Spain Neurology Devices Market Analysis

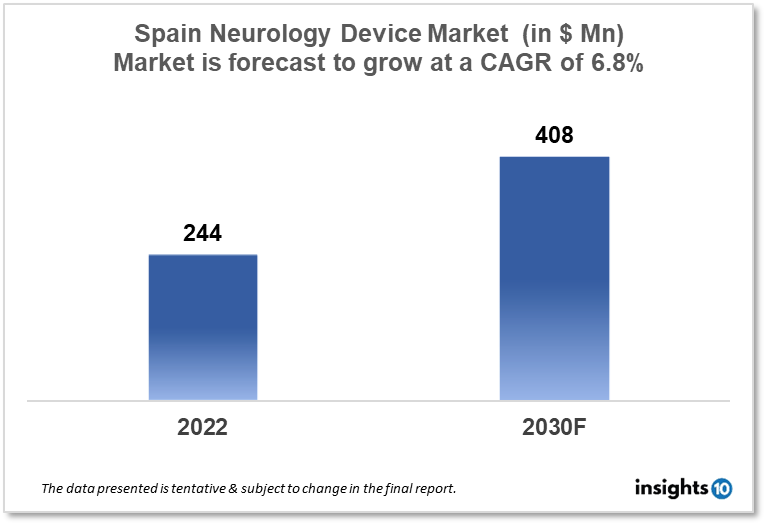

Spain's Neurology Device Market size is at around $244 Mn in 2022 and is projected to reach $408 Mn in 2030, exhibiting a CAGR of 6.8% during the forecast period. The emphasis of the market is on upgrading high-tech equipment and infrastructure for neurology devices by accelerating the move to digitization, big data, and expanding public-private collaborations in Spain. Major players are Medtronic, Boston Scientific, Johnson & Johnson, and Abbott Laboratories. This report by Insights10 is segmented by product type like neurostimulation, interventional neurology, neurosurgery devices, and neuro-endoscopes, and by the end user.

Buy Now

Spain Neurology Device Market Executive Summary

Spain's Neurology Device Market size is at around $244 Mn in 2022 and is projected to reach $408 Mn in 2030, exhibiting a CAGR of 6.8% during the forecast period. Spain, with a population of over 47 Mn people and Europe’s fourth-largest economy, is an important market for medical devices. All citizens of Spain have access to comprehensive medical care. Public healthcare institutions now account for over 70% of the healthcare sector, i.e., public hospitals, health centres, and research institutes. They are the primary purchasers of medical equipment and supplies and with the necessity for greater public/private collaboration, particularly in light of the strain placed on the system by COVID, the weight of the private healthcare sector continues to grow. The private healthcare industry accounts for 2.7% of GDP, while the state sector accounts for 6.6%. Spain has an advanced healthcare system and a large number of highly skilled and experienced neurosurgeons. Spanish neurosurgeons are internationally regarded for their expertise and experience in treating a wide range of neurological diseases, and the country has a long history of innovation in the field of neuroscience. In terms of neurology device availability, Spain has a well-established medical device market and is expected to have access to a diverse range of neurology devices, including deep brain stimulation devices, spinal cord stimulation devices, and intrathecal drug delivery systems, among others. The Spain neurology device market is expected to be worth $243.57 Mn in 2022 and $412.27 Mn in 2030, with a CAGR of 7.8% during the forecast period.

Over 80% of medical equipment sales are made in the Madrid and Catalonia regions. Small and medium-sized businesses account for 90% of the market and generate more than 40% of revenues. Large corporations account for only 10% of the market but account for roughly 60% of sales. The majority of the major American and European brands are well-established in Spain, with only 6% manufactured domestically. At the start of COVID-19 in 2020, Spain has not entirely recovered from the devastating effects of the 2007-2013 economic crisis. Spain has a serious problem with old equipment, according to the country's healthcare technology organisation, FENIN. Spain has a serious problem with old equipment, according to the country's healthcare technology organisation, FENIN. Part of Europe’s assistance funds is expected to be utilised to begin renovating the equipment. The industry is still significantly reliant on imports. A breakdown is presently unavailable due to a lack of statistics. Prior to COVID, the majority of imports came from Europe, with Germany accounting for over half of all imports. The majority of well-known US brands are well-established in the Spain market. Imports from the US are estimated to be in the 15-20% range. The European Union (EU) remains the primary destination for Spanish exports in this sector, accounting for more than 60% of total exports to Germany, Portugal, Belgium, France, and Italy. EEG machines, EMG machines, TMS devices, and functional MRI (fMRI) machines are the most often utilised neurological medical devices in Spain. These gadgets are used to diagnose and monitor illnesses such as epilepsy, headaches, strokes, and neurodegenerative disorders. The specific equipment employed would be determined by the ailment being evaluated as well as the treating physician's preference.

The Clinic Institute of Neuroscience established the Neurology Service in 1972, they provide high-quality, cost-effective care to persons suffering from neurological illnesses. It also features teaching and research programmes, making it a premier healthcare resource on a national and worldwide scale. The Neurology Service admits 1,300 patients per year, handles 20,000 outpatient visits, 4000 one-day hospital sessions, 9000 sessions of cognitive or physical examinations for patients with neurodegenerative diseases, 7500 functional tests like electromyography [EMG], electroencephalography [EEG], evoked potentials, and polysomnography. This provides an initial snapshot of the demand for a public neurology treatment centre in the heart of Spain.

