UAE Anemia Therapeutics Market Analysis

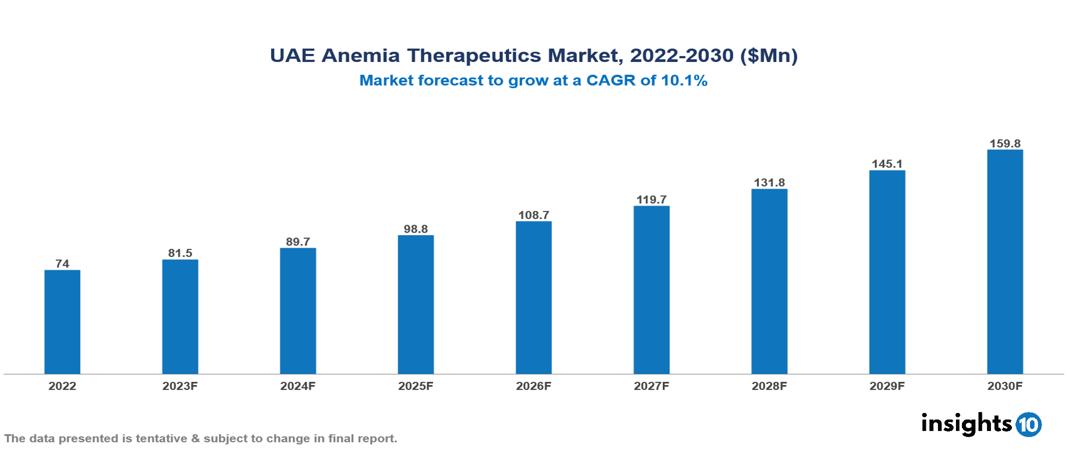

The UAE Anemia Therapeutics Market is anticipated to experience a growth from $74 Mn in 2022 to $160 Mn by 2030, with a CAGR of 10.10% during the forecast period of 2022-2030. The UAE Anemia Therapeutics Market is driven by increased government efforts, research investments, pharmaceutical and delivery system advancements, increased healthcare awareness, and growing per capita income. The UAE Anemia Therapeutics Market encompasses various players across different segments, including Amgen, Roche, Novartis, Eli Lilly, GlycoMimetics, Apellis Pharmaceuticals, Life Pharma, Neo Pharma, New Bridge Pharmaceuticals, Sahara Pharmaceuticals, etc, among various others

Buy Now

UAE Anemia Therapeutics Market Analysis Executive Summary

The UAE Anemia Therapeutics Market is anticipated to experience a growth from $74 Mn in 2022 to $160 Mn by 2030, with a CAGR of 10.10% during the forecast period of 2022-2030.

Anemia, a medical condition characterized by insufficient red blood cells or hemoglobin in the bloodstream, results in a reduced capacity of blood to carry oxygen to bodily tissues. Hemoglobin, a protein found in red blood cells, is responsible for oxygen binding and transport. Various factors, like iron deficiency, chronic illnesses, genetic factors, and certain medical treatments, can cause anemia, affecting individuals of all ages due to dietary gaps or underlying health issues. Treatment options vary based on the severity and underlying cause. Addressing nutritional deficiencies, such as iron, vitamin B12, or folic acid, may involve supplementation or dietary adjustments. Iron supplements are commonly prescribed for Iron Deficiency Anemia (IDA). Chronic diseases necessitate treating the root cause, while severe cases might require blood transfusions. Ongoing research explores innovative therapies, including new erythropoiesis-stimulating agents (ESAs) and advanced iron replacement medications, catering to those with limited responses to conventional treatments.

The frequency of anemia in the UAE varies according to age, gender, and underlying health issues. According to World Bank data, the prevalence of anemia among UAE women of reproductive age (15–49 years) is 24.3%. IDA is most common and affects about 5% of teenagers (15–18 years) in the country. The UAE Anemia Therapeutics Market is driven by increased government efforts, research investments, pharmaceutical and delivery system advancements, increased healthcare awareness, and growing per capita income.

