UAE Diabetes Devices Market Analysis

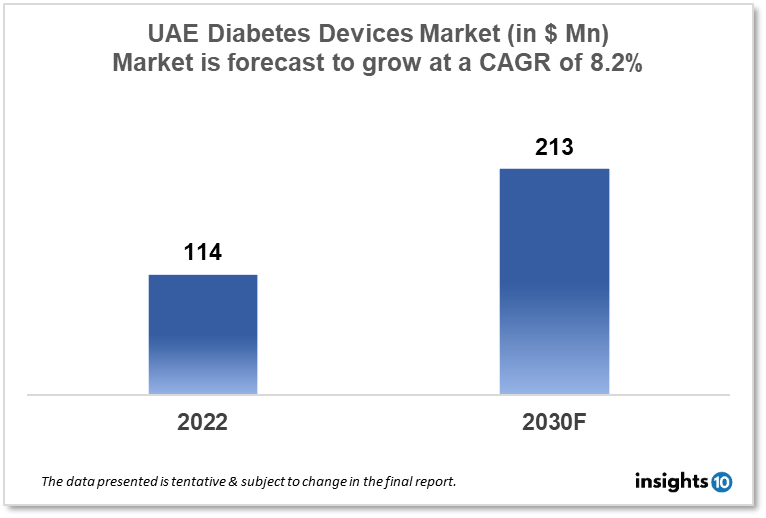

The UAE Diabetes Devices Market is expected to witness growth from $114 Mn in 2022 to $213 Mn in 2030 with a CAGR of 8.20% for the forecasted year 2022-2030. The high prevalence of diabetes, the quick uptake of novel products, increased R&D efforts, and the raising awareness of diabetes preventive care are some major market drivers for diabetes devices in the UAE. The market is segmented by type and by the end user. Some key players in this market include Mecomed, Pioneer Medical Supplies, Johnson & Johnson, Philipps Healthcare, Medtronic, DSM N.V., Roche and Dexcom.

Buy Now

UAE Diabetes Devices Healthcare Market Executive Analysis

The UAE Diabetes Devices Market size is at around $114 Mn in 2022 and is projected to reach $213 Mn in 2030, exhibiting a CAGR of 8.20% during the forecast period. Healthcare costs in the UAE are present at $2,996.36 per person, up from $2,843.78 in 2018. The UAE's GDP include 5.5% of healthcare spending in 2021. Male and female life expectancy statistics in the UAE are 78.21 and 80.99 years, respectively, in 2022.

Diabetes is predicted to be more common in the UAE than the global norm of 10.5%, at 17.3%. As of 2022, 1.19 million UAE residents, or approximately 18.9% of the population, had diabetes. In UAE, medical advancements such as diabetes devices were developed to help diabetics manage their condition. Blood glucose metres are the tools used to test blood glucose levels. By monitoring their blood sugar levels, diabetics can adjust their lifestyle or medication as needed. A greater quality of life, better glycemic control, and a decreased risk of complications are all benefits. In UAE, the majority of blood glucose metres are available and supported by health insurance. Continuous Glucose Monitoring (CGM), which sends the data to a receiver or smartphone software, continuously monitors blood sugar levels. Advantages include improvements in glycemic control, a lower risk of hypo and hyperglycemia, and an overall increase in quality of life. CGM systems are available in the UAE and backed by health insurance for patients who qualify.

Market Dynamics

Market Growth Drivers

The high prevalence of diabetes, the quick uptake of novel products, increased R&D efforts, and the raising awareness of diabetes preventive care are some major market drivers for diabetes devices in the UAE. Several diabetes awareness programmes and government initiatives are anticipated to add to market growth during the forecast period. The demand for diabetes screening and monitoring devices is rising as more people become aware of the risks linked to diabetes. This is driving the growth of the diabetes devices market in the UAE. Patients are finding it simpler to monitor their blood glucose levels and control their condition because of advancements in diabetes device technology. Manufacturers are releasing cutting-edge products like smart insulin pens and CGMs, which are assisting with the growth of the UAE diabetes devices market.

Market Restraints

The UAE market for diabetes devices is highly competitive among makers, which frequently results in price rivalry. Manufacturers may find it difficult to make a profit due to the ongoing demand to keep prices low in order to remain competitive. Although diabetes is more widely recognised in the UAE, many patients may not fully understand how to use their devices and manage their condition. This may lower the demand for diabetes devices and make it more difficult for manufacturers to educate users and healthcare professionals.

Competitive Landscape

Key Players

- Mecomed (UAE)

- Pioneer Medical Supplies (UAE)

- Johnson & Johnson

- DarioHealth

- Medtronic

- Philipps Healthcare

- Dexcom

Recent Notable Deals

September 2021: Roche announced a partnership with the Abu Dhabi Health Services Company (SEHA) to provide diabetes care and education in Abu Dhabi. As part of the collaboration, patients with diabetes can use Roche's mySugr app to better control their condition and their quality of life.

Healthcare Policies and Regulatory Landscape

A regulatory framework for diabetes devices is in place in the well-established healthcare system of the United Arab Emirates. The Ministry of Health and Prevention (MOHAP) is the primary regulatory body for healthcare in the UAE, and it is in charge of creating and carrying out healthcare laws and regulations. The MOHAP is in charge of registering and approving diabetes devices. The UAE's national standardisation body, Emirates Authority for Standardization and Metrology (ESMA), is in charge of creating and enforcing the technical guidelines and standards for diabetes devices. Diabetes device safety and quality requirements are met thanks to ESMA's collaboration with the MOHAP. Healthcare services in Dubai are governed and supervised by the Dubai Health Authority (DHA). The DHA and MOHAP collaborate closely to make sure that diabetes devices adhere to strict safety and quality requirements. The criteria for the registration, approval, and marketing of medical devices in the UAE are outlined in the Medical Device Regulations (MDR). Specific specifications for diabetes devices are included in the MDR, including requirements for performance and safety.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The market is segmented by type and by the end user.

The UAE Diabetes Devices Market is studied from 2022-2030.

Mecomed, Pioneer Medical Supplies, Johnson & Johnson, Philipps Healthcare, Medtronic, DSM N.V., Roche and Dexcom are the major companies operating in the UAE diabetes devices market.