UAE Blood Disorder Therapeutics Market

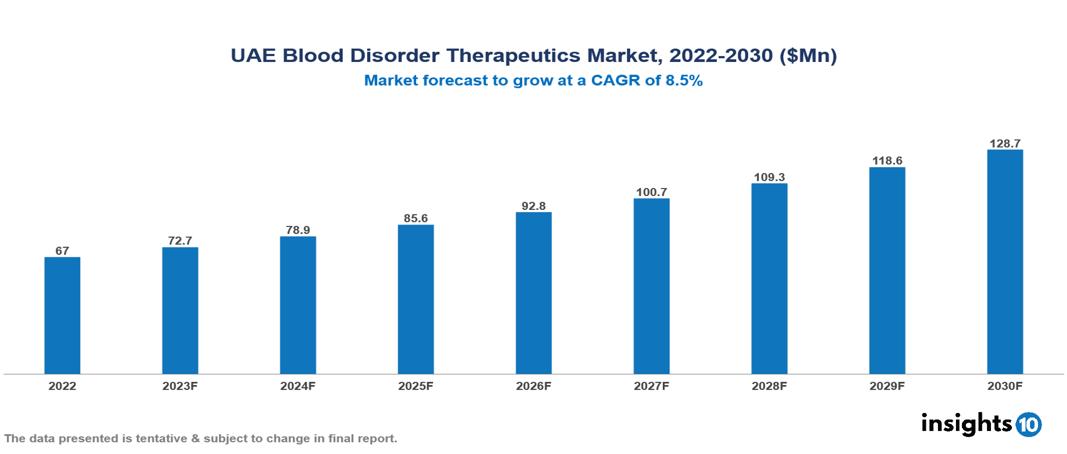

UAE Blood Disorder Therapeutics Market valued at $67 Mn in 2022, projected to reach $129 Mn by 2030 with a 8.5% CAGR. The UAE's political and economic stability, regional healthcare initiatives, aging populations, rising lifestyle trends that are contributing to an increase in chronic diseases, and improvements in diagnostic technologies that are providing more targeted and effective treatments are the main factors driving the market's growth. The UAE Blood Disorder Therapeutics Market encompasses various players across different segments, including Pfizer, Novartis, Roche, Bayer, Takeda Pharmaceuticals, Gilead, Sanofi, Neopharma, Julphar, Sun Pharma etc, among various others.

Buy Now

UAE Blood Disorder Therapeutics Market Executive Summary

UAE Blood Disorder Therapeutics Market valued at $67 Mn in 2022, projected to reach $129 Mn by 2030 with a 8.5% CAGR.

Blood diseases are illnesses that impact the platelets, plasma, white blood cells, red blood cells, and white blood cells. Numerous reasons, including genetics, infections, autoimmune responses, and certain drugs, can result in these illnesses. Hemophilia, a hereditary condition affecting blood clotting, leukemia, a malignancy of the blood-forming tissues, anemia, which is defined by a decrease in red blood cells or hemoglobin, and thrombocytopenia, which is characterized by a low platelet count, are common blood diseases. They might not be malignant or cancerous. The precise kind and degree of a blood issue determine the available treatment choices. Changes in diet or avoidance of certain drugs can be beneficial for some blood diseases. Others could require interventions like blood transfusions, chemotherapy, replacement treatment, radiation therapy, iron supplements, or stem cell transplantation. Treating genetic blood abnormalities like hemophilia and some other kinds of anemia may be possible with newer methods like precision treatment and gene therapy.

Approximately 40% of people in the UAE have blood problems. Since one in twelve people in the nation are thought to be carriers of thalassemia, the disease is a serious public health concern. Furthermore, 24.3% of women between the ages of 15 and 49 reported having anemia.

The UAE's political and economic stability, regional healthcare initiatives, aging populations, rising lifestyle trends that are contributing to an increase in chronic diseases, and improvements in diagnostic technologies that are providing more targeted and effective treatments are the main factors driving the market's growth.

When compared to local players, well-known international corporations like Pfizer and Roche frequently have a better reputation and brand presence. With its medications for aplastic anemia, von Willebrand disease, and hemophilia, Pfizer is in a good position. Furthermore, Sanofi and Novartis have large market shares in some categories.

