UAE Alzheimer’s Disease Drugs Market Analysis

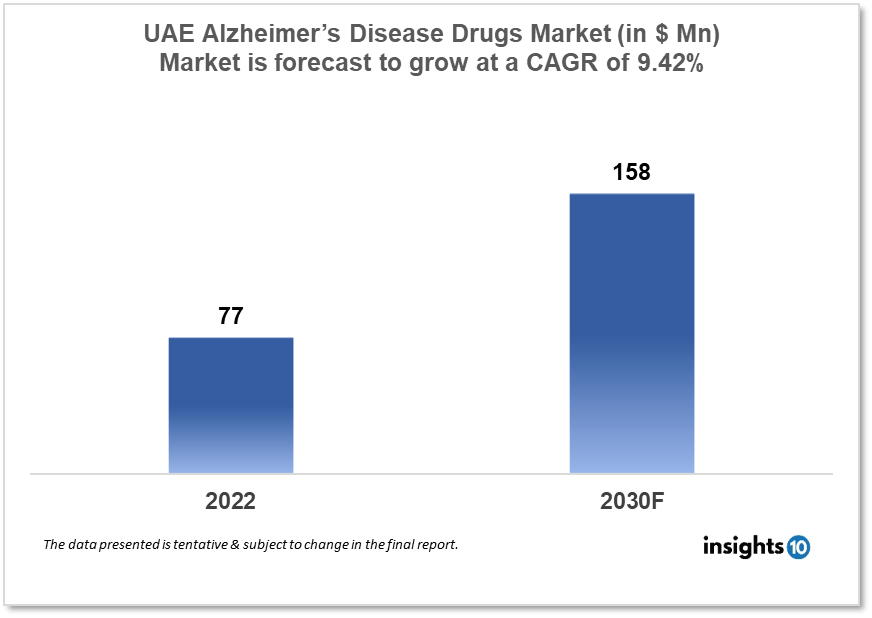

UAE Alzheimer’s Disease Drugs market was valued at $77 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 9.42% from 2022 to 2030 and will reach $158 Mn in 2030. One of the main reasons propelling the growth of this market is the introduction of newer technologies, and the aging population. The market is segmented by drug classes and by Distribution Channels. Some key players in this market are Julphar, Lundbeck, Eisai Co., Eli Lilly and Company, Johnson and Johnson, H. Lundbeck A/S, Roche, Merck & Co., Novartis, Pfizer, and Teva Pharmaceutical among others.

Buy Now

UAE Alzheimer’s Disease Drugs Market Executive Summary

The UAE Alzheimer’s Disease Drugs market was valued at $77 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 9.42% from 2022 to 2030 and will reach $158 Mn in 2030. Alzheimer's disease is a brain ailment that gradually damages memory and thinking skills, as well as the capacity to do the most basic tasks. Alzheimer's patients can endure behavioural and personality changes. Alzheimer's disease is not a natural component of the ageing process. It is caused by complex brain alterations that begin years before symptoms manifest and contribute to the loss of brain cells and their connections.

According to a new study published in the Lancet Public Health, the UAE and other Gulf nations will see the greatest rise in the number of people living with dementia over the next 30 years. The UAE is expected to witness a 1,795% increase in dementia cases by 2050, while neighbouring Gulf countries such as Qatar and Bahrain will also see a 1,926% and 1,084% increase in dementia cases, respectively.

Market Dynamics

Market Growth Drivers

As the population in UAE continues to age, the prevalence of Alzheimer's disease is expected to increase. In the UAE in 2020, only 1.6 people over the age of 65 were dependent on 100 working-age people. However, by 2050, this figure will have risen to 18.5, posing financial, social, and medical challenges for families and the UAE government. This will drive the demand for drugs that can treat the symptoms of the disease. There is growing awareness about Alzheimer's disease in UAE, which has led to an increased demand for treatment options. Patients and their families are seeking effective drugs that can improve the quality of life for those suffering from the disease. The development of new drugs and therapies for Alzheimer's disease is ongoing. This has led to the introduction of new drugs in the market, which has further driven the growth of the market. The UAE government is taking steps to improve healthcare infrastructure in the country, including investing in the development of new drugs for the treatment of Alzheimer's disease. This is expected to further drive the growth of the market. The UAE is a high-income country with relatively high healthcare expenditures. The increase in healthcare spending is expected to lead to greater investment in the development and distribution of drugs for the treatment of Alzheimer's disease.

