Spain Atherosclerosis Therapeutics Market Analysis

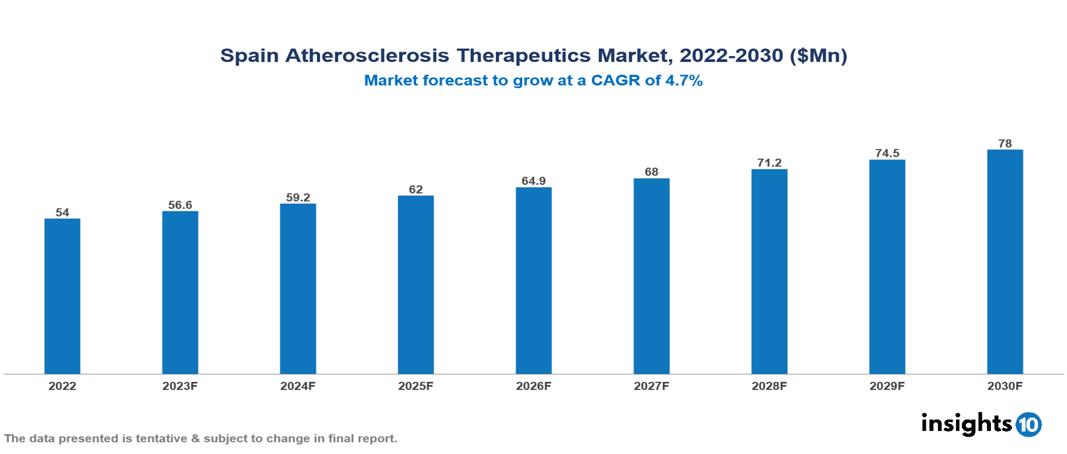

Spain Atherosclerosis Therapeutics Market was valued at $54 Mn in 2022 and is estimated to reach $78 Mn in 2030, exhibiting a CAGR of 4.7% during the forecast period. The increasing prevalence of cardiovascular diseases, which are worsened by sedentary lifestyles, poor diets, and an aging global population, is expected to drive growth in the market for atherosclerosis treatments. Sanofi, Novartis, Pfizer, Bayer, AstraZeneca, AbbVie, Roche, Johnson & Johnson, and Bristol-Myers Squibb are well-known pharmaceutical companies that currently have a sizable share in the industry.

Buy Now

Spain Atherosclerosis Therapeutics Market Executive Summary

Spain Atherosclerosis Therapeutics Market was valued at $54 Mn in 2022 and is estimated to reach $78 Mn in 2030, exhibiting a CAGR of 4.7% during the forecast period.

Plaque, a sticky substance composed of calcium, fat, cholesterol, and other elements, accumulates inside the walls of arteries as a result of atherosclerosis. This accumulation raises the risk of serious conditions, including heart attacks and strokes, and can cause blood vessels to constrict or get obstructed. Atherosclerosis can be caused by several things, such as high blood pressure, high cholesterol, diabetes, obesity, smoking, having a family history of heart disease, being inactive, and eating an unhealthy diet. Several medications, including beta-blockers, aspirin, and statins, have shown potential in slowing or stopping the advancement of atherosclerosis.

The incidence of atherosclerosis is a significant health concern in Spain, where more than 50% of adults between the ages of 45 and 74 have carotid plaques, which is indicative of the disease. Furthermore, a further indication linked to atherosclerosis is coronary artery calcification, which is present in about 20% of Spanish people over 50. The population is more likely to develop atherosclerosis if risk factors such as high blood pressure, increased cholesterol, smoking, and diabetes are widely prevalent. The likelihood of a high incidence of early stages is supported by these variables, even though not all cases progress to a clinically obvious disease. In Spain, cardiovascular disease is the leading cause of death, accounting for 32% of all fatalities. High blood pressure, which affects 47% of men and 39% of women, total cholesterol levels ≥250 mg/dl (43% and 40%, respectively), tobacco use (33% and 21%, respectively), and diabetes (16% and 11%, respectively) are the most common cardiovascular risk factors.

Phase II clinical studies for ATN-101, an apolipoprotein A-I (apoA-I) imitated by Atrys Health and aimed at enhancing HDL, are presently taking place in Spain for patients with acute coronary syndrome and significant residual cardiovascular risk. Promising improvements in HDL levels and anti-inflammatory markers have been observed.

