South Korea Palliative Care Market Analysis

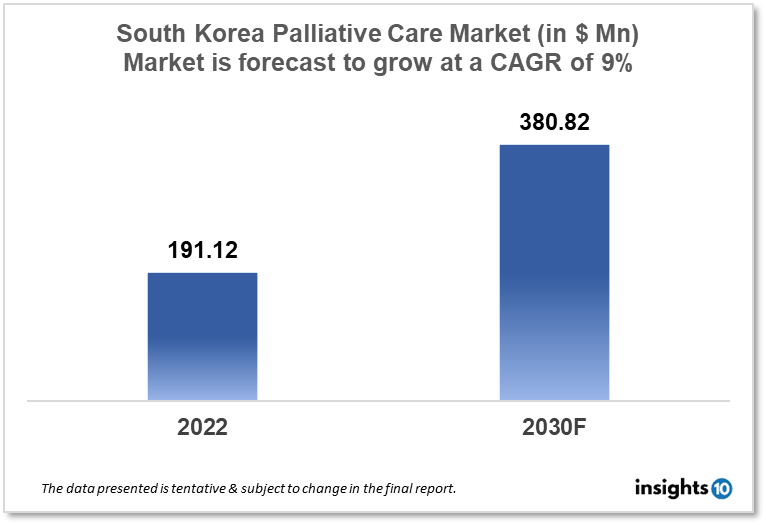

The South Korea Palliative care market is projected to grow from $191.12 Mn in 2022 to $380.82 Mn by 2030, registering a CAGR of 9% during the forecast period of 2022 - 2030. The main factors driving the growth would be growing awareness, government support and the ageing population. The market is segmented by service type and by the end user. Some of the major players include Seoul National University Hospital, Calvary Clinic, Bobath Memorial Hospital, Chunchon St. Colomban Clinic, Daegu Fatimah Hospital and Daejeon St. Mary’s Hospital.

Buy Now

South Korea Palliative Care Market Executive Summary

The South Korea Palliative care market is projected to grow from $191.12 Mn in 2022 to $380.82 Mn by 2030, registering a CAGR of 9% during the forecast period of 2022 - 2030. The national health spending as a percentage of GDP in South Korea in 2019 was 8.16% or $2,624.53 per person. Healthcare spending is still below the OECD average despite having increased consistently over the years.

For people with terminal illnesses and their families, palliative care enhances the quality of life. Palliative care services aim to both prevent and relieve suffering by accurately diagnosing and treating pain in combination with other conditions, such as mental, physical, and spiritual illnesses. By utilising a collaborative approach, palliative care also helps patients and those who care for them. This involves providing them with a network of support and taking care of their material requirements in order to enable them to live as fully as they can until they pass away. Palliative care is necessary for those with cancer, respiratory conditions, diabetes, kidney failure, chronic liver disease, and other illnesses.

Palliative care was first implemented in South Korea in 1965 at the Calvary Hospice in Gangneung City by Sisters of the Little Company of Mary, who immigrated from Australia in 1964. Since then, it has primarily been developed by the efforts of a small number of nurses, priests, and sisters of the Catholic Church, ministers of the Protestant Church, and some committed doctors in the early stages.

Market Dynamics

Market Growth Drivers

In South Korea, there has been a growing awareness and an increase in the number of patients and families seeking out palliative treatment. In addition, the South Korean government has established palliative care training programs for medical students in an effort to improve education and training for healthcare workers in this field. With this growing awareness, government support and the ageing population, the palliative care market is expected to expand.

Market Restraints

There aren't enough hospice and palliative care facilities, despite the rise in these institutions, to fulfil the rising demand in South Korea. Over 80 days on average were spent waiting to be admitted to a hospice centre in 2017, and some patients had to be turned away owing to capacity issues. Further, workforce shortage and limited reimbursement are expected to hinder market growth.

Competitive Landscape

Key Players

- Seoul National University Hospital (KOR)

- Bobath Memorial Hospital (KOR)

- Chunchon St. Colombian Clinic (KOR)

- Daegu Fatimah Hospital (KOR)

- Daejeon St. Mary’s Hospital (KOR)

- Calvary Clinic

Healthcare Policies and Regulatory Landscape

The regulatory framework for palliative care in South Korea and its healthcare policies are well-developed, with a focus on increasing and improving access to end-of-life care. The Korean Ministry of Health and Welfare launched a 10-year plan to increase palliative care services in 2011, with the objective of having palliative care teams in every hospital with more than 200 beds by 2020.

In addition, the Korean National Assembly passed a bill in 2018 mandating that all hospitals provide access to palliative care, recognising patients' legal right to such care. The bill also includes financing for the development of palliative care services in hospice facilities and the training of healthcare professionals in this field.

Reimbursement Scenario

The National Health Insurance Service (NHIS) of South Korea oversees payment procedures for palliative care services. Palliative care expenses for individuals with advanced cancer, AIDS, and end-stage renal disease are covered by the NHIS. All patients, however, may not be eligible for coverage for palliative care treatments due to limitations on the types of care that are covered and the duration of care that may be given.

The NHIS reimburses palliative care services supplied by recognised medical facilities that meet certain criteria, such as providing interdisciplinary treatment and including a palliative care specialist. Other medications used in palliative care, such as those for pain treatment, are also covered by the NHIS.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Palliative Care Market Segmentation

By Service Type (Revenue, USD Billion):

Based on service type, the South Korea palliative care market is divided into the following:

- Private residence care

- Hospice inpatient care

- Hospital inpatient care

- Nursing home and residential facility care

- Others

By End User (Revenue, USD Billion):

Based on end-user type, the South Korea palliative care market is divided into the following:

- Hospitals

- Home Care Settings

- Palliative Care Centers

- Long-Term Care Centers & Rehabilitation Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.