Spain Addiction Therapeutics Market Analysis

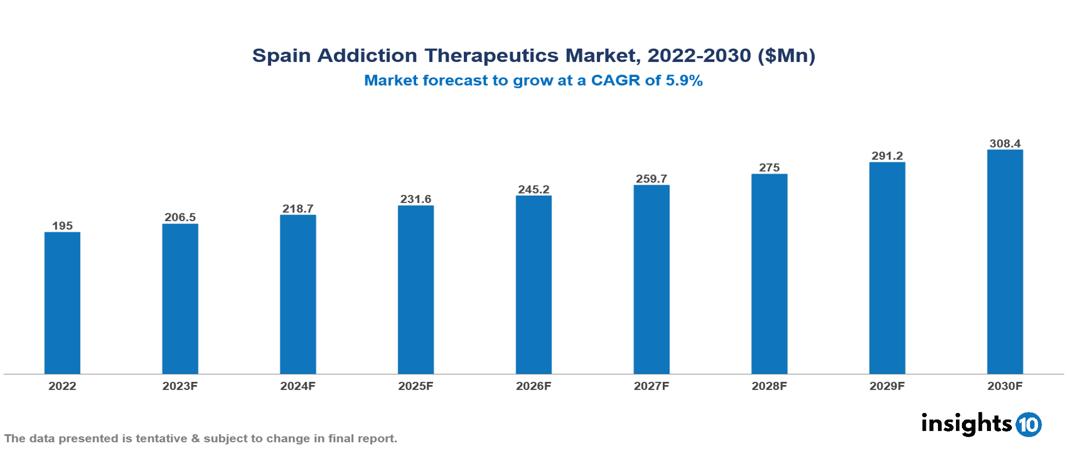

Spain addiction therapeutics market was valued at $195 Mn in 2022 and is estimated to reach $308 Mn in 2030, exhibiting a CAGR of 5.9% during the forecast period. The market for addiction treatment is growing as a result of the growing understanding and recognition of substance use disorders as serious public health issues. Major market players are Indivior, Reckitt Benckiser Pharmaceuticals, Teva Pharmaceutical Industries, Mundipharma, Camurus AB, Grunenthal, Ethypharm, Molteni Farmaceutici, Lacer and Asofarma

Buy Now

Spain Addiction Therapeutics Market Executive Summary

Spain addiction therapeutics market was valued at $195 Mn in 2022 and is estimated to reach $308 Mn in 2030, exhibiting a CAGR of 5.9% during the forecast period.

Diverse techniques, interventions, and methods are used in addiction therapy with the goal of controlling and preventing addiction. Its main goal is to help people who are struggling with addiction and co-occurring problems while reducing or eliminating substance use, particularly alcohol and drugs. Methadone and buprenorphine are two commonly used drugs prescribed as part of continuing treatment for opioid use disorder addiction. Acamprosate, disulfiram, and naltrexone are a few more drugs that are approved for the treatment of substance use disorders; however, they might not be started until after detox is over.

Spain's population aged 15 to 64 exhibited significant prevalence rates of alcohol, tobacco, and hypnosedative intake in 2022. While the age of initiation for hypnosedatives and opioid analgesics was usually initiated later, the age of initiation for tobacco, alcohol, and cannabis remained consistent. With the exception of hypnosedatives and opioid analgesics, which were more common in older age groups, prevalence rates were greater in the 15–34 age range. Remarkably, 76.4% consume alcohol, making it the most commonly taken drug. It is common for young adults (ages 15 to 34) to binge drink; among them are 24.1% of women and 35.4% of men. The percentage of people who have smoked tobacco continues to be 69.6%, but the percentage of people who use e-cigarettes increased to 12.1% in 2022. Furthermore, the percentage of people using hypnosedatives increased to 23.5%, with women being the main users. With 40.9% having used cannabis at some point in their lives, it remained the most often used illicit substance. While heroin use stabilized at 0.6% of the population, 2.4% used cocaine in the previous 12 months. Nonetheless, throughout the past year, the use of ecstasy, amphetamines, hallucinogens, and inhalants was found to have been rather modest, at 0.8%, 0.6%, 0.6%, and 0.2%, respectively. A 15% increase from 2020 was seen in Spain's 44,347 treatment admissions for psychoactive substance abuse in 2021. However, because of COVID-19-related mobility restrictions that affect treatment accessibility, this increase did not return to pre-pandemic levels. Cocaine continued to be the most common reason for treatment admissions (46.8%), with cannabis coming in second (27.8%) and opioids third (19.2%). Cannabis dominated among kids seeking treatment (93.7%), whereas cocaine surpassed cannabis in producing first-treatment admissions (45.3%). In addition, there was a 9.5% decrease in injection drug use, which included 20,741 admissions linked to cocaine and 12,350 admissions related to cannabis. In 2021, 25,140 admissions were made for therapy connected to alcohol consumption.

