UAE Clinical Diagnostics Market Analysis

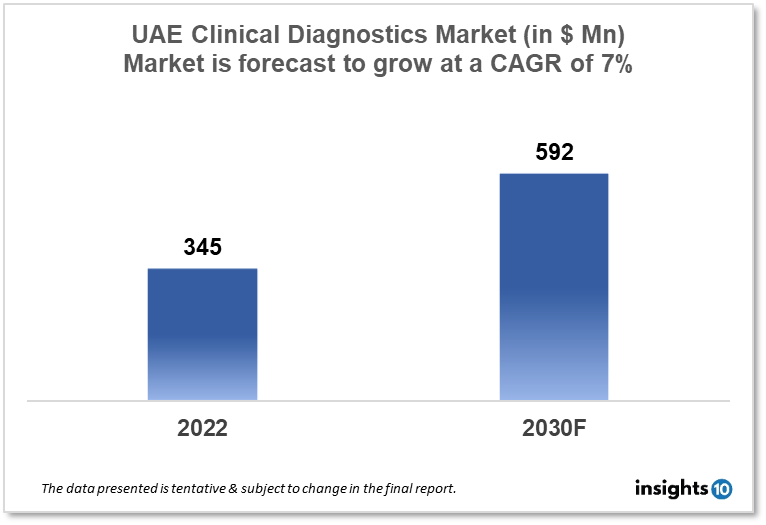

UAE clinical diagnostic market was valued at $345 Mn in 2022 and is estimated to expand at a CAGR of 7% from 2022-30 and will reach $592 Mn in 2030. One of the main reasons propelling the growth of this market is an increase in chronic disease and government support. The market is segmented by type, drug, and distribution channel. Some key players in this market are Al Borg Laboratories, Aster DM, National Reference Laboratory, Fujifilm Middle Eas, Al Zahrawi Medical, Gulf Medical University, Life Medical Diagnostics, Abbott, BD, bioMérieux SA, Bio-Rad Laboratories, Danaher Corporation, Siemens F. Hoffmann-La Roche Ltd, and others.

Buy Now

UAE Clinical Diagnostic Market Executive Summary

UAE clinical diagnostic market was valued at $345 Mn in 2022 and is estimated to expand at a CAGR of 7% from 2022-30 and will reach $592 Mn in 2030. In the UAE, the clinical diagnostics market is rapidly expanding. The process of diagnosing diseases and disorders by examining patient samples such as blood, urine, and tissue is known as clinical diagnostics. In the UAE, the clinical diagnostics market is rapidly expanding. The process of diagnosing diseases and disorders by examining patient samples such as blood, urine, and tissue is known as clinical diagnostics. An aging population, an increasing frequency of chronic diseases, and government attempts to improve healthcare infrastructure are driving the clinical diagnostics market in the UAE. In the UAE, the clinical diagnostics industry is highly competitive, with both domestic and international businesses vying for market share.

The UAE government has also invested in the development of the country's healthcare infrastructure, which has helped the expansion of the clinical diagnostics industry. The UAE implemented the National Unified Medical Record (NUMR) system in 2020, with the goal of increasing healthcare service efficiency and facilitating seamless access to patient data. This effort is projected to increase the country's need for clinical diagnostics.

Market Dynamics

Market Growth Drivers

The UAE government is increasing its healthcare spending to provide better healthcare services to its citizens. The healthcare expenditure in the UAE is expected to reach AED USD 27.89 Bn by 2023, which is likely to drive the growth of the clinical diagnostics market. The UAE is experiencing a rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases. According to a report by the World Health Organization (WHO), non-communicable diseases (NCDs) are responsible for 73% of deaths in the UAE. This has led to a surge in demand for diagnostic tests to detect and monitor these conditions. The UAE government has been taking several initiatives to improve healthcare infrastructure and services, including the development of advanced diagnostic facilities. The Dubai Health Authority launched the Dubai Diagnostic Centre in 2019, which offers advanced diagnostic services and treatments to patients. The UAE is adopting the latest technologies in the field of clinical diagnostics, including point-of-care testing (POCT) and molecular diagnostics. This has resulted in the development of faster, more accurate, and cost-effective diagnostic tests. The UAE is a popular destination for medical tourism, with several world-class hospitals and clinics offering advanced diagnostic services. This has contributed to the growth of the clinical diagnostics market in the country.

