UAE Diagnostic Imaging Services Market Analysis

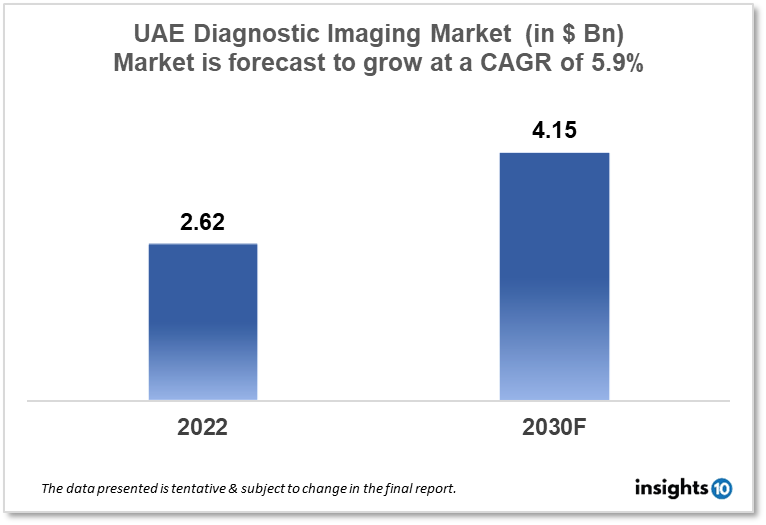

The UAE Diagnostic Imaging Services market size was valued at $2.62 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030 and will reach $4.15 Bn in 2030. The market is segmented by product, application, and end user. The UAE Diagnostic Imaging Services market will grow the prevalence of chronic diseases is rising, demand for minimally invasive operations is rising. The key market players are Emirates Hospitals Group (UAE), Neusoft Medical Systems Middle East FZ LLC (UAE), Emirates Healthcare Group LLC (UAE), NMC Health Plc (UAE), Gulf Imaging and Radiology (UAE), and others.

Buy Now

UAE Diagnostic Imaging Services Market Executive Summary

The UAE Diagnostic Imaging Services market size was valued at $2.62 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.9% from 2022 to 2030. and will reach $4.15 Bn in 2030. To provide images of the inside of the body that are used to diagnose and treat medical disorders, diagnostic imaging uses a variety of medical imaging technologies. X-rays, CT scans, MRIs, ultrasounds, and nuclear medicine imaging are some of these imaging methods. A beam of radiation is sent through the body when the patient is positioned between an X-ray machine and a special film or detector during an X-ray. Radiologists and other medical professionals can interpret the image on the film or detector created by the radiation absorption by the bodily tissues to various degrees. The use of medical imaging technologies to create images of the inside of the body for the purpose of diagnosing and treating medical disorders is known as diagnostic imaging. Examples of diagnostic imaging methods include nuclear medicine imaging, ultrasound, MRIs, CT scans, and X-rays.

Due to an ageing population and an increase in the prevalence of chronic diseases, there is a rising demand in the UAE for diagnostic imaging services. Companies now have the chance to increase their service offerings in response to the rising demand. The diagnostic imaging sector is no exception to the UAE's rapid adoption of new technologies. Businesses can obtain a competitive edge in the market by using and adopting the newest imaging technologies.

Diagnostic imaging services are desperately needed in the UAE's rural and regional locations. Businesses who are able to grow into these regions can take advantage of a large growth opportunity. Diagnostic imaging businesses have a chance to collaborate closely with healthcare professionals to offer patients a more streamlined and effective service as healthcare becomes more integrated. Overall, the UAE's diagnostic imaging market offers a number of chances for businesses that can extend their services, innovate, and adapt to customers' and healthcare providers' evolving needs.

Market Dynamics

Market Growth Drivers

The UAE diagnostic imaging market is being driven by an increase in the frequency of chronic illnesses, an increase in the demand for less invasive surgeries, and advancements in medical imaging technologies. As the population ages, chronic diseases including cancer, cardiovascular ailments, and neurological issues are more common, which increases the demand for diagnostic imaging services. Moreover, the need for less invasive treatments has raised the need for accurate and comprehensive imaging to guide surgeries, which is accelerating the growth of the diagnostic imaging market.

Market Restraints:

The diagnostic imaging market in the UAE is also constrained by a variety of issues. One of the key problems the market is now facing is the high cost of imaging equipment and associated maintenance and operating expenditures. Moreover, there may be a shortage of licenced radiologists and imaging technicians in some areas, which prolongs wait times and delays diagnosis and treatment. The industry is also subject to regulations and compliance requirements, which may increase operational costs and complexity. Concerns regarding the possible health risks associated with exposure to ionising radiation during specific imaging techniques continue to provide a challenge to the business.

