South Korea Liver Cancer Therapeutics Market Analysis

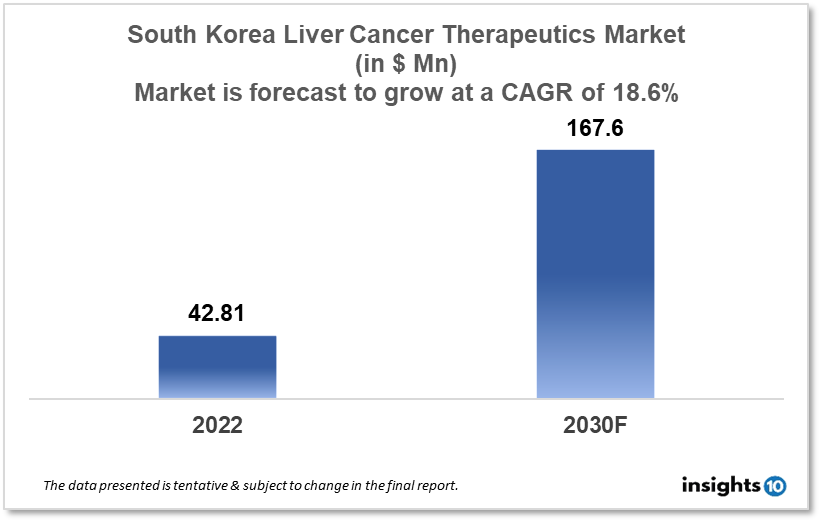

By 2030, it is anticipated that the South Korea Liver Cancer Therapeutics market will reach a value of $ 167.6 Mn from $42.81 Mn in 2022, growing at a CAGR of 18.6% during 2022-2030. Liver Cancer Therapeutics in South Korea is dominated by a few domestic pharmaceutical companies such as Green Cross Cell Corporation, Handok Pharmaceuticals and Yuhan Corporation. The Liver Cancer Therapeutics market in South Korea is segmented into different types of cancer and different therapy type. Some of the major factors affecting the South Korea Liver Cancer Therapeutics market are the growing prevalence of liver cancer and the high cost and side effects related to certain liver cancer therapies.

Buy Now

South Korea Liver Cancer Therapeutics Analysis Summary

By 2030, it is anticipated that the South Korea Liver Cancer Therapeutics market will reach a value of $ 167.6 Mn from $42.81 Mn in 2022, growing at a CAGR of 18.6% during 2022-2030.

South Korea is a high-income, developed country in Eastern Asia occupying the southern half of the Korean Peninsula. In South Korea, it was anticipated that there will be 42% of new cases of liver cancer in 2020, attributed to alcohol drinking. According to the most recent WHO data, 11,589 people died from liver cancer in South Korea in 2020, accounting for 4.62 % of all deaths. South Korea ranks 21st in the world with an age-adjusted death rate of 12.57 per 100,000 inhabitants. South Korea has a thriving pharmaceutical industry, and several Korean firms are working hard to find new treatments for liver cancer. Yuhan Corporation, for example, has created a novel medication called YHP1411, which is currently being tested in clinical trials for the treatment of liver cancer.

South Korea has a thriving pharmaceutical industry, and several Korean firms are working hard to find new treatments for liver cancer. Yuhan Corporation, for example, has created a novel medication called YHP1411, which is currently being tested in clinical trials for the treatment of liver cancer. South Korea's government spent 8.4 % of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

According to South Korea's National Cancer Center, liver malignancy is the third most frequent cancer, accounting for 9.2 % of all new cancer cases in 2018. In South Korea, liver cancer is the primary cause of cancer-related deaths. Liver cancer accounted for 13.2 % of all cancer fatalities in the United States in 2018. As a developed country, South Korea boasts substantial private and public R&D spending, as well as a broad industrial base. These aspects could boost South Korea Liver Cancer Therapeutics market.

Market Restraints

There are currently just a few therapy options for liver cancer, and the efficacy of these treatments varies depending on the stage of the cancer and the patient's overall condition. Cultural ideas and attitudes may influence some patients' willingness to seek treatment for liver cancer, especially if they believe it, is a terminal illness. South Korea's youth unemployment rate is significant, and the country's proximity to North Korea makes doing business difficult. These factors may deter new entrants into the South Korea Liver Cancer Therapeutics market.

Competitive Landscape

Key Players

- Green Cross Cell Corporation: Green Cross Cell Corporation is a biopharmaceutical company that specializes in developing innovative cell therapies. They are currently developing a liver cancer treatment using natural killer (NK) cells

- Chong Kun Dang Pharmaceutical Corp.: Chong Kun Dang Pharmaceutical Corp. is a leading pharmaceutical company in South Korea that develops and produces a wide range of drugs, including cancer treatments

- Handok Pharmaceuticals Co., Ltd.: Handok Pharmaceuticals Co., Ltd. is a South Korean pharmaceutical company that specializes in the development and commercialization of prescription drugs. They have developed several liver cancer treatments, including the drug 'oxaliplatin', which is used in combination with other drugs to treat advanced liver cancer

- Yuhan Corporation: Yuhan Corporation is a leading South Korean pharmaceutical company that develops and produces a wide range of drugs, including cancer treatments

- Bukwang Pharmaceutical: Bukwang Pharmaceutical is a South Korean pharmaceutical company that specializes in the development and commercialization of prescription drugs

Recent Notable updates

January 2023: The main findings of Handok's phase 2 clinical trial of HD-B001A (CTX-009, ABL001) for bile duct cancer patients were reported at the American Society of Clinical Oncology Gastroenterology Cancer in San Francisco, USA. The poster will be displayed at the symposium. HD-B001A is a next-generation anticancer medication that is being developed using bispecific antibody platform technology. Handok has signed a license agreement with ABL Bio and holds the rights in Korea. Furthermore, we created the framework for HD-B001A to expand to global clinical trials based on the Korean clinical trial and examined how Compass Therapeutics and the US clinical trials are cooperating.

Healthcare Policies and Reimbursement Scenarios

Regulation and reimbursement of liver cancer therapeutics in South Korea are governed by the Ministry of Food and Drug Safety (MFDS) and the National Health Insurance Service (NHIS), respectively. It is possible to import unapproved liver cancer therapeutics into South Korea under certain circumstances, such as for compassionate use or clinical trials. However, the importation of unapproved drugs is strictly regulated by the MFDS and may require special permission.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Liver Cancer Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Hepatocellular Carcinoma

- Cholangio Carcinoma

- Hepatoblastoma

- Other Types

By Treatment (Revenue, USD Billion):

- Chemotherapy

- Immunotherapy

- Targeted Therapy

- Radiation Therapy

- Ablation Therapy

- Embolization Therapy

By Equipment (Revenue, USD Billion):

- Computed Radiography

- MRI

- Sonography

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Intravenous

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.