UAE Diabetes Therapeutics Market Analysis

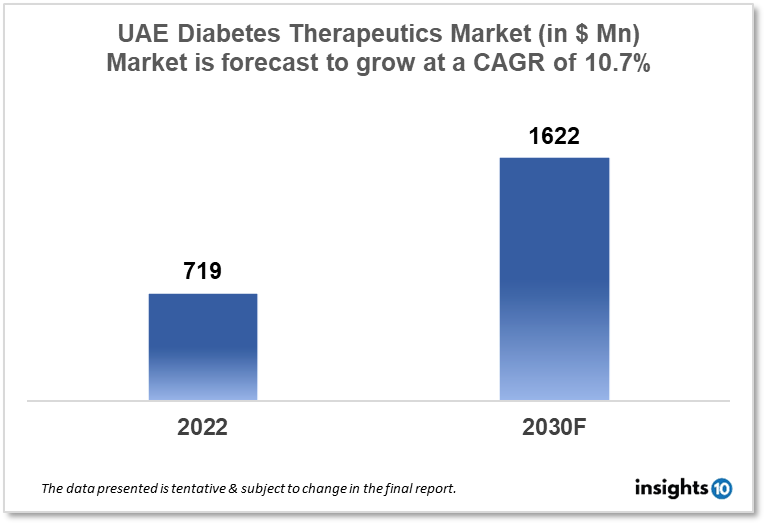

UAE's diabetes therapeutics market is expected to grow from $719 Mn in 2022 to $1,622 Mn in 2030 with a CAGR of 10.7% for the forecasted year 2022-30. The development of novel and ground-breaking treatment options along with supportive government programs like Thiqa and Saada are driving the growth of the market. The UAE diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Rimo Pharmaceuticals, Medspero Pharma, and Boehringer Ingelheim are the major players in the UAE diabetes therapeutics market.

Buy Now

UAE Diabetes Therapeutics Market Executive Analysis

UAE's diabetes therapeutics market is expected to grow from $719 Mn in 2022 to $1,622 Mn in 2030 with a CAGR of 10.7% for the forecasted year 2022-30. By 2025, it is anticipated that revenue produced in the UAE's entire healthcare sector will have increased by 7.5% annually, reaching $10.7 Bn. By 2026 and 2029, respectively, healthcare expenditure is expected to increase to 4.6% and 5.1% of GDP. With increased government initiatives, the UAE healthcare industry is expanding at an astounding rate. Additionally, the UAE government is significantly enhancing and extending its healthcare system to create a powerful, top-notch healthcare infrastructure. To improve the current infrastructure and match the caliber of services provided in developed nations, the government is also encouraging private sector involvement.

With a prevalence of 16% in the UAE (UAE), diabetes is one of the main public health problems affecting hundreds of millions of people globally. Diabetes can cause serious complications, such as kidney and heart disease, stroke, blindness, and a shorter life span if it is not addressed. Non-optimal glucose level regulation may be to blame for up to one-third of all deaths in adult UAE citizens with Type 2 diabetes mellitus (T2DM). There are few studies done on the Arab population, despite mounting evidence that genetic factors play a role in the development of T2DM in various ethnic groups around the globe. First-line treatment for T2DM metformin has an extremely variable therapeutic response, which is partly influenced by genetic factors. There haven't been any studies done on the UAE population yet, and metformin pharmacogenomic studies have conflicting findings in various ethnic groups.

Market Dynamics

Market Growth Drivers

Due to the enhancement of current services, the introduction of new, improved technologies, and the increased privatization of the healthcare industry, the UAE diabetes therapeutics market is predicted to experience substantial growth. Over the course of the forecast period, rising health awareness among the general population and rising health expenditures are anticipated to support market expansion. The UAE's Vision 2030 strategy seeks to invest in world-class health infrastructure facilities and reduce the prevalence of lifestyle diseases like obesity and diabetes among its citizens. Additionally, a number of government healthcare initiatives, including the Saada and "Thiqa" programs and the Dubai Medical Insurance Law, are expected to support the expansion of the UAE diabetes therapeutics market.

Market Restraints

Diabetes care in the UAE is relatively expensive, which may discourage some patients from getting treatment. Delays in diagnosis and treatment could have negative long-term effects, including complications and increased healthcare expenses. Companies developing diabetes therapeutics that want to join the market may face difficulties due to the UAE's regulatory environment, especially with regard to product registration and approval. This might discourage some businesses from making investments in the market, thereby reducing the range of available treatments for patients hence limiting the expansion of the UAE diabetes therapeutics market.

Competitive Landscape

Key Players

- Al Waha Pharmaceutical (ARE)

- Elis Pharmaceuticals (ARE)

- Gulfdrug (ARE)

- Rimo Pharmaceuticals (ARE)

- Medspero Pharma (ARE)

- Boehringer Ingelheim

- Eli Lilly

- Glaxosmithkline

- Novartis

- Novo Nordisk

- Sanofi

Notable Deals

December 2022- In order to advance the Health Metaverse in the UAE, GOQii has collaborated with Harley International Medical Clinic. The comprehensive digital diabetes care initiative will now be available to UAE residents thanks to this partnership. This statement was made at the annual Reimagine Health in the Metaverse event hosted by GOQii.

June 2022- Following the signing of a memorandum of understanding (MoU), Emirates Health Services (EHS) and Novo Nordisk Pharma Gulf will work together on areas of shared interest, most notably healthcare innovation, in an effort to improve health services and adopt the most cutting-edge medical advancements. In accordance with the conditions of the Memorandum of Understanding, Novo Nordisk Pharma Gulf promises to give 50 Type 2 diabetes patients 12 months of free treatment with its oral Semaglutide medication. Within six months, EHS is expected to assess the effectiveness of the therapy. The business will also assist in treating doctors with type 2 diabetes management through scientific communication.

Healthcare Policies and Regulatory Landscape

The Ministry of Health and Prevention (MOHAP) is the authority in charge of approving and regulating medicines in the UAE. All pharmaceutical properties, including prescription drugs, over-the-counter drugs, and medical devices, are listed and approved under the MOHAP's administration. All pharmaceutical goods must be secure, efficient, and of high quality, according to the MOHAP. To ensure adherence to Good Manufacturing Practices, they examine drug applications and perform inspections of manufacturing sites. The MOHAP also controls drug import and export into the UAE and imposes severe penalties for any infractions, such as the selling of illegal or counterfeit medicines. The UAE also has a number of free zones with its own regulatory agencies in addition to the MOHAP. For instance, the Abu Dhabi Health Services Company (SEHA) is in charge of policing healthcare services in Abu Dhabi, while the Dubai Healthcare City Authority (DHCA) regulates pharmaceutical organizations working within the free zone of Dubai Healthcare City.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Rimo Pharmaceuticals, Medspero Pharma, and Boehringer Ingelheim are the major players in the UAE diabetes therapeutics market.

The UAE diabetes therapeutics market is expected to grow from $719 Mn in 2022 to $1,622 Mn in 2030 with a CAGR of 10.7% for the forecasted year 2022-2030.

The UAE diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.