Spain Cancer Immunotherapy Market Analysis

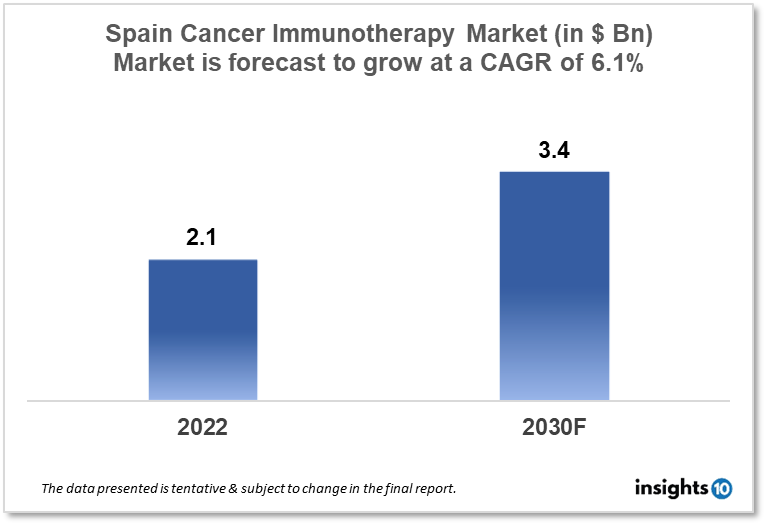

Spain's cancer immunotherapy market is expected to witness growth from $2.1 Bn in 2022 to $3.4 Bn in 2030 with a CAGR of 6.1% for the forecasted year 2022-30. The rising incidence of cancer in Spain and the consequent increase in demand for cancer immunotherapy treatment options are driving the growth of the market. The Spain cancer immunotherapy market is segmented by type, application, and end user. Oryzon Genomics, VIVEbiotech, and Amgen are the major players in the Spain cancer immunotherapy market.

Buy Now

Spain Cancer Immunotherapy Market Executive Analysis

Spain's cancer immunotherapy market is expected to witness growth from $2.1 Bn in 2022 to $3.4 Bn in 2030 with a CAGR of 6.1% for the forecasted year 2022-30. Given the decentralized character of the Spanish health system, where Ministry of Health spending represents less than 3% of overall governmental spending, the funding allocated to the Ministry of Health in 2023 will increase by 6.5% to $3,310 Mn. This amount includes funding from both the European Recovery and Resilience Facility and the national public budget allotted for 2023. The nationwide network for public health monitoring will receive $4.4 Mn, and the new nationwide Public Health Agency will receive $3.4 Mn. Another $1,404 Mn is allotted for the centralized acquisition of the COVID-19 vaccine. With a focus on enhancing primary care, the Ministry of Health has allocated about $1,280 Mn to enhance primary care facilities and equipment for specialty care, screening programs, and mental healthcare. These funds will go to independent towns.

With an anticipated 276,239 new cases of cancer in 2021, cancer is one of the leading causes of morbidity and mortality in Spain. Normal tissue cells give rise to tumors through "mutations," which are changes to a cell's DNA. When a cell undergoes a mutation, it radically alters and begins to divide uncontrolled, eventually leading to cancer. One of the body's most effective systems, the immune system often serves as a physiological buffer against assaults of any kind. This mechanism, which has developed over countless generations to protect against the acts of outside forces, has enabled humans to survive in harsh environments. It is made up of a wide range of cells with various roles that work together in unison to identify and get rid of aberrant cells from the body. These aberrant cells have substances called antigens on their surface or release them when they are destroyed, which prompts the immune system to create antibodies as a defence.

The development and activation of T lymphocytes, which have the ability to neutralize or eradicate these aberrant cells, is an important part of this response. These immune system-specific Dendritic Cells, whose primary function is to present activation antigens, activate these T lymphocytes by presenting the previously identified antigens. These long-understood notions have led to the creation of medications that aim to unclog the system that prevents the lymphocytes' damaging activity. A group of substances called monoclonal antibodies has been created that work in patients to regain their defensive skills in order to carry out this "unblocking" function. The introduction of so-called immunotherapy agents has ushered in a new era of medicine.

Market Dynamics

Market Growth Drivers

The prevalence of cancer has been rising in Spain over time, which has increased the demand for cancer immunotherapy therapies. Research on cancer immunotherapy has advanced significantly, resulting in the creation of fresh and efficient therapies. Cancer immunotherapy treatments can be customized for specific individuals, which is crucial in the healthcare sector. Through funding and other initiatives, the Spanish government has been promoting the growth of the cancer immunotherapy sector resulting in the expansion of the Spain cancer immunotherapy market.

Market Restraints

The cost of cancer immunotherapy treatments may make them inaccessible to some patients and healthcare systems. The market potential of some cancer immunotherapy treatments may be constrained since they are only successful in a small subset of patients. The use of cancer immunotherapy treatments may be constrained by the availability of numerous other cancer treatments, including chemotherapy and radiation therapy. Treatments for cancer immunotherapy may only be used in specific patient populations due to potential adverse effects and safety issues limiting the growth of the Spain cancer immunotherapy market.

Competitive Landscape

Key Players

- Oncomatryx Biopharma (ESP)

- Immucura (ESP)

- Minoryx Therapeutics (ESP)

- Oryzon Genomics (ESP)

- VIVEbiotech (ESP)

- Amgen

- Astrazeneca

- Bayer

- Bristol-Myers Squibb

- Eli Lily

- F. Hoffmann-La Roche

- Pfizer

Healthcare Policies and Regulatory Landscape

The National Health System (SNS), which offers comprehensive coverage for all citizens in Spain, is in charge of overseeing the country's cancer health insurance and payment procedures. The SNS covers cancer treatment, including immunotherapy. The Spanish Agency of Medicines and Medical Devices (AEMPS), which assesses the safety, efficacy, and cost-effectiveness of novel treatments, oversees the payment of cancer immunotherapy treatments in Spain. The cost of the medication is established by the AEMPS and is then discussed between the pharmaceutical business and the Ministry of Health. The Spanish government has taken a number of steps to guarantee that cancer patients have access to the most advanced therapies, such as immunotherapy. To ensure that novel medicines, including cancer immunotherapy treatments, are made available to patients as soon as feasible, the Spanish government established a fast-track approval process in 2017. The SNS has also put into practice a number of measures to enhance cancer care, including the establishment of multidisciplinary cancer units, the compilation of cancer treatment guidelines, and the introduction of cancer screening programs.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Immunotherapy Segmentation

By Type (Revenue, USD Billion):

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- PD-1/PD-L1

- CTLA-4

By Application (Revenue, USD Billion):

- Lung Cancer

- Breast Cancer

- Head and Neck Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Cancer Research Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Oryzon Genomics, VIVEbiotech, and Amgen are the major players in the Spain cancer immunotherapy market.

The Spain cancer immunotherapy market is expected to grow from $2.1 Bn in 2022 to $3.4 Bn in 2030 with a CAGR of 6.1% for the forecasted year 2022-2030.

The Spain cancer immunotherapy market is segmented by type, application, and end user.