Market Restraints

Alzheimer's medications can be costly, keeping them out of reach for many people. The high cost of medications is frequently highlighted as a barrier to treatment availability. Early detection and intervention are critical for good Alzheimer's disease care. Unfortunately, there is a lack of understanding about the condition and its symptoms, which can cause diagnosis and treatment to be delayed. Certain pharmaceuticals that are available in other parts of the world may not be available in the UAE, limiting patients' treatment options. Companies seeking to bring innovative pharmaceuticals to market in the UAE may face difficulties due to the regulatory environment. The approval procedure can be time-consuming, and regulatory requirements might be burdensome Alzheimer's disease is still stigmatised in some regions of the UAE, making it difficult for sufferers and their families to seek and get treatment.

Competitive Landscape

Key Players

- Eisai Co.

- Eli Lilly and Company

- Johnson and Johnson

- Roche

- Novartis

- Pfizer

- Julphar

- Lundbeck

- Shalina Healthcare

Recent Updates

After the United States, the UAE has become the world's second country to authorise the registration and usage of Biogen's Aduhelm (aducanumab), the first and only medicine to treat the early stages of Alzheimer's disease. Aduhelm had already been licenced by the Food and Drug Administration (FDA) in the United States, and its clearance by UAE authorities came in accordance with the Ministry of Health and Prevention's Fast Track/Accelerate Process method (MoHAP).

Healthcare Policies and Regulatory Landscape

The healthcare policy in the UAE aims to provide accessible and affordable healthcare services to all its citizens and residents. The government is actively investing in the healthcare sector to improve the infrastructure, facilities, and services provided to patients in the country.

In terms of the Alzheimer's drugs market, the UAE Ministry of Health and Prevention (MOHAP) has taken steps to regulate the import, sale, and use of drugs for the treatment of Alzheimer's disease. The MOHAP has established guidelines for the registration and approval of new drugs, which must meet certain safety and efficacy standards before they can be approved for use in the UAE. In addition, the UAE government has established partnerships with global healthcare organizations and pharmaceutical companies to improve access to new and innovative drugs for the treatment of Alzheimer's disease. For example, the MOHAP has signed a memorandum of understanding with the Global Alzheimer's Platform Foundation (GAP) to support the development of clinical trials for Alzheimer's disease in the UAE.

Reimbursement Scenario

In the UAE, healthcare is provided by a mix of public and private healthcare providers. The government provides healthcare services to citizens and residents through a publicly-funded system known as the Dubai Health Authority (DHA). The DHA provides coverage for a range of healthcare services, including prescription drugs. For patients with health insurance, the coverage for prescription drugs depends on the specific policy and provider. Some insurance policies may cover the cost of Alzheimer's drugs, while others may not. The government has taken steps to address this issue by introducing price controls for certain drugs and by providing financial assistance to low-income patients. In addition, some pharmaceutical companies may offer patient assistance programs to help eligible patients access their drugs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Alzheimer's Disease Drugs Market Segmentation

By Drug Class (Revenue, USD Bn)

- Cholinesterase Inhibitors (Donepezil, Rivastigmine, Galantamine)

- N-Methyl-D-Aspartate (NMDA) Receptor Antagonists (Memantine)

- Combination Drugs

- Others (Lecanemab, Aducanumab)

Drug segmentation is the process of dividing a set of drugs into different categories or classes based on their pharmacological properties, therapeutic uses, and other characteristics. Here, Alzheimer’s Disease Drugs Market is segmented into Cholinesterase Inhibitors, N-Methyl-D-Aspartate (NMDA) Receptor Antagonists, Combination Drugs, and others like (Lecanemab, Aducanumab).

By Distribution Channel (Revenue, USD Bn)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Route of Administration

- Oral

- Transdermal

- Intravenous

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.