Spain Corneal Implants Market Analysis

Spain Corneal Implants Market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The market for Corneal Implants is expanding as a result of rising prevalence of corneal diseases. Rise in corneal blindness and increasing demand of corneal transplantation are fueling the development of better procedures and devices for implantation procedure of cornea. Some of the key players in the global Corneal Implants Market include Presbia Plc, CorNeat Vision, Aurolab, AJL Opthalmic SA, LinkoCare Life Sciences AB, CorneaGen, DIOPTEX, Mediphacos, EyeYon Medical, and KeraMed, Inc.

Buy Now

Spain Corneal Implants Market Executive Summary

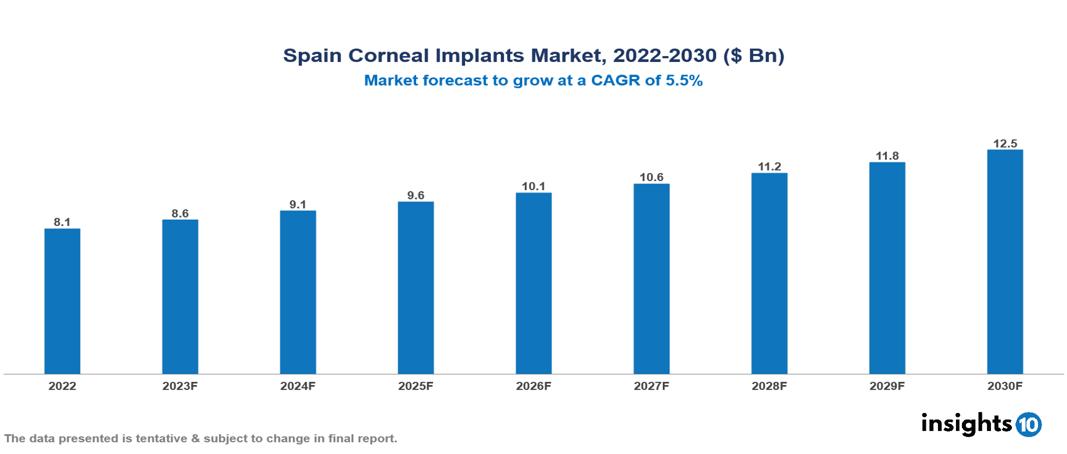

Spain Corneal Implants Market is valued at around $8.1 Bn in 2022 and is projected to reach $12.4 Bn by 2030, exhibiting a CAGR of 5.5% during the forecast period 2023-2030.

The Corneal Implant Market refers to the market for devices and procedures used for the treatment of corneal diseases and disorders. Corneal implants are small devices that are surgically embedded into the cornea which helps to correct vision problems or correct abnormalities of vision.

The increasing prevalence of corneal diseases has contributed to the growth of the global market for corneal implants. According to WHO, around 2.2 Bn people worldwide were suffering from eye and vision problems in 2022. Of them, 253 Mn people suffer from moderate to severe visual impairment and 36 Mn were blind.

There are many players in the global corneal implants market but Presbia Plc, CorNeat Vision, Aurolab, AJL Ophthalmic SA, LinkoCare Life Sciences AB, CorneaGen, DIOPTEX, Mediphacos, EyeYon Medical, and KeraMed, Inc are some of the major players in the market.

Corneal conditions like Cataracts, Keratoconus, Infectious Keratitis, and Fuchs Dystrophy are the most common conditions for increasing vision impairment and loss of vision. Prevalence for these conditions is increasing and it has driven the market for corneal implants. There have been new developments in corneal implants and procedures that have improved the efficacy and outcome of corneal implants.

Corneal diseases are most common in the geriatric population and it is increasing globally which is projected to fuel the market for corneal implants. There are still many challenges like complex regulatory procedures to enter the market, development, and commercialization of the implants, lack of surgical expertise, high cost of implants, and risk of complications.

Market Dynamics

Drivers of Spain Corneal Implants Market:

Increasing Prevalence of Corneal Diseases: Increasing prevalence of corneal diseases like keratoconus, corneal scarring, and corneal dystrophy are driving the demand for the corneal implants market. Corneal implants provide a solution for vision correction for patients with these conditions.

Technological Advancements: The expansion of the corneal implant market is being driven by advancements in technologies like improved design, materials, and surgical techniques. It has improved the safety, efficacy, and outcomes of corneal implant Procedures which is fueling the market demand for corneal implants.

Growing Aging Population: With increasing age people are more prone to develop corneal diseases like presbyopia and age-related molecular degeneration. For the treatment of these conditions, corneal implants are required and it is fueling the market demand.

Favorable Reimbursement Policies: With more coverage of insurance and reimbursement policies people are demanding treatment for corneal conditions and it has increased the demand for the corneal implants market. It has reduced the financial burden of people and increased the affordability of corneal implant surgeries.

Increasing Demand for Minimally Invasive Procedures: Corneal implants offer less invasive procedures compared to traditional corneal transplant surgeries. It provides faster recovery time and reduced post-operative complications which improves patient comfort. Increasing demand for minimally invasive procedures is driving the adoption of corneal implants.

Developments in Corneal Implants Market:

The market for corneal implants is always changing due to new discoveries and improvements in science and technology. Recent market developments include the following:

Bioengineered Corneal Implants: Tissue engineering and regenerative medicine are being used to develop bioengineered corneal implants. It replaces damaged or diseased corneal tissues with lab-grown tissue and provides solutions to corneal problems.

Customized Corneal Implants: There have been advancements in imaging techniques and 3D printing which has helped in the development of customized corneal implants according to the need and condition of patients. These implants have improved the efficacy and outcomes of the procedures for corneal implantation.

Extended Depth of Focus Implants: It has been developed to address conditions like myopia and presbyopia. It helps to improve the range of vision without the need for contact lenses or spectacles. It has fueled the market for corneal implants.

Improvement in material: Materials used to develop corneal implant has become more biocompatible to reduce the risk of adverse effects and improve long-term outcomes for a patient with corneal diseases. Continuous research is being done for new materials and surface modifications to optimize the connection between corneal implants and tissues.

Given that they increase the precision and effectiveness of corneal implants, these innovations are anticipated to propel the expansion of the market for corneal implants.

Key players

Johnson & Johnson Vision Bausch + Lomb Carl Zeiss Meditec AG Alcon (Novartis AG) CorneaGen SightLife Surgical KeraMed, Inc. Presbia PLC Cornea Biosciences CorNeat Vision1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Spain Corneal Implants Market

By Type:

- Artificial Corneal Implant

- Human Corneal Implant

By Procedure:

- Endothelial Keratoplasty

- Penetrating Keratoplasty

- Other procedures

By Disease Indication:

- Keratoconus

- Fuchs Dystrophy

- Infectious Keratosis

- Corneal Ulcers

- Other Diseases

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.