Spain Financial Assistance Programs Market Analysis

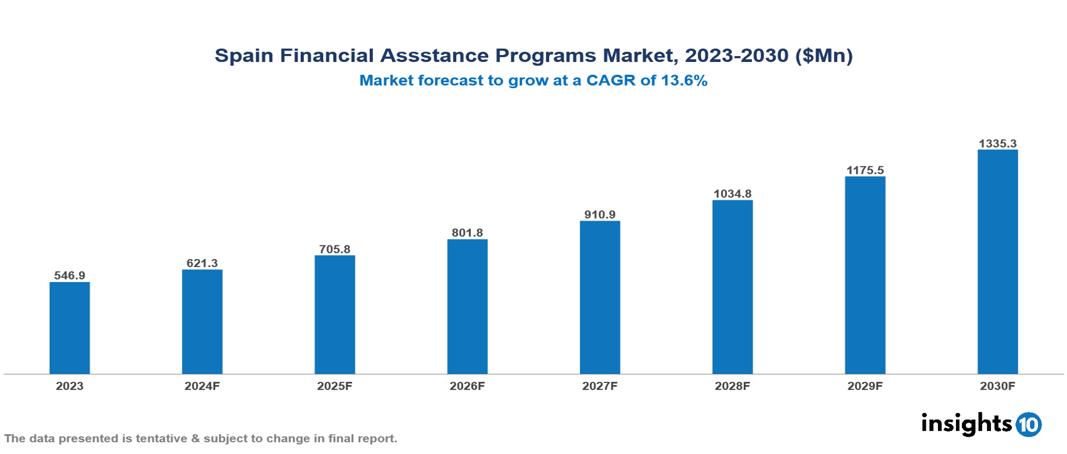

The Spain Financial Assistance Programs Market was valued at $546.9 Mn in 2023 and is projected to grow at a CAGR of 13.6% from 2023 to 2023, to $1,335.3 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Merck, GSK, Johnson & Johnson, Novartis among others.

Buy Now

Spain Financial Assistance Programs Market Executive Summary

The Spain Financial Assistance Programs Market is at around $546.9 Mn in 2023 and is projected to reach $1,335.3 Mn in 2030, exhibiting a CAGR of 13.6% during the forecast period 2023-2030.

The aim of drug manufacturers' patient financial support is to minimize or remove out-of-pocket cost sharing as an obstacle when patients choose medications, thereby keeping them on brand-name drugs for longer. Co-pay assistance, free drugs trails, bridge programs, sliding scale programme, Coupons, Bulk purchasing programs etc are some of the widely used financial assistance programme under patient assistance programs. The formulary, which is a list of recommended and nonpreferred prescription medicines, is used by pharmacy benefit managers (PBMs) or health plans to calculate the out-of-pocket drug cost sharing for their clients. The efficacy, cost, and amount of the manufacturer's rebate that the payer receives for selecting a drug above its rivals determine a drug's preferred status. Generally speaking, patient cost sharing for preferred brand and generic medications is lower than that of nonpreferred brand medications. Patient cost sharing has gone up along with prescription prices, which has led to some patients stretching, skipping, or stopping too-expensive medication. Pharmaceutical companies frequently try to lessen these impacts by offering or sponsoring different kinds of financial assistance to patients.

According to Global Burden Disease report, the five main causes of death in Spain are, ischaemic heart disease, which accounted for 14.6% of all deaths, Alzheimer disease and other dementias (13.6%), stroke (7.1%), chronic obstructive pulmonary disease (COPD) (6.9%) and lung cancer (5%). Therefore, the market is predominately driven by factors such as increasing prevalence of Chronic disease, rising drug cost, and complex insurance landscape where factors such as investment costs, pricing pressures and limited awareness among patients restrict the market.

Pharmaceutical companies providing financial assistance to patient are such as Merck, GSK, Pfizer, Johnson & Johnson, Novartis among others.

Market Dynamics

Market Drivers

Increasing cost of medications: Increasing cost of medications: Novel and specialized medications are getting more and more expensive, especially for complex or uncommon disorders. Even for individuals with insurance, this tendency results in increased out-of-pocket expenses for patients. More individuals thus require financial aid in order to obtain their prescription drugs.

Chronic disease prevalence: According to Global Burden Disease report, the five main causes of death in Spain are, ischaemic heart disease, which accounted for 14.6% of all deaths, Alzheimer disease and other dementias (13.6%), stroke (7.1%), chronic obstructive pulmonary disease (COPD) (6.9%) and lung cancer (5%). This increasing number of patients with chronic conditions necessitates long-term, often expensive treatments. This creates a sustained need for financial assistance over extended periods. Chronic disease management is a priority in healthcare, driving support for assistance programs.

Complex insurance landscape: The prevalence of high-deductible health plans means patients often face significant upfront costs before insurance coverage kicks in. Increasing co-pays and coinsurance rates shift more of the financial burden onto patients. These insurance trends create a larger pool of patients who could benefit from financial assistance programs.

Market Restraints

Cost and Investment Requirements: The high costs associated with developing and manufacturing innovative medicines can be a significant barrier to entry for pharmaceutical companies, making financial assistance programs essential. The need for significant investments in infrastructure and technology can be a challenge for smaller companies or those with limited resources.

Pricing Pressures: The competitive nature of the pharmaceutical market, with pricing pressures from both domestic and international players, can make it difficult for companies to maintain profitability and justify the costs of financial assistance programs. The need to balance pricing with affordability can be a complex issue, especially for innovative medicines that may require higher prices to justify the research and development costs.

Limited Awareness and Adoption: Lack of awareness about the benefits of patient assistance programs among both patients and healthcare providers can hinder the adoption of financial assistance programs. The financial assistance market is still evolving, and there may be limited understanding of the value it can bring to patients and the healthcare system.

Regulatory Landscape and Reimbursement Scenario

The regulatory authority for medicines, health products, cosmetics, and personal care products in Spain is primarily governed by the European Medicines Agency (EMA) at the European Union level and the Spanish Agency of Medicines and Medical Devices (AEMPS) at the national level. AEMPS is responsible for evaluating and authorizing medicines for human and veterinary use, closely monitoring the safety and efficacy of drugs, and establishing specific rules and regulations to guarantee the quality of medical products in Spain.

After EU approval, medications in Spain must first be approved by the Spanish Agency of Medicines and Medical Products (AEMPS), followed by the Therapeutic Positioning Report (IPT). The process of obtaining a license for drugs and pharmaceuticals in Spain involves a comprehensive process overseen by (AEMPS). Applicants are required to compile and submit all the necessary scientific data about the drug product. AEMPS experts will thoroughly evaluate the dossier after complete satisfaction market authorization is granted.

The Spanish Ministry of Health, Consumer Affairs, and Social Welfare oversees the reimbursement framework for cancer drugs. In partnership with regional health authorities, the ministry develops pricing and reimbursement policies based on clinical benefit, cost-effectiveness, and budget impact.

Competitive Landscape

Key Players

Here are some of the major key players in the Spain Financial Assistance Programs Market:

- Roche

- Pfizer

- Bayer

- Sanofi

- Novartis

- Merck

- GSK

- Johnson & Johnson

- AbbVie

- AstraZeneca

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.