Spain Conjunctivitis Therapeutics Market Analysis

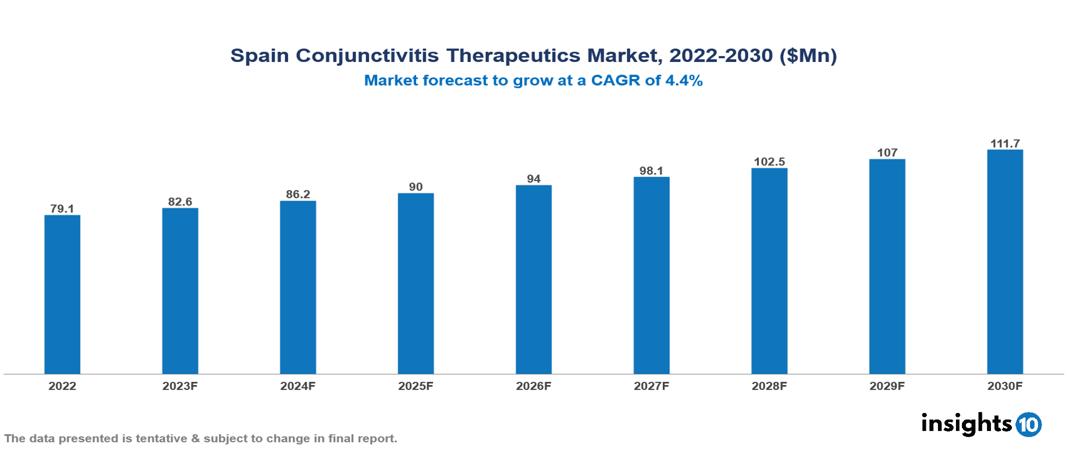

The Spain Conjunctivitis Therapeutics Market was valued at $79 Mn in 2022 and is predicted to grow at a CAGR of 4.4% from 2023 to 2030, to $112 Mn by 2030. The key drivers of this industry include the increasing burden of conjunctivitis, the development of new therapeutics in the industry, and expanding healthcare infrastructure. The industry is primarily dominated by players such as Allergan, Pfizer, Bausch & Lomb, Merck, Santen, Novartis, and Sanofi among others.

Buy Now

Spain Conjunctivitis Therapeutics Market Analysis Executive Summary

The Spain Conjunctivitis Therapeutics Market is at around $79 Mn in 2022 and is projected to reach $112 Mn in 2030, exhibiting a CAGR of 4.4% during the forecast period.

Conjunctivitis, commonly known as pink eye, refers to the inflammation of the thin membrane covering the eyelids and the whites of the eyes. Various factors, including viruses, bacteria, allergies, and irritants, can trigger this condition. Viral conjunctivitis, often caused by the adenovirus responsible for the common cold, is highly contagious and typically begins in one eye before spreading to the other. Symptoms vary depending on the underlying cause but generally include redness in the whites of the eyes, a gritty sensation, excessive tearing, itching, swollen eyelids, and discharge. While the condition often resolves on its own within a few weeks, seeking medical attention becomes crucial if severe pain, changes in vision, light sensitivity, persistent discharge, or worsening symptoms occur. Treatment is determined by the specific cause of conjunctivitis. Managing symptoms with pain relievers and cool compresses is common for viral cases, antibiotic eye drops are prescribed for bacterial cases, and antihistamine eye drops or oral medications are recommended for allergic cases. Companies such as Alcon, Allergan, Bausch & Lomb, Pfizer, and Santen Pharmaceutical manufacture these treatments.

Allergic conjunctivitis is highly prevalent with an estimated prevalence of around 37% in Spain posing a major public health burden. The market growth is driven by several factors such as the rising prevalence of conjunctivitis, the development of new therapeutics in the industry, and expanding healthcare infrastructure. However, conditions such as strong competition from generics, a high prevalence of self-medication, and a complex regulatory environment limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in prevalence of conjunctivitis: Allergic conjunctivitis is highly prevalent in Spain with an estimated prevalence as high as 37%, followed by infectious conjunctivitis, serving as a significant catalyst for market expansion. Factors such as a rise in contact lens usage and the development of antibiotic resistance can lead to a further increase in the incidence of these forms of conjunctivitis, emphasizing the demand for efficient treatments. With the aging of the Spanish population, there is a growing prevalence of age-related eye conditions like dry eye syndrome, frequently resulting in secondary conjunctivitis and necessitating targeted therapeutic interventions.

