Spain Hepatitis A Therapeutics Market Analysis

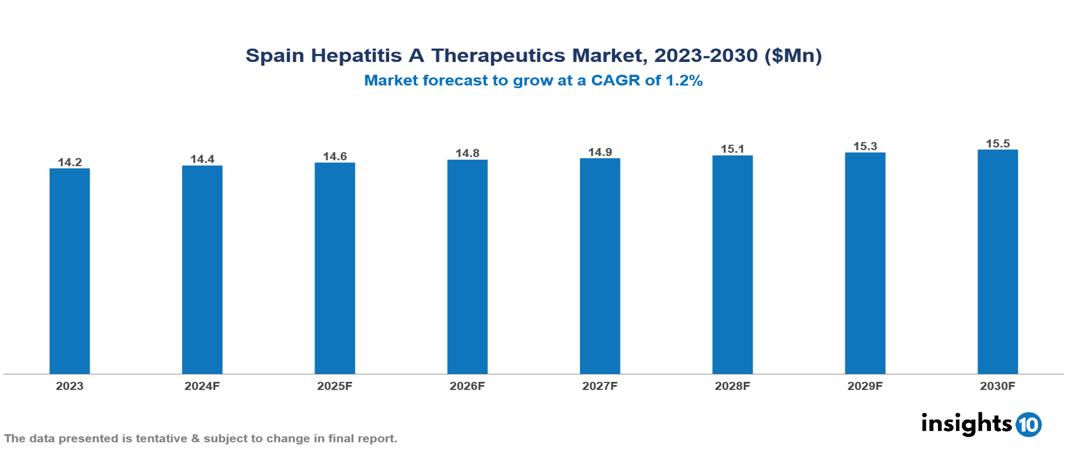

The Spain Hepatitis A Therapeutics Market was valued at $14.23 Mn in 2023 and is predicted to grow at a CAGR of 1.2% from 2023 to 2030 to $15.27 Mn by 2030. Significant factors driving this market include the rising prevalence of Hepatitis A in Spain, the growing vulnerable population, and Spain's global health initiatives. Leading companies in this sector, such as F. Hoffmann-La Roche Ltd. and Grifols, play significant roles.

Buy Now

Spain Hepatitis A Therapeutics Market Executive Summary

The Spain Hepatitis A Therapeutics Market was valued at $14.23 Mn in 2023 and is predicted to grow at a CAGR of 1.2% from 2023 to 2030 to $15.27 Mn by 2030.

Hepatitis A, caused by the Hepatovirus A (HAV), is a viral liver infection. Most infected individuals, especially younger people, show few or no symptoms. When symptoms do occur, they usually last around eight weeks and may include nausea, vomiting, diarrhea, jaundice, fever, and abdominal pain. Acute liver failure is rare but can happen, particularly in older adults. Diagnosis is done through blood tests due to symptoms similar to other diseases. The Hepatitis A vaccine is an effective preventive measure recommended in some countries for children and high-risk individuals who haven't been vaccinated. The vaccine generally provides lifelong immunity. Key pharmaceutical companies, such as F. Hoffmann-La Roche Ltd. and Grifols, are essential in vaccine development and distribution, aiding Spain's public health initiatives.

The disease burden of hepatitis A in Spain has seen a significant increase in recent years with annual reported 5,983 cases of hepatitis A, which is almost eight times higher than the average annual number of cases reported during previous four years. This surge in hepatitis A cases highlights the importance of vaccination for high-risk groups and the need for preventive measures, indicating a rising prevalence as a significant market driver for hepatitis A therapeutics in Spain. Market growth is driven by the increasing prevalence of Hepatitis A in Spain, the growing vulnerable population, and Spain's global health initiatives. In contrast, factors like lack of awareness, decentralized healthcare, and resource constraints restrain the market.

Market Dynamics

Market Growth Drivers

Rising Prevalence: In recent years, Spain has experienced a notable rise in the incidence of hepatitis A, with an annual report of 5,983 cases, nearly eight times higher than the average annual number reported over the previous four years. This rise in cases underscores the importance of Hepatitis A vaccination for high-risk groups and the need for preventive measures, indicating a rising prevalence as a significant market driver for the Hepatitis A therapeutics market in Spain.

