including Opdivo and Yervoy, which are used to treat NSCLC

- Roche: Roche is another major player in the UAE lung cancer drug market, and offers a range of lung cancer drugs, including Tarceva, Tecentriq, and Avastin, which are used to treat NSCLC

Local pharmaceutical companies: Some of the major local players in the UAE lung cancer drug market include Emirates Pharmaceutical Industries, Gulf Pharmaceutical Industries, and Julphar. They also offer a range of lung cancer drugs and other cancer drugs.

It's worth noting that the above-mentioned companies are some of the key players in the lung cancer drug market, but there are also other local and international companies with a presence in the UAE that also offer lung cancer drugs, as well as other cancer drugs.

Healthcare Policies and Regulatory Landscape

The United Arab Emirates (UAE) has a healthcare system that is considered to be one of the most advanced in the Middle East. The country's healthcare system is regulated by the Ministry of Health and Prevention (MOHAP) and the Dubai Health Authority (DHA). The MOHAP and DHA are responsible for setting healthcare policies, regulations, and guidelines, including those related to the approval and reimbursement of drugs for lung cancer.

In terms of reimbursement, the UAE has a national formulary that lists the drugs that are covered by the country's national health insurance scheme. Drugs for lung cancer are generally covered by the national health insurance scheme, but the specific drugs that are covered may vary depending on the stage and type of cancer.

In terms of approval, the UAE follows a centralized process for the registration of drugs. The MOHAP is responsible for the registration of drugs in the country and the DHA is responsible for the registration of drugs in Dubai. The process for registering a drug in the UAE typically involves submitting an application to the MOHAP or DHA, along with clinical trial data and other relevant information. The MOHAP or DHA will then review the application and make a decision on whether to approve the drug for use in the country.

Overall, the UAE has a well-established healthcare system with regulations and policies that are in place to ensure the safety and efficacy of drugs for lung cancer.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Lung Cancer Drugs Market Segmentation

By Disease type

- Small Cell Lung Cancer (SCLC)

- Non-Small Cell Lung Cancer (NSCLC)

By Drug

- Gemzar

- Paraplatin

- Texotere

- Others

By End-user

- Hospitals

- Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.