Thailand Telemedicine Market Analysis

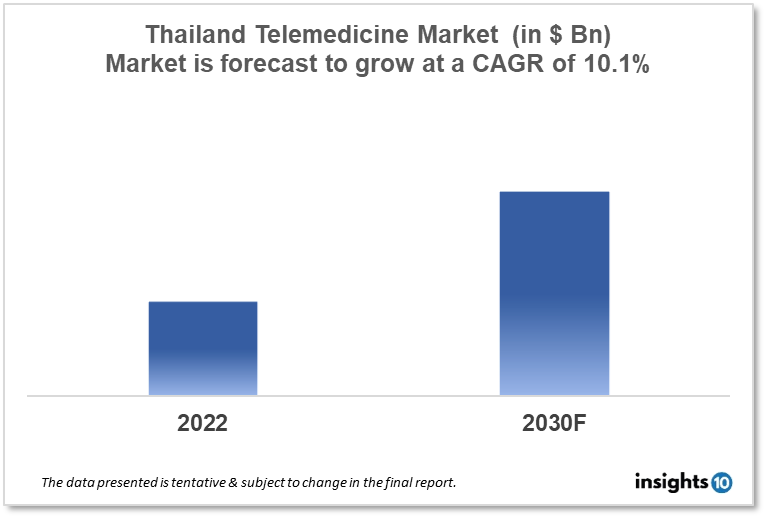

Thailand's telemedicine market is projected to grow from $xx Bn in 2022 to $xx Bn by 2030, registering a CAGR of 10.1% during the forecast period of 2022-2030. The main reasons influencing the growth of the telehealth market in Thailand are the simplicity of medical appointments and time efficiency. The key players in the Thailand telemedicine market include telemedicine platforms such as DoctorOnCall, Thai Telemedicine, and Health One.

Buy Now

Thailand Telemedicine Market Executive Summary

Thailand's telemedicine market is projected to grow from $xx Bn in 2022 to $xx Bn by 2030, registering a CAGR of 10.1% during the forecast period of 2022-30.

With an upper-middle income status and the second-largest economy in Southeast Asia after Indonesia, Thailand acts as an economic pillar for its neighbouring developing nations. Despite domestic political unrest, the nation's economy seems resilient and, according to the IMF, is predicted to grow at a moderate pace in a post-COVID-19 environment. In keeping with the government's infrastructure objectives to draw private investment and continuous strengthening of the tourism sector, public investment is anticipated to remain a significant driver and grow over the next few years. Out of its 69.8 Mn inhabitants, 39 Mn people worked in Thailand in 2020. Agriculture, which accounted for 31.2% of the active population and 8.6% of the GDP in 2021, is a major component of the economy. Thailand's Gross Domestic Product (GDP) was estimated to be worth $505.95 billion US dollars in 2021, and between 2022 and 2027, it was expected to grow steadily by a total of $197.5 Bn (+36.93%). In 2027, the GDP is anticipated to reach $732.24 Bn.

The country's rapid digitalization, as well as increased demand for remote healthcare services and self-assessment platforms for those with mild illnesses, supported Thailand's telehealth market's moderate expansion during the period 2022–2030. The main reasons influencing the growth of the telehealth market in Thailand are the simplicity of medical appointments and time efficiency.

Market Dynamics

Market Growth Drivers Analysis

In Thailand, the prevalence of chronic diseases is sharply rising. Chronic illnesses have a negative impact on people's quality of life, mobility, and mortality rate. The interaction between the healthcare provider and the patient during telemedicine comprises both phone calls and video calls. In Thailand, chronic conditions like diabetes, cancer, and cardiovascular disorders affect about half of the population. Some persons with chronic illnesses are unable to relocate from one location to another for initial treatment. These people can get telemedicine from wherever they live. The greatest care for individuals with rheumatoid arthritis and hypertension is provided using telemedicine. As a result, it is projected that Thailand's expanding chronic disease population will stimulate the market for telemedicine.

Market Restraints

The industry is being constrained by factors like the dearth of internet access in some parts of Thailand, the high cost of remote monitoring equipment, and the rise in healthcare fraud and data security concerns. The lack of telemedicine use among older and less educated people due to their unfamiliarity with the technology also restrains the development of the Thai telemedicine market.

Competitive Landscape

Key Players

The key players in the Thailand telemedicine market include telemedicine platforms such as

- DoctorOnCall,

- Thai Telemedicine, and

- Health One.

Additionally, many hospitals and clinics in Thailand have also adopted telemedicine technology, such as Bumrungrad International Hospital and Bangkok Hospital, in order to provide remote consultations to patients.

The Thai government is also investing in the development of telemedicine infrastructure, which is expected to boost the growth of the market. Private sector players such as True Corporation and Advanced Info Service are also investing in the development of telemedicine in Thailand.

Healthcare Policies and Regulatory Landscape

Prior to 2022, telemedicine services were not specifically governed by any legislation or regulations. As a result, hospitals that wanted to offer telemedicine services could do so without having to ask Thai authorities for any special remote permits or approval. They were also free to set up their own internal policies, including rules for IT and security. While by no means minimal, the Medical Professions Act of 1082, the Public Health Act of 2007, the Medical Facilities Act of 1998, the Electronic Transactions Act of 2001, the National Health Act of 2007, and, once it takes effect in 2020, the Personal Data Protection Act of 2020, only required general compliance from telemedicine service providers.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Telemedicine Market Segmentation

Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Modality

The industry is driven by three concepts, which include real-time (synchronous), store and forward (asynchronous), and others comprising remote patient monitoring, etc.

- Store and forward

- Real-time

- Others

Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call centers

Facility

- Tele-hospital

- Tele-home

End-user

- Providers

- Payers

- Patients

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.