Patients with moderate-to-severe peripheral artery disease (PAD) brought on by atherosclerosis are participating in Phase IIa trials in Spain for BIIB037, an oral sphingosine-1-phosphate modulator manufactured by Basilea Pharmaceutica. Early results show promising possibilities for its therapeutic influence, including increased walking distance and decreased inflammation.

Market Dynamics

Market Growth Drivers

High Burden of Cardiovascular Diseases: The leading cause of death in Spain is cardiovascular diseases (CVDs), to which atherosclerosis is a major contributing element. This indicates a large market opportunity for pharmaceuticals. In Spain, cardiovascular disease (CVD) continues to be the leading cause of death, accounting for about 120,000 deaths annually. Men experience CVD-related fatalities at an average age of 78 years, while women experience them at 84 years.

Aging Population: The aging population in Spain has led to an increase in the prevalence of atherosclerosis-related risk factors, such as high blood pressure, cholesterol, and diabetes. The number of people aged 65 and over is steadily increasing. It is predicted to reach nearly one-third of the total population by 2050. The demographic trend is a contributing element to the increasing market demand for therapies and interventions designed to mitigate these risk factors and treat symptoms associated with atherosclerosis. The demand for atherosclerosis treatment drugs in the market is being driven by the aging population's increased need for healthcare solutions to lessen the negative effects of these risk factors on cardiovascular health.

Lifestyle Trends: The market expansion for medications used to treat atherosclerosis is fuelled by the high prevalence of smoking, poor diets, and sedentary lifestyles in Spain. To address the rising incidence of cardiovascular diseases in the nation, there is a greater need for efficient drugs because these lifestyle variables greatly enhance the chance of developing atherosclerosis.

Market Restraints

Lack of Awareness: A lack of knowledge regarding atherosclerosis and its preventive strategies may make it difficult to intervene early and discourage people from getting treatment promptly. A lack of awareness of atherosclerosis and its preventative techniques might make it difficult for people to identify signs or take timely action to avoid it, which can delay the need for medical intervention and impede market expansion.

High Drug Cost: The high expense of the drugs used to treat atherosclerosis is a significant barrier for many people, especially those with lower incomes or less access to healthcare. High costs for prescription drugs are a barrier since they limit market penetration and impede overall growth.

Regulatory Hurdles: Prolonged clinical studies and stringent regulatory procedures may present challenges and higher expenses for pharmaceutical companies, delaying the release of new medications. Regulations that are unclear lead to ambiguity, which makes it difficult for firms to operate successfully and plan for approval processes. The unclear regulatory landscape makes it difficult for innovators to estimate requirements and review schedules, which could lead to major delays in the discovery of novel drugs. Because of this intricacy, careful planning and coordination are required at many different phases, such as clinical studies, manufacturing, and marketing approval. The unpredictability of regulations prevents business expansion.

Healthcare Policies and Regulatory Landscape

Within the Ministry of Health and Consumer Affairs in Spain, the Spanish Agency for Medicines and Medical Devices (AEMPS) is responsible for regulating therapeutic drugs. Before allowing marketing authorization, AEMPS is responsible for assessing, approving, and monitoring pharmaceutical goods to guarantee their efficacy, safety, and quality. The clinical study procedure complies with directives from the European Union and Spain, and AEMPS maintains strict control to ensure participant safety and data integrity. The Ministry of Health is in charge of overseeing the national healthcare system in Spain, which uses controlled pricing and reimbursement procedures to strike a balance between cost containment and access to cutting-edge therapies. The pharmacovigilance system monitors drug safety post-authorization, and health technology assessments may be conducted to assess the value and cost-effectiveness of new treatments.

Competitive Landscape

Key Players

- Sanofi

- Novartis

- Pfizer

- Bayer

- AstraZeneca

- Merck Sharp & Dohme

- AbbVie

- Roche

- Johnson & Johnson

- Bristol-Myers Squibb

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Atherosclerosis Therapeutics Market Segmentation

By Therapy

- Atherosclerosis Medications

- Cholesterol-lowering Medications

- Antiplatelet drugs and Anticoagulants

- Atherosclerosis Beta Blockers

- Diuretics or Water Pills

- Angiotensin Converting Enzyme (Ace) Inhibitors

- Other Atherosclerosis Treatment Therapies

By Surgery

- Bypass Surgery (Coronary Artery Bypass Grafting (CABG))

- Angioplasty

- Atherectomy

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Manufactured Combination

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital pharmacies

- Clinics

- Drug stores

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.