UAE Gram-Negative Infection Therapeutics Market Analysis

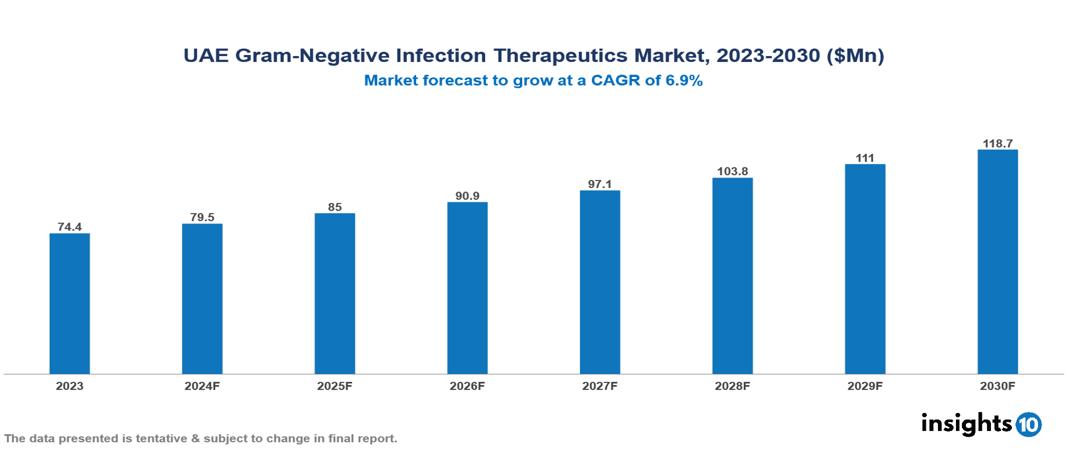

The UAE Gram-Negative Infection Therapeutics Market was valued at $74.4 Mn in 2023 and is predicted to grow at a CAGR of 6.9% from 2023 to 2030 to $118.7 Mn by 2030. This growth is driven by increasing prevalence, with a rate of approximately 9.8% in healthcare settings. Major players in this market include AbbVie Inc. and Bayer AG, among others.

Buy Now

UAE Gram-Negative Infection Therapeutics Market Executive Summary

The UAE Gram-Negative Infection Therapeutics Market was valued at $74.4 Mn in 2023 and is predicted to grow at a CAGR of 6.9% from 2023 to 2030 to $118.7 Mn by 2030.

Gram-negative bacteria are a diverse group found in various environments, from soil to the human gut. Unlike gram-positive bacteria, they have an outer membrane that shields them from certain antibiotics, like penicillin. However, when this membrane breaks down, it releases harmful toxins called endotoxins, worsening infections. These infections vary from urinary tract infections to more severe cases like pneumonia, peritonitis, bloodstream infections, wound infections, and meningitis. Despite available treatments, antimicrobial resistance is a major challenge. Therefore, swift and accurate identification of gram-negative bacteria, coupled with proper antibiotic selection, is crucial. Ongoing research focuses on combination therapy and developing new antimicrobial agents to tackle growing resistance.

UAE is burdened with antibiotic-resistant gram-negative bacteria, estimated at around 10%. Market growth is propelled by high prevalence, increasing antibiotic resistance, and an aging population. In contrast, high costs, lack of innovation in the antibiotic pipeline, and complexity of gram-negative bacteria restrain the market.

Market Dynamics

Market Growth Drivers

High Prevalence: In the UAE, hospital-acquired infections (HAIs) are a significant concern, with a prevalence rate of about 9.8% in healthcare settings. The burden of antibiotic-resistant gram-negative bacteria in the UAE is estimated to be around 10%. The rise in antibiotic-resistant gram-negative bacteria like Acinetobacter baumannii and Klebsiella pneumoniae has increased the need for effective treatments, thus driving the market.

Increasing Antibiotic Resistance: A study published in Antimicrobial Resistance and Infection Control found that antibiotic resistance rates among gram-negative bacteria in the UAE exceed 50%. This growing resistance drives the demand for alternative therapies, such as novel antibiotics or bacteriophages, making it a key market driver for Gram-negative infection therapeutics.

Aging Population: The UAE's aging population, projected to reach 18.5 older adults per 100 working-age adults by 2050, is more susceptible to Gram-negative infections due to age-related immune decline. This demographic shift, along with a high prevalence of healthcare-associated infections like hospital-acquired pneumonia (HAP) and ventilator-associated pneumonia (VAP) among the elderly, increases the demand for targeted therapeutics. With high ventilator utilization ratios in UAE ICUs, there is a significant need for effective treatments for Gram-negative infections in older adults, highlighting the market demand for tailored solutions in the UAE, thus driving the market.

Market Restraints

High Costs: Developing new antibiotics is expensive and lengthy, with costs reaching up to $1 Bn and a development time of 10-15 years. The high failure rate, with only 1 in 10,000 antibiotic developments succeeding, discourages pharmaceutical companies from investing in R&D for new antibiotics, thus restraining the market.

Lack of Innovation in the Antibiotic Pipeline: The World Health Organization (WHO) has highlighted that the current antibiotic arsenal lacks the innovation to combat emerging infectious diseases. The pipeline for new antibiotics is weak, with few treatments in development offering significant improvements over existing options, hindering efforts to address drug-resistant Gram-negative infections. These factors contribute to market restraints by limiting the availability of novel solutions to combat antibiotic resistance.

Complexity of Gram-Negative Bacteria: Treating gram-negative bacteria is particularly challenging due to their complex cell walls and the rapid emergence of resistance. This complexity delays the development of effective treatments, making it challenging to produce new antibiotics. Such challenges in understanding and combating gram-negative bacteria impede the growth of viable solutions to address antibiotic resistance in this specific bacterial class, thus adding to market restraints.

Regulatory Landscape and Reimbursement Scenario

The reimbursement scenario for gram-negative infection therapeutics in the UAE is complex, involving multiple payers, including government health insurance schemes, private insurance companies, and out-of-pocket patient payments. The UAE government prioritizes access to essential medicines, which may benefit the reimbursement of some gram-negative infection treatments. The Emirates Drug Establishment (ED) and the Ministry of Health and Prevention (MOHAP) are key regulatory bodies ensuring the safety, efficacy, and quality of pharmaceutical products in the UAE. At the same time, the Regulatory Committee at the Ministry of Health and Prevention (RCMOHP) reviews clinical trial applications and ensures compliance with UAE regulations.

Competitive Landscape

Key Players

Here are some of the major key players in the UAE Gram-Negative Infection Therapeutics Market:

- Merck & Co., Inc.

- AstraZeneca

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Sanofi-Aventis

- Novartis

- Johnson & Johnson

- AbbVie Inc.

- Bayer AG

- Eli Lilly and Company

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Gram-Negative Infection Therapeutics Market Segmentation

By Drug Types

- Antibiotics

- Combination Therapies

- Adjunctive Therapies

By Infection Types

- Urinary Tract Infections (UTIs)

- Pneumonia

- Bloodstream Infections (Bacteremia)

- Wound/Surgical Site Infections

- Gastrointestinal Infections

- Meningitis

- Hospital-Acquired Infections (HAIs)

- Respiratory Tract Infections (RTIs)

- Other Infections

By Route of Administration

- Oral

- Parenteral (injections, intravenous)

- Topical

By Distribution Channel

- Hospitals

- Clinics

- Ambulatory Surgical Centres

- Home Healthcare

- Long-term Care Facilities

- Community Health Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.