UAE Central Nervous System (CNS) Therapeutics Market Analysis

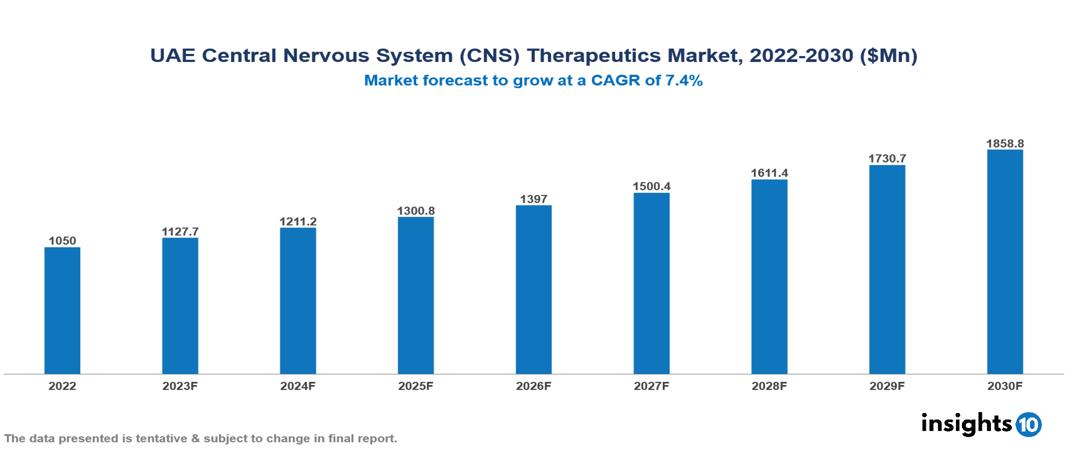

The UAE Central Nervous System (CNS)Therapeutics Market was valued at $1.050 Bn in 2022 and is predicted to grow at a CAGR of 7.4% from 2023 to 2030, to $1.859 Bn by 2030. The key drivers of this industry include the rising burden of CNS diseases, government initiatives, and the evolving pharmaceutical landscape. The industry is primarily dominated by players such as Pfizer, Novartis, Biogen, Otsuka, Eli Lilly, GSK, and Merck among others.

Buy Now

UAE Central Nervous System (CNS) Therapeutics Market Executive Summary

The UAE Central Nervous System (CNS)Therapeutics Market is at around $1.050 Bn in 2022 and is projected to reach $1.859 Bn in 2030, exhibiting a CAGR of 7.4% during the forecast period.

Central Nervous System (CNS) diseases encompass a broad array of medical conditions that disrupt the normal functioning of the brain and spinal cord. These disorders are categorized into various types, such as neurodegenerative diseases (e.g., Alzheimer's, Parkinson's), psychological conditions (e.g., depression, schizophrenia), and neurological disorders (e.g., epilepsy, multiple sclerosis). The causes of CNS disorders are diverse, spanning genetic factors, environmental influences, infections, injuries, or autoimmune responses. Symptoms vary depending on the specific disorder but often involve changes in cognitive function, motor skills, mood, or sensory perception. Current therapeutic approaches for CNS conditions aim to alleviate symptoms, slow disease progression, or manage complications and may include medication, psychotherapy, and, in certain cases, surgical interventions. Leading pharmaceutical companies contributing to the production of medications for CNS disorders include Pfizer, Eli Lilly, and Johnson & Johnson, with Pfizer specializing in Alzheimer's medications and Eli Lilly notable for advancements in psychiatric drugs.

The estimated prevalence of neurological disorders ranges from around 3% to 40% for the Saudi population. The market therefore is propelled by major factors like the rising prevalence of CNS disorders, government initiatives, and the evolving pharmaceutical landscape. However, conditions such as unequal healthcare access, stringent regulatory environment, lack of awareness, and others limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of CNS diseases: The aging demographic in the UAE is raising the likelihood of age-related neurodegenerative illnesses such as Alzheimer's and Parkinson's. The surge in urbanization, alterations in dietary patterns, and heightened stress levels are contributing factors to the higher incidence of mental health issues, encompassing depression, anxiety, and addiction.

Government initiatives: The healthcare sector is a top priority for the UAE government, with a focus on augmenting funds for medical infrastructure, equipment, and personnel. This commitment extends to investments in specialized centers for neurological and psychiatric care. Government-driven campaigns aim to enhance awareness about mental health, diminish stigmas, and facilitate access to mental health services. These initiatives contribute to an increased demand for therapeutics targeting the CNS.

Evolving pharmaceutical landscape: The increasing demand and supportive governmental policies are drawing international pharmaceutical firms to invest in the UAE market. The rising investments in clinical research contribute to the emergence and accessibility of advanced CNS therapeutics within the UAE. Initiatives are promoting domestic production of both generic and branded CNS medications, enhancing affordability and availability.

Market Restraints

Unequal healthcare access: Uneven distribution of healthcare facilities and specialists across the UAE can limit access to diagnosis, treatment, and follow-up care for CNS disorders, particularly in rural or remote areas. This creates a disparity in access to quality care for individuals suffering from these conditions.

Lack of awareness: A considerable number of people with CNS disorders go undiagnosed because of limited awareness regarding symptoms and reluctance to seek assistance. This reluctance is frequently linked to a deficiency in educational campaigns and initiatives focused on promoting awareness about mental health concerns.

Stringent regulatory environment: The registration procedure for introducing new CNS medications in the UAE can be complex and lengthy, impeding the accessibility of innovative treatment choices. This delay may postpone the introduction of potentially transformative medications for patients requiring them. Although government-imposed price controls are intended to lower expenses for patients, they can unintentionally dissuade pharmaceutical companies from introducing new and costly CNS therapies to the market. This, in turn, has the potential to curtail the range and accessibility of treatment alternatives for particular conditions.

Healthcare Policies and Regulatory Landscape

The regulatory authority for therapeutics in the United Arab Emirates (UAE) is the Ministry of Health and Prevention (MOHAP). MOHAP is responsible for overseeing and regulating the registration, importation, and distribution of pharmaceuticals and therapeutics to ensure the safety, efficacy, and quality of healthcare products in the UAE. The process of obtaining licensure for therapeutics in the UAE involves rigorous scrutiny by MOHAP. Companies seeking approval must submit a comprehensive dossier containing detailed information on the therapeutic product, including data on preclinical and clinical studies, manufacturing processes, and quality control measures. MOHAP assesses the documentation to verify compliance with international standards and regulations.

For new entrants into the therapeutic market in the UAE, the regulatory environment can be challenging yet transparent. Companies need to navigate stringent regulatory requirements, adhere to international standards, and collaborate closely with MOHAP to gain approval for their therapeutics. While this may pose initial hurdles, it ensures a high standard of quality and safety for healthcare products in the UAE market.

Competitive Landscape

Key Players

- Biogen

- Otsuka

- Eli Lilly

- Merck & Co

- AstraZeneca

- Johnson & Johnson

- Pfizer

- Novartis

- Teva

- GSK

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Central Nervous System (CNS)Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.