UAE Alcohol Addiction Therapeutics Market Analysis

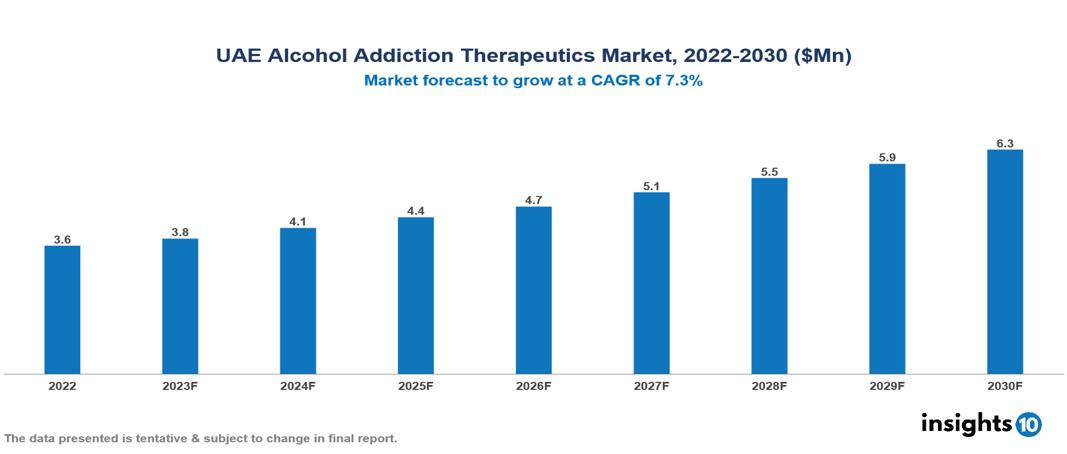

The UAE Alcohol Addiction Therapeutics Market is valued at around $4 Mn in 2022 and is projected to reach $6 Mn by 2030, exhibiting a CAGR of 7.3% during the forecast period. The UAE Alcohol Addiction Therapeutic Market's market drivers include growing urbanization, social pressures in the workplace, and increased awareness of mental health problems, all of which contribute to increased alcohol intake. The key players involved in the research, development and distribution of Alcohol Addiction Therapeutics in UAE are GlaxoSmithKline, Lundbeck, TEVA, Roche, Eli Lilly, AstraZeneca, Cipla, Pfizer, Camden, Sun Pharmaceuticals, etc among others

Buy Now

UAE Alcohol Addiction Therapeutics Market Executive Summary

The UAE Alcohol Addiction Therapeutics Market is valued at around $4 Mn in 2022 and is projected to reach $6 Mn by 2030, exhibiting a CAGR of 7.3% during the forecast period.

Alcohol Use Disorder (AUD) is a complicated and varied condition marked by the dysregulation of several executive function-related brain circuits, which results in excessive alcohol consumption despite detrimental effects on one's health and social life, as well as feelings of withdrawal when alcohol access is restricted. Anyone can acquire AUD, regardless of age, gender, or background. AUD can have a substantial influence on an individual's health, relationships, and general quality of life. Treatment options include both psychological and pharmaceutical therapies targeted at lowering alcohol use and/or encouraging abstinence while also treating dysfunctional behaviours and reduced functioning. CBT, motivational interviewing, and contingency management are examples of psychological treatments for AUD. Medications used to treat AUD include disulfiram, acamprosate, naltrexone, and nalmefene.

The frequency of alcohol addiction in the United Arab Emirates (UAE) is concerning, despite the country's rigorous alcohol consumption rules. Alcohol and drug misuse are on the rise in the UAE, despite cultural, religious, and legal barriers. Alcohol is the most often used drug among people with substance use disorders, accounting for 41.3% of all cases. The UAE Alcohol Addiction Therapeutic Market's market drivers include growing urbanization, social pressures in the workplace, and increased awareness of mental health problems, all of which contribute to increased alcohol intake.

AbbVie has a big foothold in the pharmaceutical sector because of its popular naltrexone drug. NMC Healthcare has a large network of hospitals and clinics that provide addiction treatment. NMC has a significant market share and provides critical private behavioural therapy choices.

Market Dynamics

Market Drivers

Development and Growth: Rapid urbanization in the UAE confines populations, particularly young adults, in areas with higher exposure to possible alcohol-related triggers. Social pressures in these fast-paced workplaces might lead to increased consumption and dependency. While past standards may have prevented excessive alcohol intake, increased awareness of mental health concerns is making it easier to seek addiction treatment. Social media and public efforts help to normalize the debate about alcoholism.

Increasing Focus on Well-Being: The UAE's robust economy drives up demand for high-quality, private addiction treatment solutions. This draws a large number of medical tourists seeking specialist care in a nice and exclusive setting. An increased emphasis on personal health and wellness creates a more tolerant atmosphere for people seeking treatment for alcohol addiction. This cultural movement reduces stigma and promotes proactive approaches to mental health and wellbeing.

Lack of Local Players: Recognizing the increased need, private healthcare providers are opening specialized addiction treatment clinics that offer complete programs and cater to a broader clientele with various requirements and preferences. However, there are few players in the nation capable of providing efficient and cost-effective pharmaceuticals. Almost all pharmaceuticals are imported, putting a strain on both the government and patients' finances. This increases the need for these kinds of businesses in the UAE market.

Market Restraints

Cultural Stigma: Fear of societal judgment and associated consequences can be a substantial barrier to seeking therapy. Ethical and cultural standards encourage abstinence from alcohol, and addiction treatment programs are seen as incompatible with such ideals. This might cause internal conflict and an unwillingness to get therapy. In certain cases, a lack of understanding or acceptance from family members might deter people from obtaining or continuing therapy. This can intensify feelings of loneliness and increase the difficulties of recuperation.

Expensive Treatment: Despite increases in insurance coverage, some kinds of therapy and drugs may not be completely covered, leaving patients with a financial burden. This might result in treatment cessation or reduced access for people with inadequate financial means.

Limited Market Size: While the UAE Alcohol Addiction Therapeutic Market is expanding each year, the UAE's overall population is rather small. With a limited patient pool, treatment facilities and healthcare providers may find it challenging to attain economies of scale and assure financial viability.

Healthcare Policies and Regulatory Landscape

Healthcare policies in the United Arab Emirates (UAE) are largely regulated by a set of laws, rules, norms, and policies at the federal and emiral levels. The Ministry of Health (MOH), the UAE's drug regulatory organization, is in charge of healthcare industry regulation, including drug and medicine control. The MOH, along with other bodies such as the Health Authority-Abu Dhabi (HAAD), the Dubai Health Authority (DHA), and the newly established Emirates Health Authority (EHA), monitors and regulates the UAE's healthcare industry. The UAE's National Drug Policy intends to govern the production, sale, and use of medications and medicines for defined reasons, such as diagnosing, treating, curing, alleviating, or avoiding illnesses, as well as restoring, renewing, or regenerating the normal function of the body.

Competitive Landscape

Key Players

- GlaxoSmithKline

- Lundbeck

- TEVA

- Roche

- Eli Lilly

- AstraZeneca

- Cipla

- Camden

- Pfizer

- Sun Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.