Spain Cardiovascular Diseases Therapeutics Market Analysis

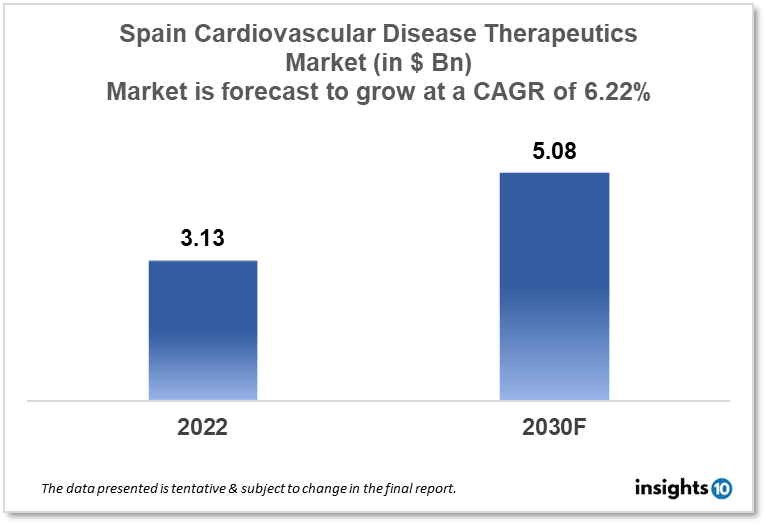

Spain's cardiovascular disease therapeutics market is expected to witness growth from $3.13 Bn in 2022 to $5.08 Bn in 2030 with a CAGR of 6.22% for the year 2022-2030. People in Spain are becoming more aware of cardiovascular diseases and their implications, therefore, leading to the development of new and inventive therapeutic options for the treatment of cardiovascular disease in Spain. The Spain cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by the end user. Pharmagenus, Ferrer, and Janssen Pharmaceuticals are the major players in the Spain cardiovascular disease therapeutics market.

Buy Now

Spain Cardiovascular Disease Therapeutics Market Executive Analysis

Spain's cardiovascular disease therapeutics market size is at around $3.13 Bn in 2022 and is projected to reach $5.08 Bn in 2030, exhibiting a CAGR of 6.22% during the forecast period. The budget allotted to the Ministry of Health in 2023 will rise by 6.5%, totaling $3,320 Mn, in the setting of a decentralized healthcare system where spending by the Spanish Ministry of Health accounts for less than 3% of total government spending. The allocation of money from both the national public budget for 2023 and the European Recovery and Resilience Facility are included in this sum. Notably, $3.42 Mn and $4.49 Mn are allotted to the newly established nationwide Public Health Agency and the nationwide network for public health surveillance, respectively. The coordinated purchase of the COVID-19 vaccine is also allocated $1,408 Mn. Finally, the Ministry of Health has budgeted more than $1,284 Mn to improve primary care facilities and tools for specialized care, screening programs, and mental healthcare. This money has been specifically designated for the development of primary care. The autonomous towns will receive this funding.

Adults from lower socioeconomic classes in Spain have a significant prevalence of cardiovascular disease (CVD) risk factors. Although immigrants are a socioeconomically disadvantaged group, little is known about how these factors are distributed among them. The latest WHO statistics show that 51,684 deaths from coronary heart disease, or 15.64% of all deaths, occurred in Spain in 2020. Spain places #179 in the world with a 34.87 per 100,000 population age-adjusted death rate.

Therapeutic lifestyle changes, such as increased physical exercise, dietary modification/weight loss, and quitting smoking are of proven benefit and better outcomes starting within a matter of weeks for all of these high-risk patients. Statins and aspirin are two additional adjunctive drug treatments with a history of success; their advantages are at the very least additive.

The first-line medications currently used in Spain to manage CVD include:

- ACEIs

- ARBs

- Anticoagulants

- Statins to lower cholesterol

- Beta-blockers, and some anti-inflammatory drugs (NSAID, glucocorticoids)

Although many treatments are being researched in Spain to improve pathological cardiovascular complications, there haven't been many new drugs authorized for use as interventions or treatments. New methods of treating CVD are thus urgently required. The research and development of peptides and their mimics for therapeutic intervention have lately experienced a resurgence. As a result, using peptides that imitate the action of mediators involved in pathologic processes during vascular damage has drawn more attention.

Market Dynamics

Market Growth Drivers

The general public in Spain is becoming increasingly mindful of the risk factors for cardiovascular diseases. The Spain cardiovascular disease therapeutics market is expanding as a result of more people pursuing early diagnosis and treatment. New and inventive treatments for cardiovascular illnesses are being developed as a result of technological advancements. Patients now have access to more potent therapies, which is fuelling the market's expansion. A larger investment is being made in the research and commercialization of novel therapeutics for cardiovascular diseases as a result of rising healthcare spending overall in Spain. The Spain cardiovascular disease therapeutics market is anticipated to grow as a result in the upcoming years.

Market Restraints

It can be challenging for new drugs and treatments to get authorized in Spain due to the strict regulatory requirements for cardiovascular disease therapeutics. Due to this, the Spain cardiovascular disease therapeutics market may grow more slowly as novel therapeutics are developed. Spain has a limited healthcare infrastructure in some areas, which can make it difficult for patients to obtain healthcare services and treatments. This may restrict the use of therapeutics for cardiovascular illness in these areas, which would restrict market expansion.

Competitive Landscape

Key Players

- QbD Pharmaceuticals (ESP)

- Tillotts Pharma (ESP)

- Dunlin Pharm (ESP)

- Pharmagenus (ESP)

- Ferrer (ESP)

- Janssen Pharmaceuticals

- AstraZeneca

- Sanofi

- Novartis AG

- Merck

- Gilead Sciences

Healthcare Policies and Regulatory Landscape

The state healthcare system in Spain offers full coverage to all citizens and permitted immigrants. Healthcare services and treatments, such as those for cardiovascular illness, are provided by the National Health System (Sistema Nacional de Salud, or SNS). Regarding payment guidelines for therapies for cardiovascular disease, the SNS typically covers medicines and procedures that are thought to be secure and efficient. The SNS-covered medications are listed in the Spanish Agency for Medicines and Medical Devices (AEMPS) formulary, upon which the reimbursement policy is founded. The severity of the illness and the patient's clinical state is taken into account when determining the reimbursement policy for cardiovascular disease treatments in Spain. Treatments for milder cases might not be covered by the SNS, but treatments for more serious and acute cases are typically covered. For some treatments, including some for cardiovascular illness, patients in Spain must make a co-payment. The cost of the co-payment is determined by the type of therapy and patient income.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.