Market Dynamics

Market Growth Drivers

Geopolitical Factors: The UAE's political and economic stability has positioned it as an attractive market for pharmaceutical companies. This stability fosters a conducive environment for investment and development in the field of blood disease therapeutics. The country's involvement in various trade agreements and partnerships further facilitates the smooth import and export of blood disease therapeutics. Active participation in regional healthcare initiatives reinforces the UAE's commitment to improving access to blood disease treatments across the Middle East.

Emerging Trends and Lifestyle Factors: Shifts in lifestyle patterns, driven by urbanization and the adoption of Western lifestyles, contribute to an alarming rise in chronic diseases in the UAE. Conditions such as diabetes, hypertension, and obesity are becoming more prevalent, leading to an increased incidence of secondary blood disorders. The aging population in the UAE poses another significant factor, elevating the overall risk of developing blood diseases such as anemia, leukemia, and lymphoma. On a positive note, advancements in diagnostic technologies enable early detection of blood diseases, allowing for timely intervention and potentially improving treatment outcomes.

Technological Innovation: The emergence of customized medical techniques is resulting in more precise and efficient therapies for blood disorders. Patients with blood illnesses that were previously incurable are now seeing fresh hope because of developments in gene therapy and biotechnology. Better patient monitoring and follow-up are made possible by digital health technologies, which may enhance the effectiveness of therapy, indirectly increasing demand.

Market Restraints

High Treatment Costs: A lot of the life-saving medicines for blood diseases, including gene and novel therapies, come with a high price tag. For many people, including those with private insurance, this makes them unaffordable. Health insurance policies may not cover all treatments for blood illnesses, particularly those that are more recent or for comparatively uncommon conditions. Patients are left with a heavy financial burden as a result. Treatments for blood diseases often have opaque pricing, which makes it challenging for consumers and healthcare professionals to accurately comprehend and compare prices.

Access and Availability: Because of the reliance on imported pharmaceuticals, there may occasionally be shortages of vital blood disease treatments as well as regular supply chain interruptions, which can cause treatment delays and patient worry. There is still a lack of knowledge regarding blood disorders and the available treatments, especially in underprivileged areas. This may result in missed possibilities for early intervention and delayed diagnosis.

Existence of Established Players: Reputable pharmaceutical firms are well-known and have a significant market share. They also have connections with healthcare providers, extensive distribution networks, and a thorough awareness of regional regulatory procedures. Because of this, it is difficult for newcomers to become known and earn the confidence of healthcare providers and patients.

Healthcare Policies and Regulatory Landscape

Healthcare policies in the United Arab Emirates (UAE) are primarily governed by a series of laws, regulations, standards, and policies at both federal and emirate levels. The UAE's drug regulatory body, the Ministry of Health (MOH), is responsible for regulating the healthcare industry, including the control of drugs and medicines. The MOH, along with other authorities such as the Health Authority-Abu Dhabi (HAAD), the Dubai Health Authority (DHA), and the recently formed Emirates Health Authority (EHA), monitor and regulate the healthcare sector in the UAE. The UAE's healthcare sector has experienced significant growth and progress, with a focus on diversifying the oil-reliant economy and improving public health. The government has invested heavily in healthcare infrastructure, and public spending accounts for over two-thirds of overall healthcare expenditure. The UAE has also established healthcare zones in Dubai, such as Dubai Healthcare City and Dubai Biotechnology and Research Park, which have their own regulatory bodies. The National Drug Policy in the UAE aims to control the manufacturing, selling, and use of drugs and medicines for specific purposes, such as diagnosing, treating, curing, mitigating, or preventing diseases, as well as restoring, renewing, or regenerating the normal function of the body. This policy framework helps ensure the safe and effective use of drugs and medicines in the UAE, contributing to the overall improvement of the country's healthcare system.

Competitive Landscape

Key Players:

- Pfizer

- Novartis

- Roche

- Bayer

- Takeda Pharmaceuticals

- Gilead

- Sanofi

- Neopharma

- Julphar

- Sun Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.