Global major players such as Amgen and Roche are projected to have the greatest market share in terms of total revenue produced by anemia medications in the UAE. Their diversified product portfolios address various kinds of anemia and serve a large patient population. Local producers like Life Pharma or New Bridge Pharmaceuticals may sell a greater amount of anemia medications because of their concentration on inexpensive generics, notably for iron deficiency anemia, which is common in the region.

Market Dynamics

Market Growth Drivers

Government Initiatives and Investment: The UAE government's focus on enhancing healthcare accessibility and affordability through insurance coverage and subsidy programs supports market development. Investment in research & development of novel medications and treatment options for anemia stimulates market expansion.

Advancements in Treatment Options: The emergence of innovative medicines such ESAs and tailored medications for particular forms of anemia promises improved treatment results and draws patient demand. Technological developments in pharmaceutical delivery systems and telemedicine promote patient convenience and treatment adherence.

Increased Healthcare Awareness and Identification: Growing public awareness of anemia symptoms and health efforts supporting screening programs contribute to earlier identification and treatment. Improved healthcare infrastructure and availability of diagnostic techniques assist in the detection of anemia patients.

Rising Per Capita Income: With a continually expanding GDP per capita, the UAE citizenry enjoys increasing disposable income. This results in better affordability for previously non-accessible anemia therapies, particularly for new or higher-priced drugs. This growth in purchasing power also stimulates a desire for tailored and specialized treatment alternatives, such as genetic testing for targeted medicines, further extending the market scope.

Market Restraints

Expensive Drugs: Innovative and focused medicines for certain forms of anemia are frequently expensive, leaving them out of reach for a large segment of the population, particularly those without complete health insurance coverage.This cost barrier hinders market penetration and treatment alternatives for those who may benefit from these cutting-edge medicines.

Specific Subgroups Lack of Awareness: In certain cultures, cultural stigma or a lack of health literacy can contribute to a lack of understanding of anemia symptoms and the significance of obtaining prompt diagnosis and treatment. This information gap among certain subgroups inhibits early intervention and commercial penetration of anemia therapies among these populations.

Increasing Focus on Preventive Measures: Recognizing the high economic cost of anemia treatment, there is a rising emphasis on preventative strategies such as dietary education, iron fortification initiatives, and prenatal care. By treating the underlying causes of anemia, such as iron deficiency, this preventative strategy can reduce the number of identified instances and the need for costly treatment alternatives later.

Healthcare Policies and Regulatory Landscape

In the United Arab Emirates (UAE), healthcare policies are critical to safeguarding the population's well-being, and a vital component of this framework is pharmaceutical regulation by the drug regulating agency. The UAE has implemented strict healthcare rules to ensure the safety, effectiveness, and quality of drugs supplied to its citizens. The Emirates Health Authority (EHA), the country's drug regulatory organization, is in charge of approving, registering, and monitoring pharmaceutical goods. Specialized authorities, such as the Health Authority - Abu Dhabi (HAAD) and the Dubai Health Authority (DHA), play critical roles in pharmaceutical monitoring adapted to the unique requirements of Abu Dhabi and Dubai, respectively. EHA evaluates medication submissions, inspects production facilities, and ensures conformity with international standards. The UAE's goal in creating and enforcing effective healthcare regulations is to protect public health, restrict disease transmission, and give access to high-quality and safe drugs for its varied population. The drug regulatory board acts as a protector, actively contributing to the UAE's trustworthy and efficient healthcare system.

Competitive Landscape

Key Players:

- Amgen

- Roche

- Novartis

- Eli Lilly

- GlycoMimetics

- Apellis Pharmaceuticals

- Life Pharma

- Neo Pharma

- New Bridge Pharmaceuticals

- Sahara Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.