Competitive Landscape

Key Players

- Emirates Hospitals Group (UAE)

- Neusoft Medical Systems Middle East FZ LLC (UAE)

- Emirates Healthcare Group LLC (UAE)

- NMC Health Plc (UAE)

- Gulf Imaging and Radiology (UAE)

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems

- Carestream Health

- Hitachi Medical Systems

- Fujifilm Medical Systems

- Samsung Medison

- Hologic

Healthcare Policies and Regulatory Landscape

Diagnostic imaging is governed in the UAE by the Dubai Health Authority (DHA) and the Abu Dhabi Health Services Company (SEHA).

Every diagnostic imaging equipment used in the emirate of Dubai must be registered with the DHA in order for it to control diagnostic imaging there. They also create criteria for the education and licencing of medical specialists who conduct and interpret imaging examinations as well as policies for the proper application of imaging in patient care.

Diagnostic imaging is governed in Abu Dhabi by SEHA, the major healthcare organisation in the city. Any imaging equipment used in SEHA facilities must comply with the necessary safety requirements and have a licence. Moreover, they create standards for the application of imaging in patient care and guarantee that those who conduct and interpret imaging investigations are duly educated and qualified. Overall, the UAE has rigorous laws in place to guarantee the security and quality of diagnostic imaging tests, as well as the education and certification of medical professionals who conduct and interpret these tests.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Segmentation

Diagnostic Imaging Services Market Segmentation

By Producta

Six product categories make up the market: mammography systems, CT scanners, ultrasound, MRI, and X-ray machines. The technology expected to expand the fastest during the projected period is CT scanners. Their broad application in hospitals and imaging centres for cancer and pulmonary screening, the expansion of their application horizon to include dentistry and interventional procedures, the availability of reimbursements in developed countries, and the ongoing digitalization of healthcare systems all contribute to their significant growth potential.

- X-ray Imaging Systems

- By Technology

- X-ray Digital Imaging Systems

- Direct Radiography (DR)

- Computed Radiography (CR)

- X-ray Analog Imaging Systems

- X-ray Digital Imaging Systems

- By Portability

- Stationary Systems

- Portable Systems

- Computed Tomography (CT) Scanners

- Conventional CT systems

- Cone Beam CT Systems (CBCT)

- High-slice CT Scanners

- Mid-slice CT Scanners

- Low-slice CT Scanners

- By Technology

- 2D Ultrasound

- 3D and 4D Ultrasound

- Doppler Ultrasound

- Trolley/Cart-based Ultrasound Systems

- Compact/Portable Ultrasound Systems

- Conventional CT Systems Market, by Technology

- Closed MRI

- Open MRI

- High- and Very-high-field MRI Systems

- Low-to-mid-field MRI Systems

- Ultra-high-field MRI Systems

- Ultrasound Systems

- Standalone SPECT Systems

- Hybrid SPECT Systems

- By Technology

- By Portability

- Magnetic Resonance Imaging (MRI) Systems

- By Architecture

- By Field Strength

- Nuclear Imaging Systems

- SPECT Systems

- Hybrid PET Systems

- Mammography Systems

By Application

The market is divided into several modalities, such as mammography systems, MRI systems, ultrasound systems, X-ray imaging systems, CT scanners, and nuclear imaging systems, based on the applications they are used for. Cardiology under CT scanners, brain and neurological MRI under MRI systems, radiology and general imaging under ultrasound systems, general radiography applications under X-ray imaging systems, and cancer under nuclear imaging systems made up the majority of the applications in 2021. Among all application categories of the diagnostic imaging market in 2021, general radiography applications under the X-ray imaging systems application represented the greatest market share.

- X-ray Imaging Systems

- General Radiography

- Dental

- Fluoroscopy

- MRI Systems

- Brain & Neurological MRI

- Spine & Musculoskeletal MRI

- Vascular MRI

- Pelvic & Abdominal MRI

- Breast MRI

- Cardiac MRI

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology

- Urology

- Vascular

- Other Applications

- Cardiology

- Oncology

- Neurology

- Other Applications

- Cardiology

- Oncology

- Neurology

- Other Applications

- Ultrasound Systems

- CT Scanners

- Nuclear Imaging Systems

- Mammography Systems

By End User

The various end-user segments of the worldwide diagnostic imaging services market include hospitals, ambulatory surgical centres, diagnostic centres, and others. Hospitals are the main consumers of diagnostic imaging services, making them a critical market for service providers. Hospitals see a large influx of patients because they offer a wide variety of diagnostic imaging technology for patients. Due to the rise in the recommendation of diagnostic imaging tests for speedy and precise detection of patient medical conditions, the hospitals sector held the highest share of the market in 2022.

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.