South Korea 3D Imaging Market Analysis

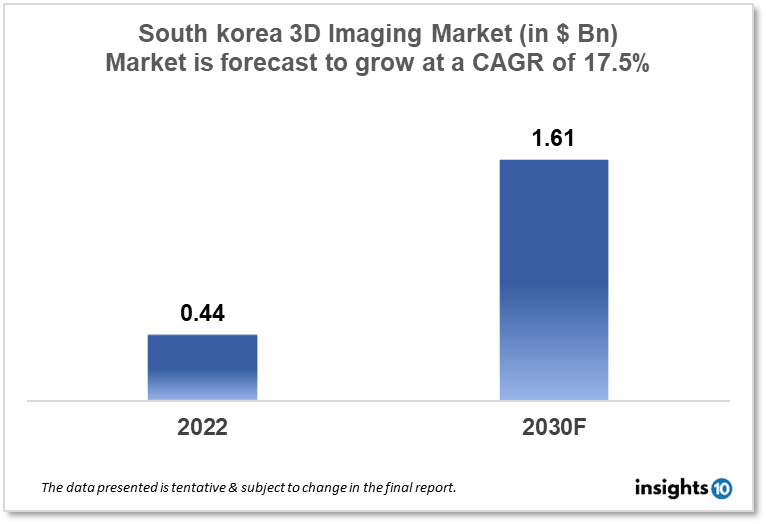

South Korea's 3D imaging market is projected to grow from $0.44 Bn in 2022 to $1.61 Bn by 2030, registering a CAGR of 17.5% during the forecast period of 2022-30. The market will be driven by the implementation of new 3D imaging technology, applications, and support from the government sector. The market is segmented by product, by application, end-user & by portability. Some of the major players include GE Healthcare, Siemens Healthineers & Samsung Medison.

Buy Now

South Korea 3D Imaging Market Executive Summary

South Korea's 3D imaging market is projected to grow from $0.44 Bn in 2022 to $1.61 Bn by 2030, registering a CAGR of 17.5% during the forecast period of 2022-30. South Korea's GDP in 2021 was predicted to be around 1.81 trillion US dollars. South Koreans spent around 3.9 thousand US dollars per capita on health in 2021. Koreans spent an average of $3.6 thousand in the previous year. While per capita expenditure has been progressively growing, it remains below the 2019 OECD average of over $4,000. The South Korean government is a major contributor to the country's healthcare system, with the government's percentage of overall health expenditure increasing in recent years. In 2022, Korea is anticipated to see 274,488 new cancer cases and 81,277 cancer deaths. According to the WHO statistics from 2020, the number of Coronary Heart Disease fatalities in South Korea was 28,043 (or 11.19% of total deaths).

South Korean healthcare relies heavily on 3D Imaging, and the country has made major expenditures in this sector in recent years. South Korea is well-known for its superior medical technology and healthcare infrastructure, and 3D Imaging is becoming increasingly crucial in the diagnosis and treatment of a wide range of medical disorders. 3D Imaging is employed in a range of healthcare settings in South Korea, including hospitals, clinics, and diagnostic imaging institutes. The advancement of advanced imaging technologies, such as computed tomography (CT) scans, magnetic resonance imaging (MRI) scans, and ultrasound has eased the use of 3D imaging.

In April 2022, NANO-X IMAGING LTD, a cutting-edge Imaging technology business, announced the opening of its new semiconductor chip production facilities in South Korea. The facility will be the primary manufacturing site for Nanox micro-electro-mechanical systems ("MEMs"). SOURCE, a chip that generates the Company's Nanox's digital X-ray source. The ARC system is a three-dimensional Imaging system that has the potential to democratize meaningful access to imaging that is unavailable in about two-thirds of the globe.

Market Dynamics

Market Growth Drivers

South Korean healthcare professionals and research scholars have been at the forefront of creating and implementing new 3D Imaging technology and applications, such as virtual and augmented reality (VR/AR) applications for clinical training and patient involvement, and the use of artificial intelligence (AI) to improve the precision and effectiveness of diagnostic imaging. The South Korean government has put in place a number of measures to encourage the development and use of 3D imaging, including research and innovation funding and investments in healthcare infrastructure. The government has also put in place regulatory frameworks to guarantee that Imaging technology, particularly 3D imaging, is used safely and effectively.

Market Restraints

The South Korean 3D imaging industry is confronted with a number of obstacles and constraints that may hinder its growth and development. These include the high cost of Imaging equipment, restricted access to specialist imaging equipment in some parts of the country, a lack of standardization in Imaging technology and data, and issues with data privacy and security. Addressing these concerns will be critical for assuring the continuing growth and development of South Korea's 3D imaging industry.

