Spain Depression Therapeutics Market Analysis

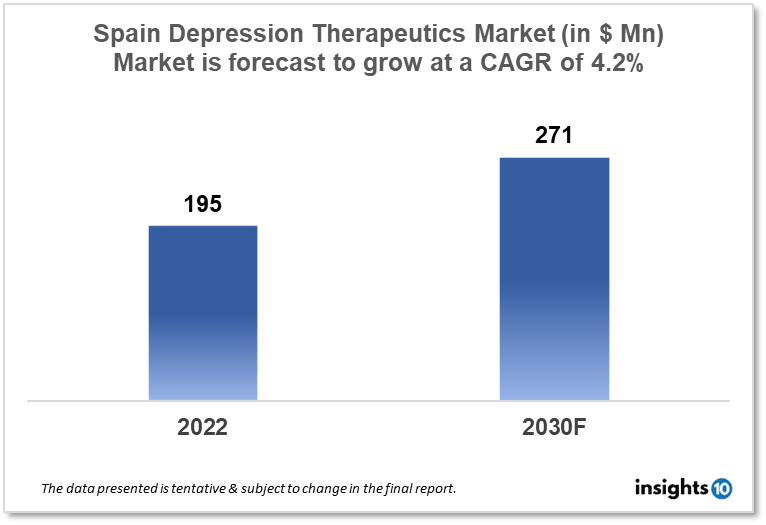

The Spain depression therapeutics market is expected to witness growth from $195 Mn in 2022 to $271 Mn in 2030 with a CAGR of 4.2% for the forecasted year 2022-2030. The increasing incidence of depression in Spain and rising healthcare expenditure are the major growth drivers of the market. The Spain depression therapeutics market is segmented by drug type, therapies, indication, and by end users. TecnyFarma, Pharmaloop, and Pfizer are the major players in the Spain depression therapeutics market.

Buy Now

Spain Depression Therapeutics Market Executive Analysis

The Spain depression therapeutics market size is at around $195 Mn in 2022 and is projected to reach $271 Mn in 2030, exhibiting a CAGR of 4.2% during the forecast period. The funding allotted to the Ministry of Health in 2023 will rise by 6.5% to $3,310 Mn in light of the decentralized nature of the Spanish health system, where Ministry of Health spending accounts for less than 3% of total governmental spending. This sum accounts for both the money allocated from the national public budget for 2023 and the European Recovery and Resilience Facility. The new National Public Health Agency will receive $3.4 Mn, and the national network for public health monitoring will receive $4.4 Mn. For the centralized purchase of the COVID-19 vaccine, an additional $1,404 Mn is allocated. The Ministry of Health has also budgeted over $1,280 Mn to upgrade primary care facilities and tools for specialized care, screening programs, and mental healthcare, with a particular focus on improving primary care. The autonomous towns will receive this funding.

According to the 2017 National Health Survey in Spain, women were more than twice as likely to be diagnosed with depression (9.2% vs. 4.0%), and antidepressants and stimulants were more frequently prescribed to and consumed by women than by males. With a significant increase in healthcare expenditure over the past 20 years, Spain's health indicators have seen highly positive changes. Between 1984 and 2001, per capita spending on the National Health Service grew six-fold. In terms of psychological treatment, the 1980s saw the beginning of a reformation process that has helped to advance mental health care in recent years.

Based on randomized trials in Spain that showed that the combination of pharmacotherapy and psychotherapy was more effective than either of these therapies alone, doctors recommend this approach for the initial treatment of unipolar major depression. Clinical studies, however, have not proven the superiority of any particular medication/psychotherapy combination. Instead, when selecting a monotherapy, clinicians choose each modality based on the same principles. Because antidepressants are typically more readily accessible and practical than psychotherapy, and some patients prefer pharmacotherapy, they have been studied and used more frequently than combination treatments or psychotherapy alone. Comorbidity, psychosocial stressors, and cost are additional considerations when selecting a therapy plan.

Patients with unipolar severe depression may benefit from antidepressants. Agomelatine, amitriptyline, citalopram, duloxetine, escitalopram, imipramine, mirtazapine, paroxetine, sertraline, monoamine oxidase inhibitors, selective serotonin reuptake inhibitors, tricyclics are a few examples of specific antidepressants and antidepressant classes that have been found to be effective in treating unipolar major depression in Spain.

Market Dynamics

Market Growth Drivers

There are over three Mn individuals who suffer from depression in Spain, making it a common mental health disorder. The high incidence of depression is fuelling the market for treatment. Transcranial magnetic stimulation (TMS) and ketamine injections are two cutting-edge depression therapies that have been made possible by technological advancements. The market for depression therapeutics in Spain is expanding as a result of these novel treatment options. With an emphasis on mental health, the Spanish government has been making significant investments in the healthcare industry. The Spain depression therapeutics market is expanding as a result of the country's rising healthcare costs.

Market Restraints

The cost of treating depression can be high, particularly for leading-edge procedures like Transcranial Magnetic Stimulation (TMS) and ketamine injections. Some patients may be disheartened from seeking treatment due to the high expense, especially those who lack access to sufficient health insurance. Despite increased knowledge of mental health subjects, there is still a serious stigma related to mental disease in Spain. Because of the stigma, some patients may decide not to seek treatment or may be unenthusiastic to talk about their mental health difficulties with medical experts. Although medicine is a common form of therapy for depression, some patients may find its side effects to be unbearable. Patients may stop taking their drugs as a result of these side effects, or they may be reluctant to begin therapy at all, therefore, restraining the Spain depression therapeutics market evolution.

Competitive Landscape

Key Players

- Vestilab (ESP)

- Théa Pharma (ESP)

- Farmasierra (ESP)

- TecnyFarma (ESP)

- Pharmaloop (ESP)

- Pfizer

- AstraZeneca

- GlaxoSmithKline

- Elly Lilly

- Allergan

- Takeda Pharmaceutical

Healthcare Policies and Regulatory Landscape

The Sistema Nacional de Salud (SNS), a national healthcare system, is in place in Spain. There are now 17 regional health ministries as a consequence of the transfer of health duties to the regional level since 2002. The Ministry of Health, Social Services, and Equality is still in charge of setting national policy and keeping an eye on implementation. All primary medical treatments are free through the SNS. The public healthcare system in Spain, which provides complete coverage to all citizens and authorized immigrants, provides treatment for depression. This suggests that depression patients can receive free or extremely affordable therapy for their condition. The level of coverage offered by the patient's health insurance plan and the type of medication used determine the refund rate for depression medicines. The Spanish National Health System generally includes a variety of depression treatment options, such as prescription medications, counselling, and additional procedures like transcranial magnetic stimulation (TMS) and electroconvulsive therapy (ECT). The national healthcare system also provides access to inpatient care for patients who need to be hospitalized for their depression.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.