Spanish scientists are looking into cutting-edge treatments for alcoholism that target cravings and stop relapses. Prospective possibilities like acamprosate and naltrexone are being investigated in collaboration with pharmaceutical giants like Bristol-Myers Squibb and Alkermes.

Market Dynamics

Market Growth Drivers

Government Support and Policies: Market expansion has been fueled by government programs that emphasize addiction treatment and mental health as essential elements of healthcare. Policies that facilitate the financing, accessibility, and incorporation of addiction therapies within medical systems have been crucial. One of the main initiatives for addiction prevention is the National Strategy against Drugs and Addictions (SNDCA), a five-year plan that emphasizes early intervention, school-based education, and awareness campaigns with a focus on prevention, particularly among young and vulnerable groups. In order to address the difficulties of drug addiction in Spain, the Plan Nacional sobre Drogas (PNSD) supports local initiatives and coordinates evidence-based prevention methods in addition to the SNDCA.

Increasing Awareness and Acceptance: More people are seeking treatment as a result of increased public understanding of mental health disorders, including addiction. A decrease in the stigma associated with addiction is causing an increase in the number of people seeking help and being more willing to go through addiction treatment. This increase in awareness and acceptance in society drives the increase in the addiction therapeutics market.

Supportive Insurance Coverage: People are encouraged to seek and afford treatment when there is adequate insurance coverage and reimbursement rules in place, which has a beneficial effect on the growth of the addiction therapeutics market.

Market Restraints

Limited Access and Resource Constraints: Inequitable access to addiction treatment facilities or limited resources in certain areas can prevent people from getting the treatment they need. The inadequacy of treatment centres or lack of healthcare professionals specializing in addiction treatment may limit market growth Insufficient access to specialized facilities and qualified medical personnel makes it difficult to offer complete and efficient addiction therapeutics in response to demand. This limitation of skilled workers and specialized facilities constrains the growth of the addiction therapeutics market.

Workforce Shortage: One issue is the lack of qualified medical professionals with expertise in treating addiction, such as counsellors, psychologists, psychiatrists, and addiction specialists. A small workforce may make it more difficult to offer complete care, which could result in gaps in the availability of treatments.

Stigma and Perception: Stigma and societal attitudes toward addiction can prevent people from seeking treatment. Misconceptions or societal prejudices about addiction can prevent affected individuals from acknowledging their illness or seeking appropriate treatment options. This stigma associated with substance abuse restricts the market's potential for expansion.

Notable Recent Updates

- Jan 2023, Tempero Bio announced the FDA clearance of an investigational new drug (IND) application for TMP-301. TMP-301 is an investigational metabotropic glutamate receptor 5 (mGluR5) negative allosteric modulator (NAM) candidate that is considered for the treatment of cocaine use disorders (CUD).

- Jan 2022, Pfizer announced a new strategic partnership with Alex Therapeutics to personalize treatment through digital therapeutics and use AI-based platform of the latter company to provide Cognitive Behavioural Therapy (CBT) and Acceptance and Commitment Therapy (ACT) to patients of nicotine addiction.

Healthcare Policies and Regulatory Landscape

The National Healthcare System (Sistema Nacional de Salud, or SNS) and regional health authorities in Spain are in charge of healthcare policies and rules pertaining to addiction therapies. Autonomous communities have significant authority in overseeing healthcare and customizing addiction treatment plans to meet specific community requirements. Regulatory oversight by the Spanish Agency of Medicines and Medical Devices (Agencia Española de Medicamentos y Productos Sanitarios, - AEMPS) ensures the safety, efficacy, and quality of addiction therapeutics. In Spain's healthcare system, treatment guidelines, professional training, patient rights, public health measures, and integration initiatives work together to address substance use disorders, advance accessibility, and improve the caliber of addiction treatment services. A significant challenge is adhering to the strict restrictions set forth by the Spanish Agency of Medicines and Medical Devices (AEMPS) regarding safety, efficacy, and quality requirements. In addition, the regional autonomy of the decentralized healthcare system results in policy diversity among autonomous communities, which makes it necessary to navigate several regulatory frameworks with skill.

Competitive Landscape

Key Players

- Indivior

- Reckitt Benckiser Pharmaceuticals

- Teva Pharmaceutical Industries

- Mundipharma

- Camurus AB

- Grunenthal

- Ethypharm

- Molteni Farmaceutici

- Lacer

- Asofarma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Spain Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.