South Africa Top Selling Biologics Market Analysis

South Africa Top Selling Biologics Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. Increasing research and development activities and favorable reimbursement policies act as market growth drivers. Some of the major players in this market are Roche/Genentech, Johnson & Johnson, AbbVie, Amgen etc.

Buy Now

South Africa Top Selling Biologics Market Analysis Summary

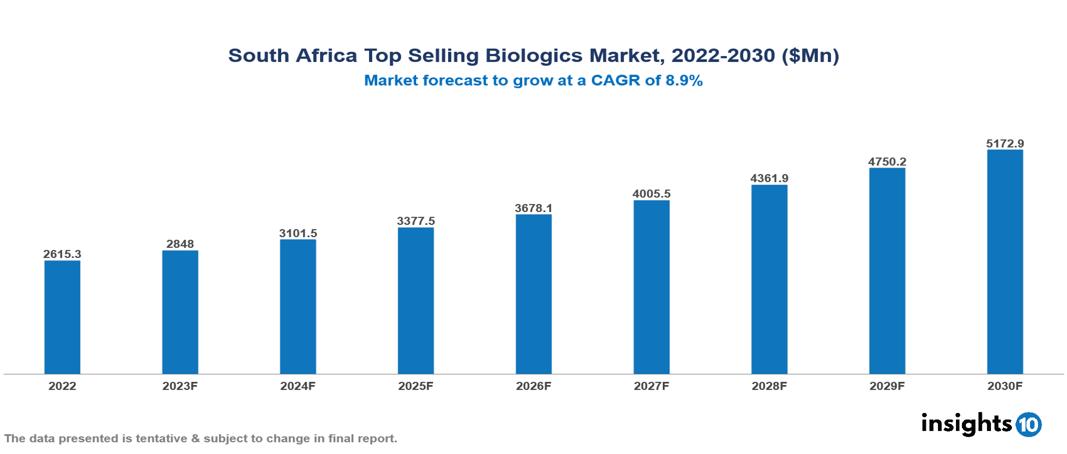

South Africa Top Selling Biologics Market is valued at around $2615.3 Mn in 2022 and is projected to reach $5172.9 Mn by 2030, exhibiting a CAGR of 8.9% during the forecast period 2023-2030.

Biologics are complex molecules derived from living organisms, such as proteins, antibodies, and vaccines, and they have revolutionized the treatment of various diseases. A few decades back the pharmaceutical market was dominated by small-molecule drugs. However, owing to concerns, such as off-target toxicity and low specificity, associated with chemical moieties a better class of pharmacological interventions was required. Thus, biologics were invented and biologics offered several benefits target specificity, and better therapeutic efficacy. There are presently more than 65 top-selling biologics on the market with sales that have reached or exceeded $500 million in 2020. Following hormones (19%) and enzymes (9%), monoclonal antibodies make up the majority (54%) of the aforementioned options. Additionally, the subcutaneous route (50%) and intravenous route (40%) were shown to be the most popular methods of administering these treatments. The top-selling biologics market is currently dominated by the presence of large companies (82%). Over 2,450 clinical trials were registered for the evaluation of top-selling biologics, Of the total, 1,892 trials were registered for the evaluation of products targeting oncological disorders followed by those investigating biologics intended for the treatment of metabolic disorders (122) and autoimmune disorders (98). Around 250 biosimilars of top-selling biologics are currently approved / under development. By 2030, monoclonal antibodies should account for more than 75% of the market.

By 2030, Genentech/Roche and Merck are predicted to hold more than 40% of the market share. Humira (adalimumab) to treat autoimmune conditions, Keytruda (pembrolizumab) manufactured by Merck & Co. used in the treatment of various cancers, Enbrel (etanercept) developed by Amgen and Pfizer, Enbrel is used to treat autoimmune conditions such as rheumatoid arthritis, Remicade (infliximab) marketed by Janssen Biotech used to treat autoimmune conditions, Rituxan/MabThera (rituximab) manufactured by Genentech (a subsidiary of Roche), Rituxan/MabThera is used for the treatment of non-Hodgkin's lymphoma Herceptin (trastuzumab) developed by Genentech/Roche, Herceptin is used in the treatment of HER2-positive breast cancer. It has been one of the top-selling biologics in the oncology market.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Chronic Diseases like cancer, autoimmune disorders, and inflammatory conditions. Advancements in Biotechnology and Genetic Engineering have led to the development of biologics, growing Demand for personalized medicine treatments tailored to the individual characteristics of patients, such as genetic makeup, biomarkers, and disease subtypes, Increasing research and development activities, and favorable reimbursement policies act as market growth drivers.

Market Restraints

High Costs of manufacturing, patent expiry, biosimilar competition, regulatory challenges, safety concerns, and limited therapeutic options act as market growth restraints.

Competitive Landscape

Key Players

- Roche/Genentech

- Johnson & Johnson

- AbbVie

- Amgen

- Pfizer

- Bristol Myers Squibb

- Eli Lilly

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For South Africa Top Selling Biologics Market

By Therapeutic Area

- Oncology

- Autoimmune diseases

- Infectious diseases

- Cardiovascular diseases

- Respiratory disorders

By Indication

- Breast cancer

- Lung cancer

- Hematological malignancies (lymphomas, leukemias)

- Rheumatoid arthritis

- Crohn's disease

- Psoriasis

By Product Type

- Monoclonal antibodies

- Therapeutic proteins

- Vaccines

- Cytokines

By Patient Population

- Adult patients

- Pediatric patients

By Distribution Channel

- Hospitals

- Specialty clinics

- Retail pharmacies

- Online platforms

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.