UAE Anthrax Therapeutics Market Analysis

UAE Anthrax therapeutics market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 ? 2030. Bacillus anthracis is the bacteria that causes anthrax (B. anthracis). The market for anthrax therapeutics is fueled by factors such the increased prevalence of bacterial infections, rising research funding, the development of innovative medicines for treating anthrax, and pipeline goods, which increase demand and stimulate market expansion. The current rise in healthcare spending in both developed and developing nations is anticipated to give manufacturers a competitive edge in the development of novel and ground-breaking products. Global industries in the Anthrax therapeutics market are Aristo Pharmaceuticals Private Limited, Indoco Remedies Ltd., Lupin, Deinove, Bayer AG, Pfizer Inc., Emergent, Soligenix, Zydus Group, Sanofi, Alembic Pharmaceuticals, Emergent, Sanofi, Porton Biopharma, Lupin, Sun Pharmaceutical Industries Ltd., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd and many more

Buy Now

UAE Anthrax Therapeutics Market Analysis Summary

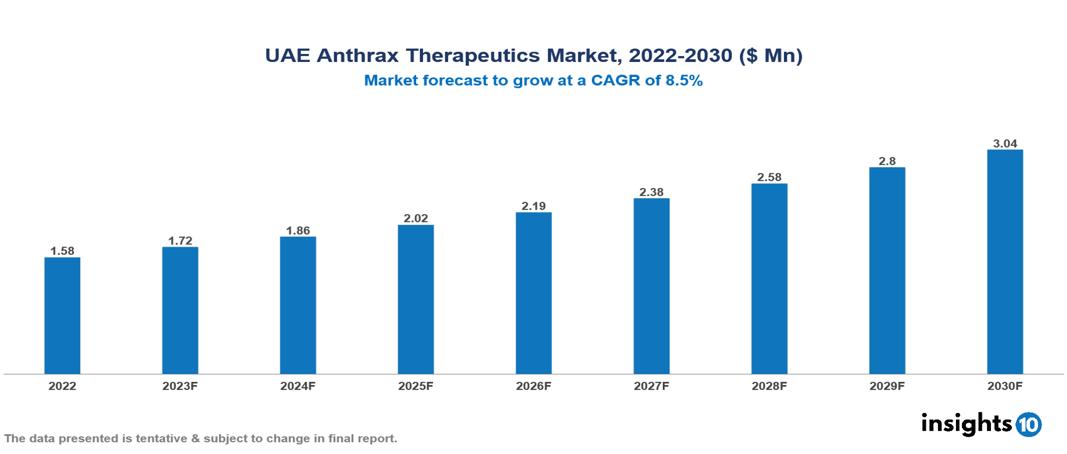

UAE Anthrax Therapeutics Market is valued at around $1.58 Mn in 2022 and is projected to reach $3.04 Mn by 2030, exhibiting a CAGR of 8.5% during the forecast period 2023-2030.

Bacillus anthracis is the bacteria that causes anthrax (B. anthracis). The majority of livestock that contract it do so by consuming soil-borne spores. Humans typically contract anthrax by handling leather or wool goods from infected animals or by breathing anthrax spores from these materials. Consuming raw meat from infected animals might also make them sick. It is unknown how anthrax spreads from person to person.

The anthrax infection has three distinct clinical manifestations. Over 95% of reported cases of anthrax are of the cutaneous kind. Each year, spores are thought to enter the body through skin abrasions and cause an estimated 2000 cases of cutaneous anthrax to occur worldwide.

The market for anthrax therapeutics is fueled by factors such as the increased prevalence of bacterial infections, rising research funding, the development of innovative medicines for treating anthrax, and pipeline goods, which increase demand and stimulate market expansion. The current rise in healthcare spending in both developed and developing nations is anticipated to give manufacturers a competitive edge in the development of novel and ground-breaking products. The market for anthrax therapy is anticipated to grow slowly due to the high cost of the surgery and treatment as well as the strict regulatory restrictions for product approval.

Alembic Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Zydus Group, Bayer AG, Pfizer Inc., Emergent, Sanofi, Porton Biopharma, Lupin, Soligenix, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Aristo Pharmaceuticals Private Limited, Indoco Remedies Ltd., and Deinove are a few of the Global competitors in the anthrax therapeutics market.

Market dynamics

Market Drivers

- Increased disease prevalence

One of the key factors fueling the expansion of the market for anthrax therapy is the rise in the number of anthrax patients worldwide..

- Increased financial support for research

The threat of exposure to Bacillus anthracis among civilian populations and military personnel, as well as the increase in financial support for researchers researching novel remedies, both contribute to the market's acceleration of expansion.

- The demand for better treatment

Every nation is experiencing an increase in the demand for anthrax treatment. Because of this, businesses continually concentrate on research and development in an effort to succeed in successfully treating patients. The newly created technologies are more effective and efficient at detecting bacterial infection in less time.

Market Developments

- PharmAthene Receives Up to $13.9 Million NIH Contract to Work with Medarex on Valortim, Anthrax Anti-Toxin Development.

- The U.S. Food and Drug Administration has given NuThraxTM (Anthrax Vaccine Adsorbed with CPG 7909 Adjuvant), an investigational anthrax vaccine, Fast Track Designation, according to a recent announcement from Emergent BioSolutions Inc. (FDA)

- Alembic Pharmaceuticals Limited announced in January 2022 that its Abbreviated New Drug Application (ANDA) for Doxycycline Hyclate Delayed-Release Tablets USP, 75 mg, 100 mg, 150 mg, and 200 mg, which is used only to treat or prevent infections that are proven or strongly suspected to be caused by susceptible bacteria, had received final approval from the US Food & Drug Administration (USFDA). As a result, the company's product line is expanded.

Market Restraints

The market for anthrax therapy is anticipated to grow slowly due to the high cost of the surgery and treatment as well as the strict regulatory restrictions for product approval.

Key players

Pfizer Sanofi Novartis Emergent BioSolutions PaxVax VaxThera Mapp Biopharmaceuticals Immusol Armata Pharmaceuticals Cidara Therapeutics1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market segmentations for UAE Anthrax therapeutics market

By Type

- Cutaneous Anthrax

- Pulmonary Anthrax

- Intestinal Anthrax

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Government Organization

- Hospitals

- Academic and Research Institutes

- Others

By Vaccines Type

- Live Vaccines

- Cell-free PA Vaccines

By Vaccines Application

- Human Use

- Animal Use

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.