South Korea Diabetes Therapeutics Market Analysis

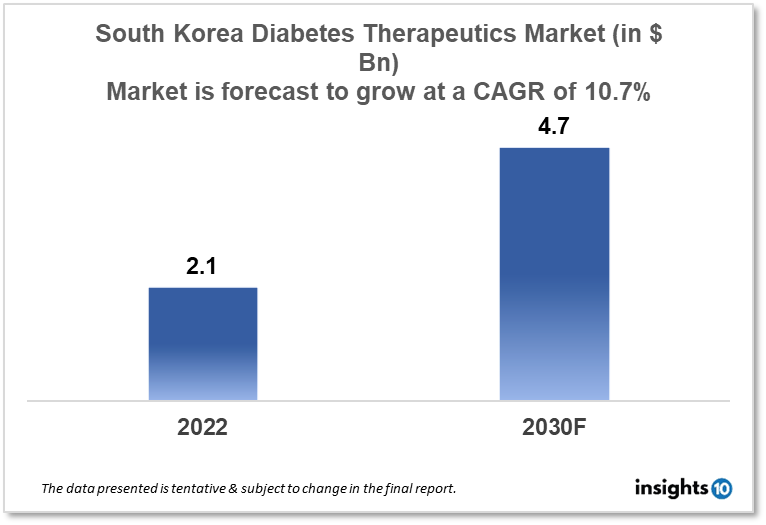

South Korean diabetes therapeutics market is expected to witness growth from $2.1 Bn in 2022 to $4.7 Bn in 2030 with a CAGR of 10.7% for the forecasted year 2022-30. The increase in the prevalence of diabetes in South Korea, as well as government policies designed to promote awareness of diabetes in South Korea, are the major market drivers. The South Korean diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Chong Kun Dang, Kwang Dong Pharmaceutical, and Boehringer Ingelheim are the major players in the South Korean diabetes therapeutics market.

Buy Now

South Korea Diabetes Therapeutics Market Executive Analysis

South Korean diabetes therapeutics market is expected to witness growth from $2.1 Bn in 2022 to $4.7 Bn in 2030 with a CAGR of 10.7% for the forecasted year 2022-30. The expense of healthcare as a %age of GDP in Korea increased at the quickest rate among OECD nations during the past five years. In Korea, the proportion of health expenditures to GDP increased by 1.5 %age points, from 6.5 to 8 % between 2016 and 2022. The government budget for 2023 totalling $497 Bn was approved by South Korea's National Assembly on Saturday. Public health, welfare, and employment programs received most of the total budget (35.4%), followed by the education sector (15.1%) and national defence spending (8.9%).

Three out of ten Koreans over the age of 65 and one out of every seven persons in that age group with diabetes mellitus had inadequate glycemic and risk factor management. According to the Korean National Burden of Disease survey, diabetes mellitus was the leading cause of years of life with a disability, and this number rose further as a result of diabetic complications.

In South Korea, there are now six classes of oral hypoglycemic agents (OHAs) and two groups of injectables with various modes of action. Recent medications that target renal glucose reabsorption (sodium and glucose co-transporter 2 [SGLT2] inhibitors) and incretin hormones (dipeptidyl peptidase 4 [DPP-4] inhibitor and glucagon-like peptide-1 receptor agonist [GLP-1 RA]) do not result in hypoglycemia or weight gain, and results of extensive clinical trials support their beneficial effects on the risk of cardiovascular events. As a result, the treatment guidelines for T2DM are being updated considering the discovery of new medications and mounting data from clinical trial findings.

The Korean Diabetes Association guidelines suggest treatment of T2DM with metformin as the first medication in conjunction with lifestyle modification, in line with the IDF recommendations. If the patient's baseline HbA1c level is less than 7.5% or if the HbA1c target is not reached within 3 months of starting metformin alone, dual treatment may be an option. If dual therapy fails to provide appropriate glycemic control, a third drug having a complementary action may be introduced.

Market Dynamics

Market Growth Drivers

One of the major difficulties facing South Korean healthcare systems is diabetes, a serious health issue. The adult population of South Korea has a very high prevalence of type 1 and type 2 diabetes, as well as a sizable number of individuals who have not yet received a diagnosis. The prevalence of type 2 diabetes is anticipated to rise steadily over the next few years due to an ageing population and an unhealthy lifestyle leading to the growth in the South Korean diabetes therapeutics market. Through programs like the National Health Screening Program and the Diabetes Control Initiative, the South Korean government has actively supported the treatment and control of diabetes. This has promoted the use of diabetes medicines and helped to increase knowledge of diabetes.

Market Restraints

Diabetes care can be expensive in South Korea, which may prevent some people from receiving it. This may have an impact on consumer demand for diabetic treatment options. Some patients may have less access to therapy due to South Korea's restrictive payment laws for diabetes medicines. This may affect the market's demand for diabetes medicines. Traditional Korean medicine, which some patients may prefer, competes with mainstream diabetic treatments as well as other complementary therapies. This may reduce consumer demand for traditional diabetes treatments thereby limiting the expansion of South Korea's diabetes therapeutics market.

Competitive Landscape

Key Players

- Yuhan Corporation (KOR)

- Kolmar Korea (KOR)

- GC Pharma (KOR)

- Chong Kun Dang (KOR)

- Kwang Dong Pharmaceutical (KOR)

- Boehringer Ingelheim

- Eli Lilly

- Glaxosmithkline

- Novartis

- Novo Nordisk

- Sanofi

Healthcare Policies and Regulatory Landscape

The Ministry of Food and Drug Safety (MFDS) and the Ministry of Health and Welfare (MoHW) are the principal administrative agencies in charge of regulating medicines in South Korea. The MFDS is the agency in charge of carrying out the Pharmaceutical Affairs Act's enforcement, and it has control over things like Approval and/or acceptance of reports or applications to produce, import, or sell pharmaceutical products, evaluation of the effectiveness and safety of novel pharmaceuticals, clinical trial approval, classification or standardization of pharmaceutical items, issuing administrative fines and corrective orders and supervision of the advertising and labelling of pharmaceuticals. The MoHW primarily oversees topics pertaining to healthcare facilities, enforces medication pricing rules and regulations, and maintains order in pharmaceutical sales procedures.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Chong Kun Dang, Kwang Dong Pharmaceutical, and Boehringer Ingelheim are the major players in the South Korean diabetes therapeutics market.

The South Korean diabetes therapeutics market is expected to grow from $2.1 Bn in 2022 to $4.7 Bn in 2030 with a CAGR of 10.7% for the forecasted year 2022-2030.

The South Korea diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.