UAE Biosimilars Market Analysis

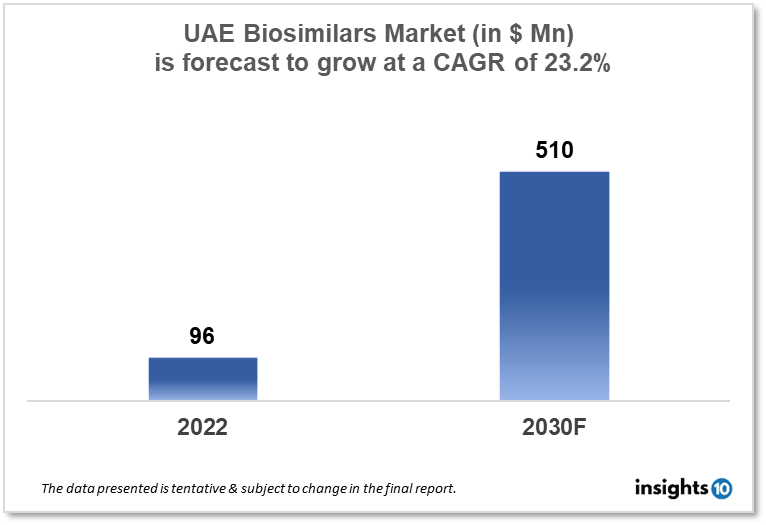

The UAE biosimilars market size was valued at $96 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 23.2% from 2022 to 2030 and will reach $510 Mn in 2030. The market is segmented by product type and indication type. The UAE Biosimilars market will grow as biosimilars are less expensive than their reference products, and patients can afford to use biosimilars as a therapy alternative. The key market players are Neopharma, Julphar, Pfizer, Roche, and others.

Buy Now

UAE Biosimilars Market Executive Summary

The UAE biosimilars market size was valued at $96 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 23.2% from 2022 to 2030 and will reach $510 Mn in 2030. The United Arab Emirates (UAE) offers a sophisticated healthcare system with first-rate facilities and cutting-edge medical technology. The government offers free or inexpensive healthcare services to its inhabitants and residents, and the private sector meets the requirements of those who can afford to pay for private medical treatments. The country's healthcare system is a hybrid of the public and private sectors. The UAE government has made considerable investments in the healthcare industry over the years and is dedicated to offering top-notch services to its inhabitants and citizens. The government's spending on healthcare has been rising rapidly, and in 2021 it was projected to total around USD 16.7 billion. This accounts for a considerable amount of the nation's GDP, demonstrating how important it is to the government that its citizens have access to quality healthcare services.

In recent years, the UAE healthcare industry has seen a growth in the use of biosimilars as regulators and healthcare providers seek to expand access to reasonably priced biologic medicines. The Ministry of Health and Prevention (MOHAP) is in charge of the UAE's thorough regulatory framework for biosimilars. This framework, which is based on the rules established by the World Health Organisation (WHO) and the European Medicines Agency (EMA), demands that biosimilars show resemblance to the reference product in terms of quality, safety, and efficacy.

The UAE market now offers a number of biosimilars, including versions of the drugs infliximab, etanercept, and rituximab. Rheumatoid arthritis, psoriasis, and cancer are just a few of the illnesses that are being treated with these products. Hence, the biosimilar market will grow across the nation during the forecast period.

Market Dynamics

Market Growth Drivers

- Savings: One of the main factors driving the market for biosimilars in the UAE is the high cost of branded biologics. Because they are typically less expensive than their reference products, patients can afford to use biosimilars as a therapy alternative.

- Support from the government: The UAE government is supporting the use of biosimilars by encouraging doctors to prescribe them and providing incentives to producers.

- Patent expirations: As branded biologics' patents lapse, biosimilar producers will have the chance to enter the market and face off against more well-known names.

There is an expanding need for biological treatments as the frequency of chronic illnesses like cancer and diabetes rises in the United Arab Emirates. A more affordable method of treating these illnesses is through the use of biosimilars.

Market Restraints

- Limited understanding and acceptance: Patients and healthcare professionals are unaware of biosimilars, which might make them reluctant to utilize these products. The effectiveness and safety of biosimilars may also raise concerns among some medical professionals.

- High development costs: Creating biosimilars is a difficult and expensive procedure that calls for a large investment in R&D. Smaller producers that do not have the resources to compete with well-established market competitors may find this to be a hindrance.

- Regulatory obstacles: The approval procedure for biosimilars can be drawn out and expensive, and the regulatory standards are complicated. Some producers may be deterred from joining the market as a result.

Competitive Landscape

Key Players

- Neopharma

- Julphar

- Pfizer

- Roche

- Sanofi

- Novartis

Healthcare Policies and Regulatory Landscape

The Ministry of Health and Prevention (MOHAP) is in charge of the UAE's regulatory framework for biosimilars. The European Medicines Agency (EMA) and the World Health Organisation (WHO) have both published recommendations that the MOHAP has adopted for the approval and registration of biosimilars in the nation. According to these regulations, biosimilars must undergo extensive testing before being authorized for use and show that they are comparable to the reference product in terms of quality, safety, and effectiveness.

The healthcare system in Abu Dhabi is run by the Abu Dhabi Health Services Company (SEHA), which has devised a payment scheme for biosimilars based on clinical evidence, cost-effectiveness, and closeness to the reference product. Additionally, the SEHA has created a list of authorized biosimilars that are covered by the emirate's health insurance programs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Biosimilars Market Segmentation

By Product

The monoclonal antibodies, insulin, granulocyte colony-stimulating factor, erythropoietin, recombinant human growth hormone, etanercept, follitropin, teriparatide, interferons, enoxaparin sodium, glucagon, and calcitonin are among the product categories that make up the biosimilars market. Monoclonal antibodies held a sizable portion of the market in 2020. The market is being driven by elements including the widespread use of monoclonal antibodies in the treatment of autoimmune diseases, cancer, and osteoporosis, as well as the affordability of such treatments.

- Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies (bevacizumab, cetuximab, ranibizumab, denosumab, and eculizumab)

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Enoxaparin Sodium

- Glucagon

- Calcitonin

By Indication

The biosimilars market is divided into oncology, autoimmune and inflammatory diseases, chronic illnesses, blood disorders, growth hormone insufficiency, infectious diseases, and other indications based on the indication (infertility, hypoglycemia, myocardial infarction, postmenopausal osteoporosis, chronic kidney failure, and ophthalmic diseases). The market's largest sector in 2020 will be oncology. This market is expanding as a result of elements like the reduced cost of biosimilars compared to novel biologics and the increased incidence and prevalence of cancer.

- Oncology

- Inflammatory & Autoimmune Disorders

- Chronic Diseases

- Blood Disorders

- Growth Hormone Deficiency

- Infectious Diseases

- Other Indications (infertility, hypoglycemia, postmenopausal osteoporosis, chronic kidney failure, and ophthalmic diseases)

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.