Spain Blood Disorder Therapeutics Market

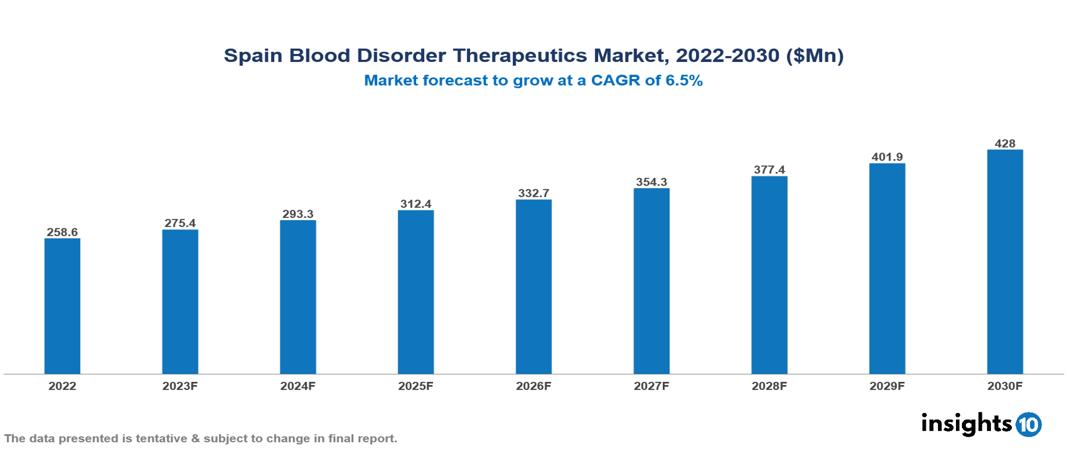

Spain Blood Disorder Therapeutics Market valued at $259 Mn in 2022, projected to reach $428 Mn by 2030 with a 6.5% CAGR. The key drivers of the Spanish market include the aging population leading to a higher prevalence of blood-related issues, technological advancements like gene editing technologies creating new treatment opportunities, and evolving healthcare dynamics such as policies supporting early diagnosis and access to innovative medicines. The Spain Blood Disorder Therapeutics Market encompasses various players across different segments, including Novartis, Pfizer, Roche, Sanofi, Takeda, Bristol-Myers Squibb, Grifols, Gilead Sciences, Janssen Pharmaceuticals, BioMarin Pharmaceuticals etc, among various others.

Buy Now

Spain Blood Disorder Therapeutics Market Executive Summary

Spain Blood Disorder Therapeutics Market valued at $259 Mn in 2022, projected to reach $428 Mn by 2030 with a 6.5% CAGR.

A variety of illnesses that impact blood components, including red blood cells, white blood cells, platelets, and plasma, are referred to as blood diseases. These illnesses, which include fibrinolytic defects, vascular disorders, and platelet disorders, are categorized according to the kinds of deficiencies or abnormalities they exhibit. Hemophilia A and B, Von Willebrand's disease, and idiopathic thrombocytopenic purpura (ITP) are common blood diseases. The variety of treatment choices is equal to that of the illnesses. Blood transfusions provide a short-term boost for anemia, but iron tablets help restore iron stores. In extreme situations, bone marrow transplants replace damaged cells with healthy ones. There is growing hope that gene therapy can treat certain hereditary illnesses. Chemotherapy and radiation treatment target malignant cells, whereas immunotherapy stimulates the immune system. Treatment for blood disorders has a bright future ahead of it. CRISPR and other gene editing technologies show promise for repairing genetic defects long-term. To get better results, personalized medicine customizes therapies for each patient. With the application of artificial intelligence, illness development, and diagnosis may be made more precisely.

An estimated 319 people in Spain are believed to have the condition, accounting for 13.3% of all hemophilia cases. African immigration to Spain is increasing the average chance of having a newborn with an uncommon or rare anemia.

