UAE Digital Biomarkers Market Analysis

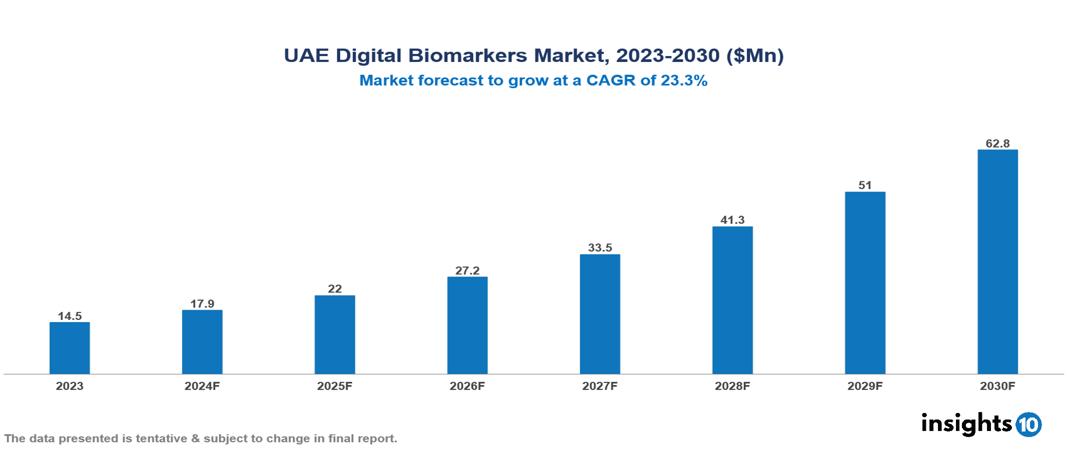

UAE Digital Biomarkers Market was valued at $14.50 Mn in 2023 and is predicted to grow at a CAGR of 23.3% from 2023 to 2030, to $62.82 Mn by 2030. The key drivers of this industry include the rising prevalence of chronic diseases, government initiatives, increased tech adoption, and focus on preventative care. The industry is primarily dominated by ActiGraph LLC, AliveCor Inc., Koneksa, and Altoida Inc. among others.

Buy Now

UAE Digital Biomarkers Market Executive Summary

UAE Digital Biomarkers Market was valued at $14.50 Mn in 2023 and is predicted to grow at a CAGR of 23.3% from 2023 to 2030, to $62.82 Mn by 2030.

Digital biomarkers are quantifiable physiological and behavioral data collected by digital devices like wearables and smartphones. They provide insights into health, including disease progression and treatment response, enabling continuous monitoring and real-time data collection. These biomarkers are used for various health conditions, such as diabetes, cardiovascular disorders, mental health issues, and neurodegenerative diseases. By tracking metrics like physical activity, heart rate, and sleep patterns, digital biomarkers help clinicians make informed decisions and support research with real-world evidence. As technology advances, their potential to transform healthcare and improve patient outcomes grows.

In the UAE, chronic diseases pose a significant health challenge. Diabetes affects 11.81% of the population, among the highest rates globally. Obesity rates are notable, with around 25.6% of males and 39.9% of females classified as obese. Hypertension prevalence ranges from 20% to 30% among adults. Annually, approximately 4,500 new cancer cases are reported, including leukemia, colorectal, prostate, and brain cancer. During the COVID-19 pandemic, market players introduced innovative solutions, such as a cost-effective mobile app by Maastricht University (September 2022) to detect COVID-19 via voice changes.

The market therefore is driven by significant factors like the rising prevalence of chronic diseases, supportive government initiatives, increased tech adoption, and focus on preventative care. However, data privacy concerns, lack of standardization, and high development costs restrict the growth and potential of the market.

Prominent players in this field are ActiGraph LLC which specializes in wearable devices and data analytics for physical activity and sleep monitoring, contributing to clinical research through reliable digital biomarkers. AliveCor Inc. excels in portable ECG monitoring and AI-driven cardiac analysis, enhancing early diagnosis and intervention with FDA-cleared devices like KardiaMobile. Other contributors include Koneksa, and Altoida Inc. among others.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Chronic Diseases: The UAE, faces a growing burden of chronic diseases like diabetes, heart disease, and obesity. Digital biomarkers offer a valuable tool for early detection, monitoring, and management of these conditions.

Supportive Government Initiatives: The UAE government is actively promoting innovation in healthcare. Initiatives like the Dubai Health Authority's "Dubai 10X" program aim to leverage digital technologies to improve healthcare delivery. This fosters a supportive environment for the digital biomarkers market.

Increased Tech Adoption: The UAE boasts a high smartphone and internet penetration rate. This tech-savvy population is receptive to using digital biomarker solutions for self-monitoring and health management.

Focus on Preventative Care: There's a growing emphasis on preventative healthcare in the UAE. Digital biomarkers can empower individuals to take a more proactive approach to their health by tracking health indicators and identifying potential risks early on.

Market Restraints

Data Privacy Concerns: Data security and privacy are major concerns in the digital age. Building trust with users regarding data collection, storage, and usage practices will be crucial for market growth.

Lack of Standardization: Standardization in data collection, analysis, and interpretation of digital biomarker data is still under development. This inconsistency can limit the usability and interoperability of these technologies across different healthcare settings.

High Development Costs: The research and development of digital biomarkers involve significant investment in technology, clinical validation, and regulatory compliance. High costs can be a barrier for small and medium-sized enterprises entering the market.

Regulatory Landscape and Reimbursement Scenario

In the UAE, the regulatory landscape for digital biomarkers is evolving with several key regulatory bodies involved. The Dubai Health Authority (DHA) and Health Authority - Abu Dhabi (HAAD) are pivotal in overseeing healthcare regulations, likely including guidelines on medical devices that may encompass digital biomarkers. Additionally, the newly established IMDAD department focuses on regulating digital health technologies, potentially including digital biomarkers. Current regulations such as Federal Law No. 3 of 2013 on Medical Products and Federal Law No. 11 of 2013 on Data Privacy provide a foundational framework for governing medical devices and safeguarding personal data, respectively.

Regarding reimbursement, coverage for digital biomarkers in the UAE is currently limited. Public health insurance plans do not typically include reimbursements for these technologies, while private insurance may offer limited coverage depending on specific applications and treatment contexts. As the digital health sector advances in the UAE and the clinical benefits of digital biomarkers become more established, there is potential for broader reimbursement from both public and private insurers in the future. This evolution hinges on continued regulatory developments and evidence demonstrating the value of digital biomarkers in improving healthcare outcomes and efficiency in the UAE's healthcare system.

Competitive Landscape

Key Players

Here are some of the major key players in the UAE Digital Biomarkers Market

- ActiGraph LLC

- AliveCor Inc.

- Koneksa

- Altoida Inc.

- Amgen Inc.

- Biogen Inc.

- Empatica Inc.

- Vivo Sense

- IXICO plc

- Adherium Limited

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Digital Biomarkers Market Segmentation

By Type

- Wearable

- Mobile-based Applications

- Sensors

- Others

By Clinical Practice

- Diagnostic digital biomarkers

- Monitoring digital biomarkers

- Predictive and Prognostic digital biomarkers

- Other's (Safety, Pharmacodynamics/ Response, Susceptibility)

By Therapeutic Area

- Cardiovascular and metabolic disorders (CVMD)

- Respiratory disorders

- Psychiatric disorders

- Sleep & Movement Disease

- Neurological disorders

- Musculoskeletal disorders

- Others (Diabetes, Pain Management)

By End-Use

- Healthcare companies

- Healthcare Providers

- Payers

- Others (Patients, caregivers)

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.