Market Restraints

There is a shortage of skilled professionals in the clinical diagnostics field in the UAE. This can result in delays in the diagnosis and treatment of patients, which can negatively impact their health outcomes. The cost of diagnostic tests in the UAE is relatively high, which can limit access to healthcare services for some patients. This is especially true for advanced diagnostic tests, which can be prohibitively expensive for many patients. The UAE is a diverse country, with many different cultures and languages being spoken. This can create communication and cultural barriers between healthcare providers and patients, which can impact the accuracy and effectiveness of diagnostic tests and treatments. The regulatory environment for clinical diagnostics in the UAE is still developing, which can create challenges for companies looking to enter the market. For example, companies must obtain approval from multiple regulatory bodies to market their products in the UAE. While the UAE government is increasing its healthcare spending, healthcare coverage is still limited for some segments of the population. This can result in lower demand for diagnostic tests and treatments, which can negatively impact the growth of the clinical diagnostics market.

Competitive Landscape

Key Players

- Al Borg Laboratories: Al Borg Laboratories is one of the largest private medical laboratories in the UAE. The company offers a wide range of diagnostic tests and services, including clinical pathology, microbiology, and genetics

- Aster DM Healthcare: Aster DM Healthcare is a leading healthcare provider in the UAE, offering a range of diagnostic services, including imaging, pathology, and laboratory services

- Emirates Healthcare Group: Emirates Healthcare Group is a leading healthcare provider in the UAE, offering a range of diagnostic services, including radiology, pathology, and laboratory services

- National Reference Laboratory

- Fujifilm Middle Eas

- Al Zahrawi Medical

- Gulf Medical University

- Life Medical Diagnostics

- Abbott

- Bio-Rad Laboratories

- Danaher Corporation

- Siemens

- F. Hoffmann-La Roche

Healthcare Policies and Regulatory Landscape

The healthcare policy and regulatory framework in the UAE are continuously evolving to ensure the delivery of quality healthcare services, including clinical diagnostics. Health Authority Abu Dhabi (HAAD) is responsible for regulating the healthcare sector in Abu Dhabi, including clinical diagnostics. It sets standards and guidelines for diagnostic testing and approves the use of diagnostic tests in healthcare facilities.

Dubai Health Authority (DHA) is responsible for regulating the healthcare sector in Dubai. It sets regulations for the use of diagnostic tests in healthcare facilities and approves the use of diagnostic tests in Dubai.

Dubai Healthcare City Authority (DHCA) is responsible for regulating the healthcare sector in Dubai Healthcare City (DHCC), including clinical diagnostics. While Emirates Authority for Standardization and Metrology (ESMA) is responsible for setting standards and regulations for diagnostic tests and medical devices in the UAE.

The regulatory framework for clinical diagnostics in the UAE is based on international standards and guidelines, including those set by the World Health Organization (WHO) and the International Organization for Standardization (ISO). The UAE also has a national accreditation system for healthcare facilities, which includes diagnostic testing facilities.

Reimbursement Scenario

In the UAE, the healthcare system is primarily financed by the government, with most medical services provided free of charge or at a subsidized cost to citizens and residents. However, diagnostic tests may not always be fully covered by the government, and out-of-pocket payments may be required in some cases.

The Dubai Health Authority (DHA) is responsible for regulating the healthcare system in Dubai, which includes reimbursement for diagnostic tests. The DHA has established a list of approved diagnostic tests that are eligible for reimbursement, which is known as the Dubai Health Insurance Benefits (DHIB) package. Under the DHIB package, patients with health insurance coverage can receive reimbursement for a range of diagnostic tests, including laboratory tests, imaging tests, and genetic tests. The reimbursement rates vary depending on the test and the insurance provider, but they typically cover a significant portion of the cost of the test.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Clinical Diagnostics Market Segmentation

By Test

- Lab Test

- Imaging Test

- Other Tests

By Product

- Instruments

- Reagents

- Other Products

By End User (Revenue, USD Bn)

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other End Users

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.