Spain Cancer Pain Management Market Analysis

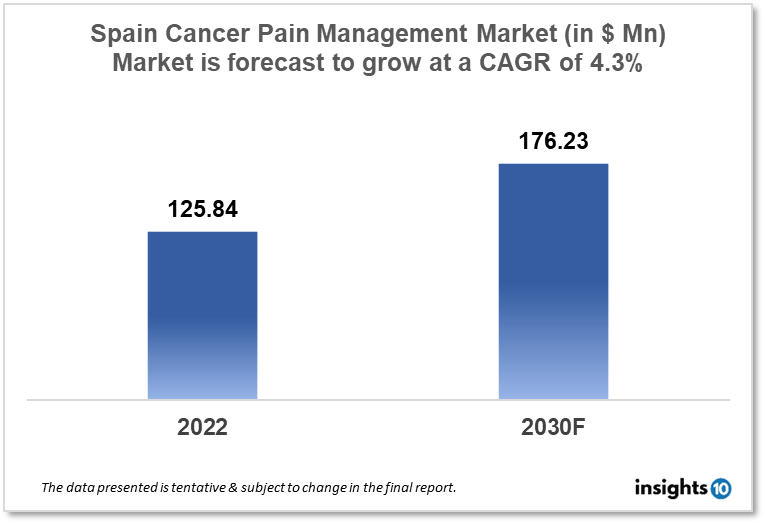

Spain's Cancer Pain Management market is projected to grow from $125.84 Mn in 2022 to $176.23 Mn by 2030, registering a CAGR of 4.3% during the forecast period of 2022-2030. The main factors driving the growth would be government support, the aging population, and increasing cancer incidence. The market is segmented by drug type and by disease. Some of the major players include Esteve, Grunenthal Pharma, Pfizer, Teva Pharmaceuticals, and Abbott.

Buy Now

Spain Cancer Pain Management Market Executive Summary

Spain's Cancer Pain Management market is projected to grow from $125.84 Mn in 2022 to $176.23 Mn by 2030, registering a CAGR of 4.3% during the forecast period of 2022 - 2030. Healthcare spending grew in 2019 from $2,740 per person or 8.99% of GDP to $2,711 per person or 9.13% of GDP. Spain continues to have lower per capita health spending than the EU average. There is a growing gap between Spain and the EU in terms of overall health spending, which suggests a slower expansion during the past ten years.

Cancer is associated with a number of well-known acute and chronic pain disorders. Cancer is a complex and potentially fatal illness that results in gene changes that impact vital cell-regulatory proteins. These changes trigger abnormal cell behavior, which then fuels unrestrained cell proliferation and the subsequent amputation of nearby normal tissues. These tumors compress the body and produce discomfort by pressing against bones, nerves, and other bodily parts. Active cancer therapy can cause cancer discomfort as well, especially when the disease is more advanced. Cancer is one of the leading causes of morbidity and mortality in Spain, with an anticipated 276,239 new cases in 2021.

Market Dynamics

Market Growth Drivers

The Spanish government offers financial assistance for cancer treatment, including pain control, through its national health insurance program. This promotes market expansion and increases cancer patients' access to pain management therapies. Additionally, Spain's population is aging quickly, and as a result, the prevalence of cancer is predicted to rise. The need for cancer pain management medications will increase as a result.

Market Restraints

The adverse consequences of utilizing drugs to treat cancer pain, such as drug tolerance, drug dependence, urinary retention, sleep problems, cognitive impairment, and others, are predicted to restrain the expansion of the cancer pain market. Additionally, there is still a lack of understanding about the many pain management options that are accessible in Spain, which leads to the underuse of these drugs.

Competitive Landscape

Key Players

- Esteve (ESP)

- Grunenthal Pharma

- Pfizer

- Teva Pharmaceuticals

- Abbott

Notable Recent Deals

January 2020: Esteve and Ardian, a renowned private investment firm, agreed to an agreement for Esteve to buy all of the outstanding shares of the German pharmaceutical business Riemser. With more than 60% of its sales coming from patented drugs, this acquisition will accelerate its transformation into a specialty pharmaceutical company and provide ESTEVE access to the hospital market, a market that is seeing rapid growth.

Healthcare Policies and Regulatory Landscape

The National Health System (NHS), which offers public health services to all residents, is the foundation of Spain's healthcare system. The Ministry of Health, Social Services, and Equality as well as the Spanish Agency for Medicines and Health Products (AEMPS) are in charge of Spain's policy for pain management. The marketing and distribution of pain relief medications in Spain are subject to both Spanish pharmaceutical rules and laws governing the European Union. In Spain, the AEMPS is in charge of the licensing, regulation, and oversight of pharmaceuticals.

Spain has also adopted a number of guidelines and standards for the care of chronic pain in addition to these laws. For instance, a set of recommendations for the management of pain in cancer patients have been developed by the Spanish Society of Anesthesia and Intensive Care (SEDAR).

Reimbursement Scenario

In Spain, the National Health System (NHS) is principally responsible for providing the reimbursement scenario for cancer pain management. The NHS pays for patients' necessary medical care and prescription drugs, including those for cancer pain management. The Ministry of Health, Social Services, and Equality oversee a centralized system for the reimbursement of medications used to treat cancer pain. The clinical efficacy, safety, and economic value of drugs are assessed. The National List of Drugs, which forms the basis for NHS reimbursement, includes medications that satisfy the requirements for reimbursement. In addition to the NHS. Patients who have private health insurance might have access to a greater selection of procedures and drugs, some of which might not be provided by the NHS.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Pain Management Market Segmentation

By Drug Type (Revenue, USD Billion):

Non-steroidal anti-inflammatory medicines relieve pain at the site of injury by blocking the cyclooxygenase enzyme, which prevents prostaglandin formation. NSAIDs are a class of medications that includes medications with analgesic, antipyretic, and, at higher doses, anti-inflammatory properties.

- Opioids

- Morphine

- Fentanyl

- Others

- Non-Opioids

- Acetaminophen

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Nerve Blockers

By Disease Indication (Revenue, USD Billion):

Based on disease Indication the market is segmented into:

- Lung Cancer

- Colorectal cancer

- Breast cancer

- Prostate cancer

- Blood cancer

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.