Market Dynamics

Market Growth Drivers

The emphasis will be on replacing/upgrading high-tech equipment and infrastructure, accelerating the transition to more digitization, big data, and increased public-private collaborations, among other things. This focus will be spread out over several years, and funding will be managed mostly by the 17 regional governments. This second aspect may imply that the speed and character of procurements will differ by location. An ageing population and the incidence of chronic diseases are additional factors that will drive demand for orthopaedics, prosthetics, patient aids, home care, hospice items, and so on in the future. The rising interest in minimally invasive technologies, particularly in cardiology and robotics, will be driven by the lower cost of therapy. The demand for trustworthy e-health technologies. The need for reliable e-health technology will persist. Consumables*. In recent years, Asia has emerged as the major supplier, owing primarily to improved cost management. It is worth noting that consumables are one of the more dynamic local sectors, despite the fact that much of this output is destined for export. Syringes, needles, sutures, staples, packing, tubing, catheters, medical gloves, gowns, masks, adhesives and sealants for wound dressing, and a variety of other devices and tools used in a hospital or surgical setting are examples of medical consumables and equipment. Pricing will remain an important factor in the decision-making process. Budgetary considerations will drive additional changes in the sector, such as more centralised procurement, continuous, if not increased attention on the cost/benefit of equipment, increasing tax on products, and so on. However, aside from competitive prices, sector professionals prefer solutions with a proven track record and, if possible, use in other European markets. Competition is fierce not just from domestic firms, but also from most well-known international suppliers, including major U.S. names that have a strong presence in the Spanish market. Traditionally, the MEDICA trade fair in Düsseldorf, Germany, held every November, has been by far the most important international platform for Spanish professionals, both manufacturers and distributors.

Market Restraints

Companies looking to bring novel neurological products to market in Spain may face obstacles because of too stringent regulations and certification requirements. In Spain, the lack of defined reimbursement policies for neurology devices may be a hindrance to their use and expansion. A lack of healthcare infrastructure, particularly in rural regions, can make widespread installation and usage of neurological equipment difficult in Spain. High levels of competition in the neurology device market from both established players and new entrants may limit growth potential in Spain. Access to finance, particularly for smaller businesses and start-ups, can stymie research and development of innovative neurological devices in Spain. In Spain, a lack of awareness and comprehension of neurology devices among healthcare providers and patients may limit demand and growth. Spain is significantly reliant on imports of neurological medical devices, and while the European Union's tax regulation system is effective, the development of Asia as a major contributor due to cost benefits means that taxes can also affect market decisions.

Competitive Landscape

Key Players

- Medtronic

- Boston Scientific

- Johnson & Johnson

- Abbott Laboratories

- Stryker

- Philips Healthcare

- Siemens Healthineers

Notable Recent Deals

January 2022 - Neuro-Bio is a biotechnology business that is working on Alzheimer's disease therapies. The company is currently seeking up to ten million pounds sterling in staged funding to pursue the clinical development of its novel chemical, NBP 14. T14, a novel bioactive peptide of 14 amino acids identified by Neuro-Bio, is a neurotoxin in the adult brain and the results published demonstrate that it is a possible key factor in neurodegeneration. Neuro-Bio is investigating this newly recognised mechanism in the hopes of discovering the first medications in its class to treat Alzheimer's disease and developing a biomarker as a complementing diagnostic tool. The CEO of NeuroBio, Susan Greenfield, is part of ICEX-Invest in Spain's Rising Up in Spain programme as a result of their project. The initiative is designed to attract international entrepreneurs who wish to establish themselves and flourish in Spain.

Healthcare Policies and Regulatory Landscape

Medical devices and products must bear the CE mark and be imported by a company that is authorised to handle medical products. The Spanish Agency of Medicine and Medical Devices issues this permit. As the Europe market has developed and expanded, as has the requirement for the CE mark, many US businesses have centralised their manufacturing and import operations into a single country from which they register and distribute their products to the rest of the Europe markets. The updated EU Medical Device Regulation (EU-MDR 2017/745) went into effect in May 2021. This MDR supersedes earlier directives which means that medical devices cannot be certified under the previous directives. Manufacturers should evaluate the new regulation to guarantee compliance with the new standards. The majority of governmental healthcare sector acquisitions are made through official tenders. Non-EU and US enterprises must have either a Spanish distributor or their own branch in Spain to participate in official bids and other market possibilities, as well as to provide the requisite after-care service. Prior to the open bid, the competing companies go through a pre-selection process. During pre-selection, the companies offer the hospital product details and pricing. Following a study of the offers, the hospital selects the companies deemed most acceptable. In the private sector, tenders are not used. Typically, private hospitals choose a restricted number of vendors.

Reimbursement Scenario

The reimbursement for neurology devices in Spain is likely to vary depending on the type of device, its intended use, and the individual patient's specific needs. In general, reimbursement for medical devices in Spain is managed by the country's National Health System (Sistema Nacional de Salud), which sets guidelines for the coverage and reimbursement of medical devices. The specific reimbursement criteria and policies for neurology devices in Spain may depend on a number of factors, such as the type of device, the patient's medical condition, and the clinical evidence available to support the device's efficacy and safety. It is important to note that reimbursement policies and processes in Spain can be complex and subject to change and that the reimbursement of neurology devices may not always be clear-cut or straightforward. Companies developing and marketing neurology devices in Spain may face challenges in securing adequate reimbursement for their products.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Neurology Device Market Segmentation

The Neurology Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Neurostimulation

- Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Gastric Electric Stimulation

- Interventional Neurology

- Aneurysm Coiling & Embolization

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting

- Carotid Artery Stents

- Filter Devices

- Balloon Occlusion Devices

- Neurothrombectomy

- Clot Retriever

- Suction Aspiration Devices

- Snares

- CSF Management

- CSF Shunts

- CSF Drainage

- Neurosurgery Devices

- Ultrasonic Aspirators

- Stereotactic Systems

- Neuroendoscopes

- Aneurysm Clips

By End User (Revenue, USD Billion):

- Hospitals and Clinics

- Specialty Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.