South Africa Remicade Biosimilar Market Analysis

South Africa Remicade Biosimilar Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. Remicade Biosimilar market is growing globally due to the rising prevalence of autoimmune illnesses including rheumatoid arthritis, plaque psoriasis, introduction of a biosimilar version could provide financial relief for healthcare systems and increased access to essential medication for patients, quicker intravenous administration reaction times, patent expiry of branded versions will create opportunity biosimilars over other branded counterparts, thus increasing remicade biosimilar demand, growing awareness about its long-term benefits and better reimbursement scenario, technological advancements in the field of biosimilars, an increase in R&D spending by pharmaceutical companies and growing awareness about biosimilars among healthcare professionals and patients. Janssen Biotech Inc., Merck &Co., Pfizer Inc. (AC. Hospira), Celltrion Inc., Alvogen, Napp Pharmaceuticals, and Nippon Kayaku are some major players in the global Remicade (infliximab mAb) market.

Buy Now

South Africa Remicade Biosimilar Market Analysis Summary

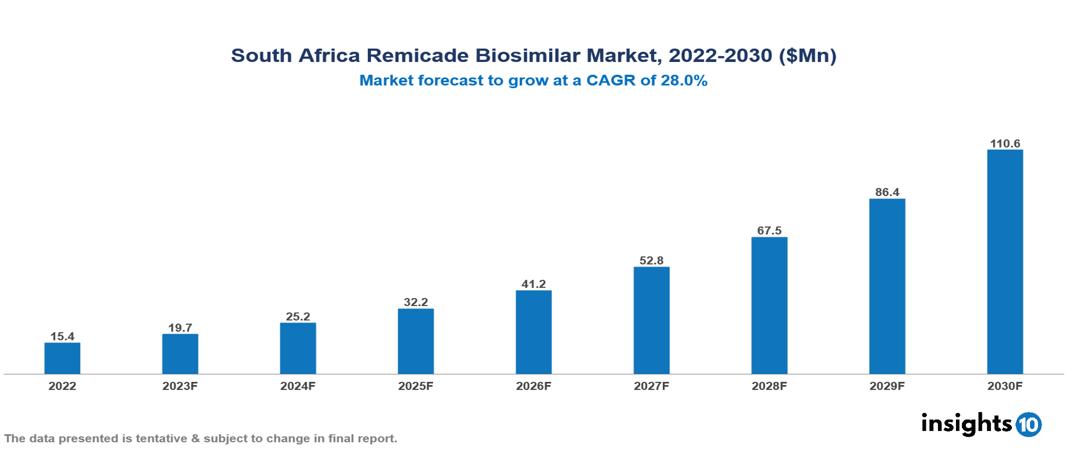

South Africa Remicade Biosimilar Market is valued at around $15.4 Mn in 2022 and is projected to reach $110.6 Mn by 2030, exhibiting a CAGR of 28% during the forecast period 2023-2030.

A monoclonal antibody (mAb), known as Remicade biosimilar, attaches particularly to tumor necrosis factor-alpha (TNF-alpha), preventing it from doing its job. It is used to treat autoimmune conditions such as ulcerative colitis, rheumatoid arthritis, and Crohn's disease. To establish equivalent efficacy and safety characteristics to the reference biologic, biosimilars go through extensive testing. Clinical studies show comparable therapeutic outcomes and side effect profiles, supporting their use as Remicade alternatives. Janssen Biotech Inc., Merck &Co., Pfizer Inc. (AC. Hospira), Celltrion Inc., Alvogen, Napp Pharmaceuticals, and Nippon Kayaku are some major players in the global Remicade (infliximab mAb) market.

Market Dynamics

Market Growth Drivers

Rising prevalence of autoimmune illnesses including rheumatoid arthritis, and plaque psoriasis, the introduction of a biosimilar version could provide financial relief for healthcare systems and increased access to essential medication for patients, quicker intravenous administration reaction times, patent expiry of branded versions will create opportunity biosimilars over other branded counterparts thus increasing Remicade biosimilar demand, growing awareness about its long-term benefits and better reimbursement scenario, technological advancements in the field of biosimilars, an increase in R&D spending by pharmaceutical companies and growing awareness about biosimilars among healthcare professionals and patients.

Market Restraints

Serious medication side effects that could necessitate hospitalization or perhaps be lethal are obstacles to the Remicade biosimilar. These include invasive fungal infections, such as histoplasmosis, bacterial sepsis, tuberculosis, and others. As a result, it is required that the drug's maker include a "Boxed Warning" to inform both medical professionals and people. The complexity of the medicine's molecule and the absence of FDA-approved manufacturing facilities are further concerns that may limit the market expansion of the drug in developing nations, the manufacturing complexity of biosimilars, regulatory and approval challenges, intellectual property, and patent issues. All these factors act as market growth restraints.

Competitive Landscape

Key Players

- Janssen Biotech Inc.

- Merck &Co.

- Pfizer Inc. (AC. Hospira)

- Celltrion Inc.

- Alvogen

- Napp Pharmaceuticals

- Nippon Kayaku

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For South Africa Remicade Biosimilar Market

By Disease Indication

- Crohn’s disease

- Rheumatoid arthritis

- Ankylosing spondylitis

- Psoriatic arthritis

- Ulcerative Colitis

- Plaque psoriasis

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End-user

- Hospitals

- Specialty clinics

- Ambulatory surgical centers

- Homecare settings

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.