The key drivers of the Spanish market include the aging population leading to a higher prevalence of blood-related issues, technological advancements like gene editing technologies creating new treatment opportunities, and evolving healthcare dynamics such as policies supporting early diagnosis and access to innovative medicines.

According to sales, Pfizer consistently ranks among the top pharmaceutical firms in Spain, indicating a sizable market share in a range of therapeutic categories, including hematology. Sanofi is a formidable competitor because of its extensive medication line and long-standing presence in Spain. Other Spanish businesses in the area offer a wider variety of treatments for other blood problems.

Market Dynamics

Market Growth Drivers

Growing Demand: As Spain's population ages, so does the prevalence of blood problems associated with aging, such as anemias and cardiovascular diseases, which raises the need for certain therapies. Better diagnostics and public awareness initiatives enable earlier identification and treatment of blood problems, hence increasing the number of patients.

Technological Progress: Advances in CRISPR and other gene editing technologies may be able to treat hereditary blood illnesses that were previously incurable, creating new business opportunities. Adapting treatment plans to each patient's unique genetic profile and illness features is increasing the effectiveness of therapy and expanding the market. More people are using telemedicine platforms, which makes it easier to monitor patients remotely and conduct effective consultations. This is especially helpful for those with chronic blood problems who live far apart.

Dynamics of the Healthcare System: Policies that support early diagnosis through nationwide screening programs and encourage access to novel medicines can have a big influence on market expansion. The accessibility and market penetration of novel, costly medicines like gene therapies can be influenced by reimbursement regulations and price tactics. Manufacturers are under pressure to provide value for money as a result of healthcare providers and public payers placing a greater emphasis on affordable treatments for long-term blood diseases.

Market Restraints

Restricted Market Scope: The smaller scale of the Spanish market, compared to larger economies, imposes limitations on the potential patient pool for blood disorder therapeutics. This restricted market size can curtail overall growth opportunities for certain treatments, particularly those requiring substantial investments in research, development, and promotion.

Challenges in Pricing and Affordability: Innovative blood disorder treatments, such as advanced gene therapies, often come with steep price tags due to intricate development processes. In the context of Spain's smaller market and potentially constrained healthcare budgets, the high pricing becomes a hurdle for both patients and the healthcare system. Ensuring affordability becomes pivotal, as it could otherwise impede patient access to these cutting-edge therapies and strain the financial sustainability of the healthcare system.

Competitive Pressures from Generic Alternatives: Established and cost-effective generic drugs pose significant competition to mature segments of the Spain Blood Disorder Therapeutics Market. The availability of generic alternatives typically exerts downward pressure on the prices of branded medications, impacting the profitability of newer, more expensive therapies. The presence of these generic options can influence market dynamics, especially if they offer comparable efficacy at a lower cost.

Healthcare Policies and Regulatory Landscape

Spain is proud of its extensive healthcare system, which is funded entirely by taxes. Preventive care, basic health care, and pharmaceutical accessibility are given top priority in the nation. To ensure the safety, effectiveness, and quality of medications and medical devices, the Spanish Agency of Medicines and Medical Devices (AEMPS) is essential to the regulatory process. AEMPS sets standards for clinical trials, tracks adverse responses, and assesses and approves novel medicines. Cost-effectiveness is emphasized in Spain's healthcare policies, with an emphasis on generic medications to keep costs under control. A comprehensive variety of medical services, such as hospital treatment, expert consultations, and prescription medicines, are offered to people through the National Health System. Notwithstanding these advantages, problems like aging populations and geographical differences still exist. The Spanish government is always striving to improve the sustainability and efficiency of its healthcare system, adjusting to changing medical advances and demography while depending on AEMPS to uphold strict regulations around pharmaceuticals.

Competitive Landscape

Key Players:

- Novartis

- Pfizer

- Roche

- Sanofi

- Takeda

- Bristol-Myers Squibb

- Grifols

- Gilead Sciences

- Janssen Pharmaceuticals

- BioMarin Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.