Turkey Depression Therapeutics Market Analysis

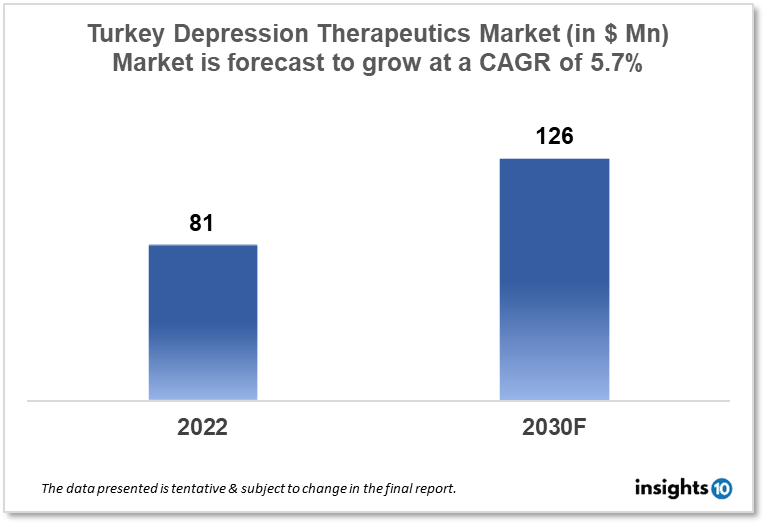

Turkey's depression therapeutics market is expected to grow from $81 Mn in 2022 to $126 Mn in 2030 with a CAGR of 5.7% for the forecasted year 2022-2030. The rise in the depression prevalence in Turkey along with the new drug launches like N6A9 class of anti-depressants is responsible for the growth of the market. The Turkey depression therapeutics market is segmented by drug type, therapies, indication, and by end users. İLKO Pharmaceuticals, Afnan Teba, and Abbott are the major players in the Turkey depression therapeutics market.

Buy Now

Turkey Depression Therapeutics Market Executive Analysis

Turkey's depression therapeutics market size is at around $81 Mn in 2022 and is projected to reach $126 Mn in 2030, exhibiting a CAGR of 5.7% during the forecast period. Turkey aspires to be a global pharmaceutical hub due to its powerful export network, geographical location, demographics, and manufacturing facilities. The pharmaceuticals sector produces over 12,000 products with its 100 pharmaceutical and 11 raw material production facilities, 680 companies, 33 R&D centres, and 40,000 workers. Turkey is an appealing market for the pharmaceutical industry due to its demographics and increasing healthcare service quality, as well as being a geographical hub connecting some of the world's most dynamic pharma markets. The Turkish pharmaceutical industry was the world's eighteenth-largest. Exports increased by 28%, reaching an all-time peak of $1.9 Bn in 2022. In 2022, the industry will have grown by 17.8% in value to $7 Bn.

Due to factors such as repeated natural disasters, migration, economic downturn, and the COVID-19 pandemic, the number of individuals in Turkey suffering from anxiety and depression has greatly increased in recent years. According to statistics from Turkey's Ministry of Health (MoH), 17% of the population suffers from mental health problems, 3.2 Mn people suffer from depression, and antidepressant consumption has grown by 56% in five years. Every year, approximately 9 Mn individuals in Turkey seek mental health treatment a population of approximately 83 Mn.

Depression is treated with drugs, talk therapy (in which a person speaks with a trained professional about his or her thoughts and emotions; also known as "psychotherapy" or "counseling"), or a combination of the two. There are several medications (drugs) available to treat the signs of depression. However, in the majority of cases where drugs are used, severe depression develops after a lengthy period of time. Lithium is the gold standard or best treatment for bipolar illness and depression. It is the most effective mood booster. Antidepressant medications may have a significant effect, but only for a brief period of time; for example, ketamine promotes a rapid anti-depressive effect and also promotes neuroplasticity, but strong and rapid responses rarely last more than a week after infusion, leaving patients either as depressed as before or provoking continuous, long-term treatment with a drug that can have negative cognitive and morphological consequences.

Market Dynamics

Market Growth Drivers

Depression prevalence has been reported to be relatively stable, so the number of individuals with the disease has been steadily increasing with the overall growth of the Turkey population. Recent and anticipated new launches in the N6A9 class that will mainly drive market development include a limited number of products that use novel mechanisms of action in a field plagued by suboptimal outcomes with existing therapies. This will result in the expansion of the Turkey depression therapeutics market.

Market Restraints

Turkey's healthcare infrastructure is not as advanced as in some countries, which may hinder the supply and accessibility of medicines for depression. This can make prompt and successful treatment challenging for patients. Depression treatments can be costly, making it challenging for some patients to afford the treatment. This is especially true for those who do not have medical coverage. The Turkey depression therapeutics market faces regulatory challenges, including problems with drug authorization and pricing regulations. These challenges may restrict the availability and accessibility of depression treatments thereby limiting the expansion of Turkey's depression therapeutics market.

Competitive Landscape

Key Players

- İmuneks Farma (TUR)

- Zeincro (TUR)

- Ali Raif Pharmaceutical (TUR)

- İLKO Pharmaceuticals (TUR)

- Afnan Teba (TUR)

- Abbott

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Cipla

- Eli Lily

- GlaxoSmithKline

Healthcare Policies and Regulatory Landscape

The GHI is made up of a contributory scheme and a non-contributory means-tested scheme that offers health insurance to all Turkish citizens and residents. A minimum contribution payment period of 30 days is required to be covered under the general health insurance scheme, with exemptions granted to all persons under the age of 18, pregnant women, those employed by the Social Security Institute, stateless persons, refugees, those with incomes less than one-third of the minimum national threshold, and those receiving social assistance payments. The GHI offers a complete package and entitlements for a variety of preventative, diagnostic, and curative services. The Republic of Turkey's GHI is the most recent achievement in healthcare coverage, dating back to the 1990s, when legislators started extending coverage to the informal sector as part of the 10-year Health Transformation Programme. In an attempt to reduce fragmentation and provide more comprehensive coverage through a streamlined strategy, the government merged three separate health insurance schemes in 2003. Investments in social services, such as GHI, are critical to establishing Turkey's social safety floor and ensuring that all those in need have access to necessary healthcare. In terms of depression treatment reimbursement rules, the Turkish Social Security Institution (SGK) is in charge of reimbursing medication costs. The SGK operates a drug reimbursement scheme that covers a variety of medications, including those used to treat depression. However, not all drugs are covered, and patients may be required to pay for some medications out of pocket.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

İLKO Pharmaceuticals, Afnan Teba, and Abbott are the major players in the Turkey depression therapeutics market.

The Turkey depression therapeutics market is expected to grow from $81 Mn in 2022 to $126 Mn in 2030 with a CAGR of 5.7% for the forecasted year 2022-2030.

The Turkey depression therapeutics market is segmented by drug type, therapies, indication, and by end users.