Competitive Landscape

Key Players

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Hologic

- Samsung Medison (KOR)

- Esaote Korea (KOR)

Notable Deals

- January 2023, GE HealthCare has agreed to acquire IMACTIS (Grenoble, France), a pioneer in the rapidly expanding field of CT interventional guiding across a wide range of treatment areas

- November 2022, GE Healthcare, and MediView XR, Inc., a leading clinical augmented reality med-tech company, revealed their collaboration to incorporate imaging techniques into mixed reality solutions via the OmnifyXRTM Interventional Suite System

Healthcare Policies and Regulatory Landscape

The Korean Food and Drug Administration (KFDA), which is in charge of regulating the country's medical device sector, has primary authority and policy for the 3D Imaging business in South Korea. The KFDA establishes criteria for the safety and efficacy of medical devices, including 3D Imaging technology, and is in charge of approving new devices for market usage. In addition to the KFDA, the Ministry of Health and Welfare is involved in establishing South Korea's policy and regulatory framework for 3D Imaging. The Ministry is in charge of regulating the country's healthcare system, including the establishment and execution of healthcare policies, and has a substantial effect on the direction of the South Korean Imaging market.

Reimbursement Scenario

In South Korea, the National Health Insurance Service (NHIS) is in charge of paying the costs of medical operations, including 3D Imaging. The National Health Insurance Program (NHIS) establishes reimbursement rates for numerous medical treatments and services, including 3D Imaging, and collaborates with healthcare providers to ensure that patients have access to high-quality medical care.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Korea 3D Imaging Market Segmentation

By Product (Revenue, USD Billion):

The 3D Imaging Market is divided majorly into X-ray Imaging Systems, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound & Nuclear Imaging Systems. X-ray Imaging systems have the highest market share in the 3D Imaging market. 3D X- rays are mostly utilized for dental and orthopedic applications. 3D Ultrasound is majorly helpful in tracking the dynamic motion of arteries, and veins and also has applications for various fetal, cardiac, obstetric, and rectal examinations, and many more. The ultrasound segment is predicted to develop substantially over the forecast period, primarily to the advancements in technology in the healthcare industry and the several advantages given by 3D ultrasound imaging over standard ultrasound imaging.

- X-ray Imaging Systems

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Nuclear Imaging systems

By Application (Revenue, USD Billion):

The market for 3D Imaging has applications covering Cardiology, Neurology, Orthopaedics, Gynaecology, Oncology, and other areas of diagnostics as well. Cardiovascular diseases are the leading cause of death globally. The second biggest cause is cancers because of which Oncology holds the highest market share in the 3D Imaging market followed by cardiology as 3D imaging is highly utilized in these two segments for diagnostics and treatments of the same. Neurosurgeons desire three-dimensional (3D) imagery of intracranial tumors, neural structures, skulls, and veins to establish a clear visual image of the surgical field's anatomical orientation prior to surgical intervention aiding better surgical outcomes for patients. Obstetricians employ 3D ultrasound scans to see the gestational sac, pinpoint the location of an ectopic pregnancy, and evaluate for fetal deformities of the face, spine, limbs, and heart. 3D Imaging applications for gynecology are yet in evolving stage and have a great scope for expansion allowing feasible and quick patient care.

- Cardiology

- Neurology

- Orthopedics

- Gynecology

- Oncology

- Others (Urology, etc.)

By End User (Revenue, USD Billion):

Hospitals, Diagnostic Imaging Centers, and other end-user such as private clinics make up the segments of the 3D Imaging Market. The hospitals among these hold the biggest market share due to the increased uptake of cutting-edge medical technology, the expansion of existing 3D Imaging facilities, the rising affordability of 3D Imaging services, the rising prevalence of chronic conditions such as cardiovascular diseases, cancers, respiratory diseases which lead to rising in demand for precise and quick diagnostic and treatment options. Diagnostic Imaging Centers have also been deploying 3D Imaging equipment to improve their standard of care.

- Hospitals

- Diagnostic Imaging Centers

- Other End Users

By Portability (Revenue, USD Billion):

The 3D Imaging market is divided into two segments Stationary & Mobile, considering the portability of the device. Stationary 3D imaging involves equipment that is installed at a particular location and is operated from the same location of installment whereas mobile ones can be relatively smaller in size and hence moved to the patients who are unable to locate the Imaging room. Mobile MRI, Ultrasound, X–ray & CT allow cutting-edge healthcare to be delivered to nearly any location and are yet in the developing stages of expansion.

- Stationary

- Mobile

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.