Sweden Dental Care Market Analysis

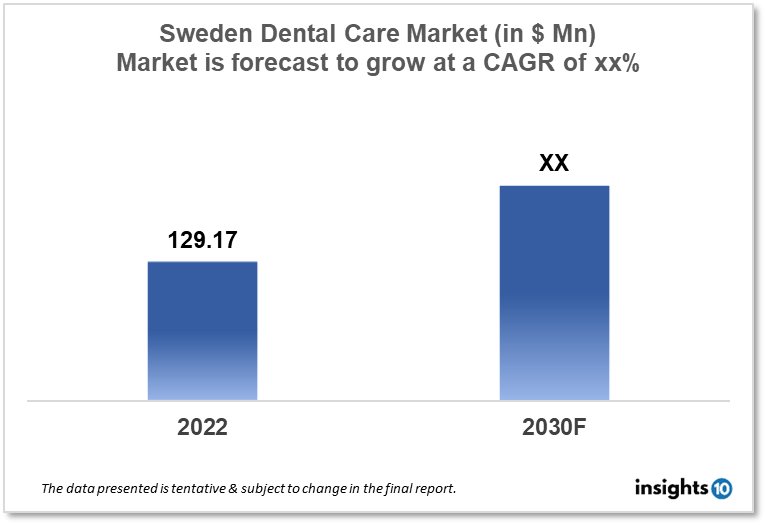

The Sweden Dental Care Market size is at around $129.17 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. The dental services are largely funded by tax-funded Universal Health Coverage (UHC) and the private corporation vies for the competition from public facilities. Major players include A-Dent, Eurodent, and Swedental. This report is segmented by treatment type, age group, clinical setup, and by demography.

Buy Now

Sweden Dental Care Market Executive Summary

The Sweden Dental Care Market size is at around $129.17 Mn in 2022 and is projected to reach $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. Sweden's economy is diverse and export-oriented, with a focus on forestry, hydroelectric power, and iron ore. The country boasts a high level of life and a large welfare state, which includes a robust social security system and universal healthcare. The GDP per capita is among the world's greatest, and the unemployment rate is low. The country is also noted for its hefty taxes, which support the welfare state. Sweden's healthcare system is based on a model of universal coverage, with the majority of healthcare services being provided by the state through the public sector. The country has a publicly funded healthcare system that is managed by the county councils and is available to all residents. It is known for its high quality of care and efficient use of resources. People in Sweden also have the option to purchase private health insurance if they wish to have more choices in healthcare providers or treatments. Sweden has a long history of national registries made possible through the system of unique personal identity numbers, consisting of a twelve-digit-PIN, maintained by the National Tax Board for all individuals residing in Sweden since 1947, thereby important tools not only for improving quality in the health sector but are also open for research.

Sweden has a high standard of oral health, with a relatively low prevalence of tooth decay and periodontal disease compared to many other countries. This is attributed to a combination of factors, including a strong emphasis on preventive care, easy access to dental services, and a high level of education about oral health among the population. The Swedish government provides a comprehensive dental care system that is available to all residents, and dental care is also provided to children and adolescents free of charge. Additionally, fluoride is added to the public water supply to help prevent tooth decay. Despite the overall high standard of oral health in Sweden, there are still some disparities in oral health outcomes among different population groups, such as people with low socioeconomic status and immigrant populations. Private dental clinics are also subject to the same rules and regulations regarding patient care as public clinics. However, private dental clinics may offer a wider range of services and may have shorter waiting times for appointments compared to public clinics. Additionally, private dental clinics may also offer more luxurious or high-end services, such as cosmetic dentistry.

Sweden has a comprehensive dental care system that is available to all residents, which is funded through taxes and social insurance contributions. The system provides a wide range of services, including preventive care, routine check-ups, and treatment for both children and adults. Dental care is provided by both public and private providers, with the majority of services being provided by private practitioners. The government sets fees for dental services and regulates the quality of care provided. Dental care for children and adolescents is provided free of charge, and adults are also entitled to a certain level of free care each year. Additionally, the government provides financial assistance for low-income individuals who cannot afford the cost of dental care. Overall, the dental care system in Sweden is considered to be of high quality and accessible to all residents.

Market Dynamics

Market Growth Drivers

In Sweden, all children and adolescents receive free dental treatment, with the prevention of oral illness being the primary focus of the care provided. Despite this, epidemiological surveys show that Swedish adolescents have poor oral hygiene, with a high level of gingival/periodontal infection (gingivitis). Private dental practices can also provide cosmetic dentistry, orthodontics, and implantology. Despite the fact that the Swedish dentistry system is heavily subsidized by the government and provides free or low-cost treatments to all residents, there are still areas where private dental firms can expand and thrive by offering different or more modern services or providing better customer care. As Sweden's standard of living grows, more people will have disposable income to spend on dental care, potentially fuelling private sector growth. As Sweden's population continues to expand and age, so does the demand for dental treatments. This opens the door for private dentistry enterprises to grow their operations and enhance their market share.

Market Restraints

The Swedish government supervises the dentistry business and sets dental fees. This has the potential to limit the profitability of private dentistry firms, particularly if the government decides to lower fees or raise regulations. In Sweden, the dentistry sector is very competitive, with several private dental corporations competing for market share. This might make it difficult for new private dental firms to enter the market, as well as for current ones to maintain or increase their market share. Economic downturns can reduce disposable income and demand for dental treatments, which can have a detrimental impact on the expansion of private dental firms. The Swedish dental system is mostly supported by taxes and social insurance contributions, and some services are provided for free. This means that private dental firms may have to compete with government-funded services and may not be able to charge as much for their services as they would want. Government-funded social programs, which frequently include dental care services available to all inhabitants, may also impede the growth of private dental firms in Sweden. In Sweden, dental care is considered a basic human right, which implies that the government plays a significant role in the business, and private corporations may have to adjust.

Competitive Landscape

Key Players

- Folktandvården

- Tandläkarförbundet

- Tandvårdsstödet

- Tandläkarnas Riksförbund

- A-Dent

- Eurodent

- Swedental

Healthcare Policies and Regulatory Landscape

The National Board of Health and Welfare is Sweden's regulatory organization for dental services (Socialstyrelsen). This is a government agency in charge of ensuring that dental services in Sweden meet specified quality and safety criteria. The National Board of Health and Welfare establishes norms and regulations for the dental business, as well as supervises and inspects dental facilities to ensure compliance. It also oversees dental professional education and training, as well as the management of the dental care system. The organization is also in charge of authorizing new dental treatments and procedures, as well as providing guidelines on the usage of new technologies in the dentistry business. The National Board of Health and Welfare collaborates with other organizations such as Folktandvrden and Tandläkarförbundet to guarantee that dental treatment in Sweden is of high quality and available to all inhabitants. FRAMM, an acronym in Swedish representing the most significant aspects of this guideline, namely "fluoride," "advice," "arena," "motivation," and "diet," was adopted in the Västra Götaland Region of Sweden in 2008. The FRAMM Guideline dental health program for 12- to 15-year-olds was assessed to be cost-effective in the long run.

Reimbursement Scenario

The administration of the dental care subsidy is handled by Försäkringskassan. Health insurance in Sweden provides free dental care until the age of 23. National dental care subsidy starts at the age of 24 and requires paying for dental care. Specific needs for dental care are covered by the same tax-funded universal health coverage. The national dental care subsidy includes standard and specific dental care allowances, as well as high-cost protection. There is protection against high expenses to encourage people to perform preventative dental treatment and to provide extra help to individuals at increased risk of suffering from poorer dental health owing to a disability or sickness.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.