Growing vulnerable population: The majority of Hepatitis A cases in Spain were among men aged 15-45 years, with MSM being the most affected group. A study highlighted that 84% of male cases identified as MSM are linked to high-risk sexual behavior. This demographic's increased incidence drives demand for Hepatitis A therapeutics, emphasizing the need for targeted treatments and prevention measures. These factors significantly boost the Hepatitis A therapeutics market in Spain.

Spain's Global Health Initiatives: Spain's national hepatitis elimination plan, aligned with the WHO's global strategy to eliminate viral hepatitis by 2030, underscores the country's commitment to controlling Hepatitis A. This proactive engagement in international efforts, including the WHO's sector strategy on viral hepatitis, highlights Spain's dedication to eliminating Hepatitis A and improving public health outcomes. Spain's legal framework supporting individuals with chronic illnesses further reinforces its comprehensive approach to advancing Hepatitis A therapeutics, thus driving the market.

Market Restraints

Lack of Awareness: The lack of knowledge and awareness about Hepatitis A transmission modes, consequences, prevention methods, and the disease itself among the public in Spain leads to an underestimation of the severity of Hepatitis A infection, resulting in reduced demand for therapeutics and vaccines. Gaps in knowledge about preventive measures, such as vaccination, hinder proactive engagement with Hepatitis A therapeutics, while stigma and misconceptions discourage individuals from seeking testing, treatment, or vaccination. Ultimately, reduced healthcare-seeking behavior due to inadequate knowledge about Hepatitis A limits the patient pool for Hepatitis A therapeutics, thus acting as a market restraint.

Decentralized Healthcare: Spain's decentralized healthcare system across autonomous regions is a restraint in the Hepatitis A therapeutics market. Disparities in access to Hepatitis A vaccinations and treatments may arise, particularly impacting marginalized populations or areas with limited infrastructure. Coordination challenges hinder consistent national strategies, while variations in regional policies and resource allocation lead to unequal access to services. These disparities constrain the market by preventing a uniform approach to Hepatitis A prevention and treatment.

Resource Constraints: Resource constraints within Spain's healthcare system, despite its commitment to universal coverage, pose significant restraints on the Hepatitis A therapeutics market. Budget limitations have strained the system's ability to effectively respond to outbreaks, resulting in challenges related to healthcare personnel, facilities, and logistical support for widespread vaccination campaigns. These limitations reduce the capacity to manage and treat Hepatitis A cases, thus hindering market growth.

Regulatory Landscape and Reimbursement Scenario

In Spain, the Spanish Agency of Medicines and Medical Devices (AEMPS) is the regulatory body that oversees drug approval and marketing. Once a Hepatitis A treatment is granted marketing authorization by AEMPS, reimbursement is primarily handled through the public healthcare system, the National Health System (SNS). The Spanish government acquires Hepatitis A medicines through public bidding processes to ensure access to healthcare as a fundamental right for citizens, allowing them to obtain drugs at the lowest possible prices.

Additionally, Spain utilizes Productive Development Partnerships to transfer technology for strategic Hepatitis A products to public pharmaceutical industries, ensuring the supply of essential drugs at agreed prices. The incorporation of new Hepatitis A technologies into public policies is overseen by the National Committee for Health Technology Incorporation to guarantee access to approved treatments within the SNS.

Competitive Landscape

Key players

Here are some of the major key players in the Hepatitis A Therapeutics Market:

- Grifols

- F. Hoffmann-La Roche Ltd.

- Merck & Co. Inc.

- Sanofi

- GlaxoSmithKline (GSK)

- Takeda

- Zydus Cadilla

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Hepatitis A Therapeutics Market Segmentation

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

By Route of Administration

- Oral Medications

- Intravenous Therapy

By Healthcare Setting

- Outpatient Care

- Inpatient Care

By Age

- Children

- Adults

- Senior Citizens

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.