Growing demand for new therapeutics: Pharmaceutical companies are currently engaged in the development of innovative therapies such as targeted anti-inflammatory medications, extended-release formulations, and combination treatments. These activities aim to provide patients with more efficient and convenient options. The rise of personalized treatments, customized to address individual needs and allergies, is gaining popularity, potentially leading to improved treatment results and increased patient contentment. Furthermore, transitioning specific medications from prescription-only status to over-the-counter availability has the potential to enhance accessibility and affordability, consequently contributing to market expansion.

Expanding healthcare infrastructure: The expansion of healthcare coverage and advancements in diagnostic tools can result in the earlier identification and treatment of health issues, thereby driving an increased demand for medications. Pharmaceutical firms are actively engaged in the development of enhanced and novel treatments for conjunctivitis, a trend that has the potential to further boost market growth.

Market Restraints

Strong competition from generics: In Spain, the generic therapeutics market is strong, constituting more than 70% of all prescribed medications. This exerts considerable pressure on branded conjunctivitis treatments, especially for milder cases. Companies producing branded drugs find it challenging to justify higher prices when more affordable generic alternatives are easily accessible. The pricing pressure has the potential to affect the overall growth of the market, particularly for well-established therapies that encounter competition from generic counterparts.

Prevalence of self-medication: Numerous cases of mild conjunctivitis are addressed using over-the-counter (OTC) medications, bypassing the need for prescription therapeutics. This practice narrows down the potential patient base for prescription treatments, thereby influencing the overall market size. The widespread availability and cost-effectiveness of OTC alternatives make them the favored option for many consumers, contributing to a constraint on the expansion of the prescription segment.

Regulatory hurdles: Navigating the intricate regulatory environment for obtaining new drug approvals in Spain can be both time-consuming and costly, which may dissuade pharmaceutical companies from venturing into the market. Additionally, reimbursement policies might not sufficiently support innovative or expensive therapies, thereby restricting their accessibility and market viability.

Healthcare Policies and Regulatory Landscape

In Spain, the main regulatory body overseeing the approval and licensure of drugs and pharmaceuticals is the Spanish Agency of Medicines and Medical Devices (Agencia Española de Medicamentos y Productos Sanitarios or AEMPS). AEMPS operates under the Ministry of Health, Consumer Affairs, and Social Welfare and is responsible for evaluating and authorizing medicinal products for human and veterinary use. AEMPS also plays a crucial role in monitoring the safety of drugs once they are on the market, conducting inspections, and enforcing compliance with regulatory requirements.

The process of obtaining licensure for drugs and pharmaceuticals in Spain involves the submission of a comprehensive dossier by the pharmaceutical company to AEMPS. AEMPS then conducts a thorough evaluation, involving scientific and technical experts, before granting or denying authorization.

The regulatory environment for new entrants in the pharmaceutical industry in Spain is characterized by stringent requirements to ensure the protection of public health. New companies entering the market must navigate complex regulatory procedures and demonstrate the safety and effectiveness of their products through extensive testing and documentation. Compliance with regulatory standards is essential for entering the Spanish pharmaceutical market.

Competitive Landscape

Key Players

- Bayer

- Akorn

- Pfizer

- Merck

- Novartis

- Allergan

- Santen Pharmaceuticals

- Alembic Pharmaceuticals

- Sanofi

- Bausch & Lomb

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Conjunctivitis Therapeutics Market Segmentation

By Drug Class

- Antibiotics

- Antiviral

- Antiallergic

- Others

By Treatment

- Mast Cell Stabilizers

- Decongestant

- Immunotherapy

- Antihistamines

- Non-steroidal anti-inflammatory drugs

- Olopatadine

- Epinastine

- Others

By Disease Type

- Bacterial

- Chemical

- Viral

- Allergic

By Formulation

- Ointment

- Drops

- Drugs

By End Users

- Hospitals and clinics

- Online Pharmacies

- Retail Pharmacies

- Drug Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.