Spain Acne Therapeutics Market Analysis

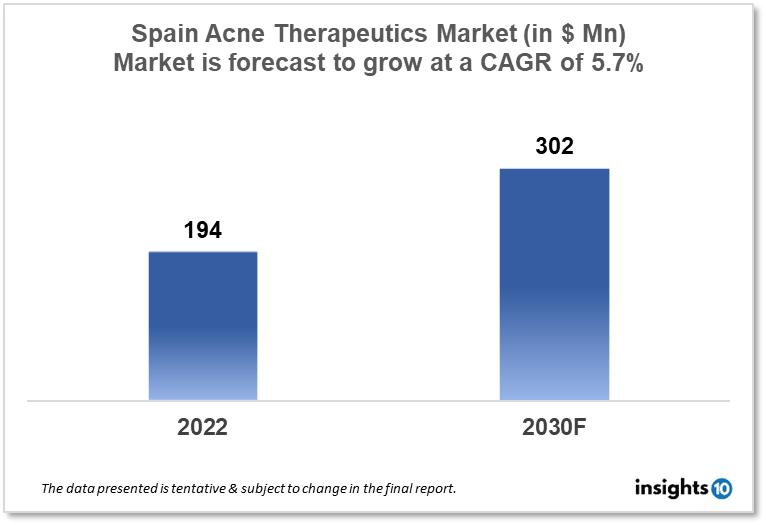

The Spain acne therapeutics market is expected to witness growth from $194 Mn in 2022 to $302 Mn in 2030 with a CAGR of 5.7% for the year 2022-2030. As more and more population becomes aware of the available acne therapies, the market for acne therapeutics is anticipated to expand. The Spain acne therapeutics market is segmented by treatment, route of administration, age group, and distribution channel. TecnyFarma, Farmasierra, and GlaxoSmithKline are some of the key competitors in the market.

Buy Now

Spain Acne Therapeutics Market Executive Analysis

The Spain acne therapeutics market size is at around $194 Mn in 2022 and is projected to reach $302 Mn in 2030, exhibiting a CAGR of 5.7% during the forecast period. The Spanish Ministry of Health's consolidated budget expenditures in 2022 were about $2.54 Bn, down from the three Bn recorded a year earlier. The Ministry of Health's budget expenditures peaked in 2021, rising by over $3.06 Bn from 2020 when the allocated budget totaled just over $126.33 Mn. In 2022, approximately $8.24 Mn of this budget was allotted for staff organization and health policies. Since the COVID-19 pandemic began in 2020, the Madrid government has come under fire for the understaffing of its hospitals and basic healthcare facilities. It is allegedly dismantling public health services and favoring commercial health providers, according to protesters.

Acne vulgaris is a prevalent chronic skin condition characterized by pilosebaceous unit blockage and/or inflammation. (hair follicles and their accompanying sebaceous gland). Acne typically affects the face, but it can also affect the back and torso. It can appear as non-inflammatory lesions, inflammatory lesions, or a combination of both. In Spain, antibiotic resistance is a significant public health issue and a multidisciplinary challenge. Resistance develops in P. acnes and staphylococcus strains as a result of improper use of antibiotics in the treatment of acne (patients in Spain are still frequently treated with topical antibiotics as monotherapy, mainly erythromycin, and clindamycin).

In Spain, topical creams and gels containing salicylic acid, retinoids, or benzoyl peroxide are frequently used as the first line of therapy for mild acne. Prescription drugs like antibiotics, topical retinoids, and hormonal treatment might be required for moderate-to-severe acne. Typically, a dermatologist or family doctor will recommend these drugs. In some circumstances, medical treatments for treating acne in Spain, such as chemical peels, microdermabrasion, and laser therapy, may be suggested. The majority of the time, dermatologists or cosmetic surgeons carry out these operations.

Market Dynamics

Market Growth Drivers

The Spain acne therapeutics market is anticipated to grow as people become more conscious of the value of early diagnosis and treatment of acne. The market for acne therapeutics in Spain is anticipated to expand as a result of the rising demand for aesthetic treatments, including acne treatment. When it comes to dermatological procedures like acne therapeutics, Spain is a common destination for medical tourism. This might stimulate the Spain acne therapeutics market to expand.

Market Restraints

A significant barrier in Spain could be the regulatory problems manufacturers of acne therapeutics experience in getting their products approved. As a hurdle for patients who cannot afford overpriced treatments, the high cost of acne therapeutics may also serve as a restraint for Spain's acne therapeutics market.

Competitive Landscape

Key Players

- Gynea Laboratorios (ESP)

- Skin Tech Pharma Group (ESP)

- Grupo Juste (ESP)

- TecnyFarma (ESP)

- Farmasierra (ESP)

- GlaxoSmithKline

- Almirall

- Galderma

- Hoffman La Roche

- Bausch Health

- Leo Pharma

Healthcare Policies and Regulatory Landscape

Medicines for human and animal use are evaluated and approved by the Spanish Agency for Medicine and Health Products (AEMPS). AEMPS oversees the efficacy and safety of medications, certifies and inspects pharmaceutical laboratories, and combats the use of illicit drugs and substandard medical supplies. The AEMPS mandates that all medications used in Spain have marketing authorization. Any variations must be authorized and reported to the AEMPS after the quality, safety, and efficacy have been evaluated and allowed. These evaluations guarantee that throughout the course of the drug's life on the market, a favorable relationship between benefit and risk is kept.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.