Tanzania Healthcare Insurance Market Analysis

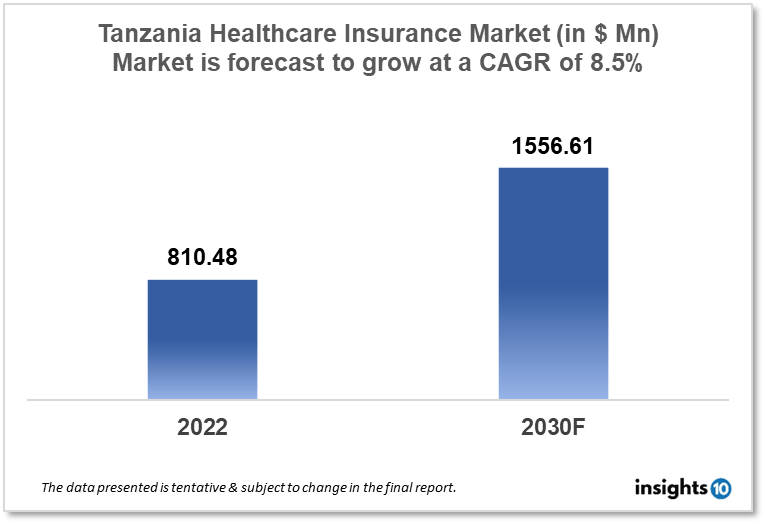

The Tanzania healthcare insurance market is projected to grow from $810.48 Bn in 2022 to $1556.61 Bn by 2030, registering a CAGR of 8.5% during the forecast period of 2022 - 2030. The main factors driving the growth would be increasing population, technological advancements and government support. The market is segmented by component, the provider, coverage, by health insurance plans and end-user. Some of the major players include Bumaco, MyHI, Jubilee, Britam and AAR Insurance.

Buy Now

Tanzania Healthcare Insurance Market Executive Summary

The Tanzania healthcare insurance market is projected to grow from $810.48 Bn in 2022 to $1556.61 Bn by 2030, registering a CAGR of 8.5% during the forecast period of 2022 - 2030. In 2019, the national health expenditures of Tanzania represented 3.83% of GDP or $40 per person. Tanzania has high rates of pneumonia, malaria, HIV/AIDS, and maternal and neonatal mortality, as well as a poor healthcare system and few resources.

International donors that contribute up to 40% of the health budget supplement the financing of healthcare. The US government, through USAID and the Centers for Disease Control and Prevention (CDC), makes a large financial contribution to initiatives that support the Tanzanian government. To increase accessibility to high-quality healthcare services, there has been a drive to implement health insurance in Tanzania in recent years. In order to offer health insurance to workers in the formal sector and their families, Tanzania established the National Health Insurance Fund (NHIF) in 1999. However, health insurance coverage is low, with only 32% of Tanzanians having health insurance as of 2019. There are barely 1% of those people have private health insurance.

Market Dynamics

Market Growth Drivers

The Tanzania healthcare Insurance market is expected to be driven by factors such as:

- Increasing population- Tanzania's population is expanding rapidly which is expanding the market for health insurance. Tanzania's population grew from 10.05 Mn in 1960 to 63.59 Mn in 2021. This is an increase of 532.6 per cent over 61 years

- Technological advancements- The demand for health insurance in Tanzania is increasing as a result of technological developments in the healthcare sector, such as telemedicine, which are increasing access for people to healthcare. Since 2012, the Tanzanian government has viewed digitalization as essential to the development of the country's health sector because of its alleged capacity to enhance, among other things, the flow and accessibility of health information, the management of people and material resources, as well as decision-making processes at various levels

- Government initiatives- The Tanzanian government has supported initiatives to widen access to health insurance, which is helping the growth of the healthcare insurance market in the region. In 2020–2021, the government of Tanzania allocated $387.9 Mn for the health sector, of which $155.5 Mn will be used on development projects to aid in the implementation of the initiatives aimed at enhancing the public

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in Tanzania:

- Low levels of income- Many Tanzanians are facing challenges in making the ends meet due to their low level of income which makes it hard for them to spend on healthcare insurance. As healthcare services are so expensive in Tanzania, particularly for specialised treatments, health insurance premiums are quite high. Around 52% of all healthcare costs in Tanzania are paid for out of pocket by individuals which represents the majority of Tanzanians

- Limited awareness- In Tanzania, although more people are becoming aware of health insurance options, many still lack awareness and understanding about how insurance works or are only aware of the benefits of insurance. The insurance penetration in the country is low as people's opinions of both public and private health care are unfavourable. They are perceived as being high-priced, remote, of poor quality, and offering inadequate continuity of care

Competitive Landscape

Key Players

- Bumaco (TZA)- About 30 years have passed since Bumaco Insurance first entered the market. It provides a range of business, family, health, and life insurance products. Its cheaper premiums are one of its noteworthy characteristics. To ensure that claims are processed quickly and easily, they have a far more streamlined claims process

- MyHI (My Health Insurance) (TZA)- It is a insurtech startup based in Dar-es-Salaam. It aims to simplify and streamline all aspects of getting access to health insurance services, including policy purchases, client interactions, and policy renewals. The MyHI platform eliminates all the paperwork and the lost time associated with traditional health insurance

- Jubilee- With the liberalisation of the financial sector in 1998, The Jubilee Insurance Company of Tanzania Limited is the first private insurance business to be founded in Tanzania. Its insurance plans include J-care, J-seniors, and J-care juniors

- Britam- A prominent and well-diversified financial organisation, Britam has business interests not just in Tanzania but also in Eastern and Southern Africa. It provides health insurance that will pay for maternity, chronic and acute diseases, radiology pathology burial costs, and benefits for accidental death as well as high hospital bills of up to $85,470.

- AAR Insurance- AAR Insurance, a top provider of health insurance in Tanzania, offers a range of services, including medical, dental, and vision coverage

Healthcare Policies and Regulatory Landscape

The Tanzanian healthcare insurance market is overseen by the National Health Insurance Fund (NHIF) and the Tanzania Insurance Regulatory Authority (TIRA). The Tanzanian insurance market, particularly the market for health insurance, is under the governance and authority of TIRA. It is in charge of granting insurance businesses licences and making sure they abide by the legal requirements. The NHIF also has the power to accept or reject applications for various healthcare insurance products.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.