Thailand Diabetes Devices Market Analysis

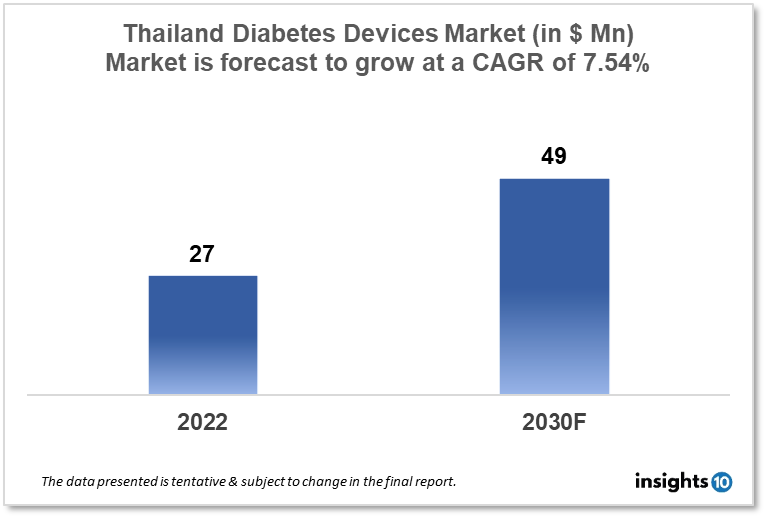

Thailand's Diabetes Devices Market is expected to witness growth from $27 Mn in 2022 to $49 Mn in 2030 with a CAGR of 7.54% for the forecasted year 2022-2030. The medical tourism industry in Thailand is well-known for drawing patients from all over the globe. For patients seeking medical care in the nation, the availability of high-quality diabetes devices and services is a crucial element, which leads to the market expansion of diabetes devices. The market is segmented by type and by the end user. Some key players in this market include Xovic, Meticuly, Johnson & Johnson, Medtronic, Roche, Ascensia Diabetes Care, and Dexcom.

Buy Now

Thailand Diabetes Devices Healthcare Market Executive Analysis

Thailand's Diabetes Devices Market is at around $27 Mn in 2022 and is projected to reach $49 Mn in 2030, exhibiting a CAGR of 7.54% during the forecast period. The overall cost of the healthcare system in Thailand is $25.3 billion. Costs are anticipated to grow by $47.9 billion by 2026, or 6.6% annually on average over the previous ten years. 6.6% of GDP, or a sizeable portion, goes toward healthcare expenses. The senior population in Thailand, which will make up 20% of the total population by 2024, is another issue. Thailand spent $300 on healthcare per individual in 2022. Thailand saw an average annual rise in health spending per person of 8.83%, from $62 in 2000 to $300 in 2022.

In Thailand, diabetes is becoming a bigger health issue. 4.8 million individuals in Thailand are estimated to have diabetes as of 2021, according to the country's estimated diabetes prevalence of 9.8%. Diabetes is becoming more common in Thailand, where 270,000 new cases are identified every year. In Thailand, prediabetes affects 23.8% of the adult population, which is a significant prevalence. Diabetes devices are tools used to control blood glucose levels in diabetics. Blood glucose levels are tested at home with the aid of glucose meters. They can help diabetics regularly monitor their blood glucose levels because they are clear-cut and easy to use. Insulin devices are used to deliver insulin continuously throughout the day. They can assist diabetics in keeping more stable blood glucose levels because they can be programmed to deliver precise amounts of insulin at specific times. Insulin pens are used to administer the drug in place of traditional insulin shots. Because they are portable and lightweight, they can be used both at home and abroad. The use of diabetes devices in Thailand has benefits for blood glucose control, reduced risk of complications, and an increase in quality of life. Diabetes devices can help patients better comprehend their condition, which can lead to better self-management and earlier medical intervention.

Market Dynamics

Market Growth Drivers

The medical tourism industry in Thailand is well-known for drawing patients from all over the globe. For patients seeking medical care in the nation, the availability of high-quality diabetes devices and services is a crucial element, which leads to the market expansion of diabetes devices. In Thailand, people are becoming more and more conscious of the significance of managing their diabetes. This is boosting the demand for diabetes gadgets and opening doors for producers to produce new goods and increase their market share. The management of diabetes is becoming simpler thanks to advancements in diabetes device technology, such as continuous glucose tracking devices and smart insulin pens. Manufacturers now have more chances to create and market cutting-edge products.

Market Restraints

In Thailand, patients may find the expense of diabetes devices to be a major obstacle, particularly those who are uninsured or have limited financial resources. As a result, the market for diabetes devices may be constrained, and makers may face difficulties in pricing their goods in the Thai market for diabetes devices. In Thailand, there is fierce competition for market share among local and foreign makers of diabetes devices. Manufacturers may find it difficult to differentiate their goods and compete on price as a result.

Competitive Landscape

Key Players

- Xovic (TH)

- Meticuly (TH)

- Infus Medical (TH)

- Johnson & Johnson

- Medtronic

- Roche

- Dexcom

- Ascensia Diabetes Care

Recent Notable Deals

September 2022: To sell its Eversense continuous glucose monitoring system in Thailand, Senseonics announced in September 2022 that it had teamed up with PT Transmedic Thailand. Through this partnership, individuals with diabetes in the nation should have easier access to technology.

2021: In Thailand, the MiniMed 770G insulin device was introduced by Medtronic in 2021. In order to help people with diabetes better control their condition, this pump uses artificial intelligence to automatically modify insulin delivery based on a patient's glucose levels.

Healthcare Policies and Regulatory Landscape

The Thai Food and Drug Administration (FDA) and the Medical Device Control Division (MDCD) are in charge of Thailand's healthcare laws and regulations in relation to the diabetes devices industry. Before being distributed in Thailand, all medical devices, including those used to treat diabetes, must be registered with the local FDA. An evaluation of the device's quality, effectiveness, and safety is part of the registration procedure. Diabetes devices brought into Thailand must adhere to Thai FDA safety and quality standards. In a similar vein, diabetes devices exported from Thailand must satisfy the legal specifications of the final location. Through the Social Security Scheme and the Universal Coverage Scheme (UCS), the Thai government pays for diabetic equipment. However, based on the device or supply, reimbursement policies might be strict and different. Diabetes device manufacturers in Thailand are required to have quality management systems in place to guarantee that their goods are produced, examined, and disseminated in accordance with legal requirements. The Thai FDA's rules and guidelines must be followed when conducting clinical trials for diabetes devices. Clinical trials may be needed by the Thai FDA as a requirement for the registration of novel devices.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.