South Africa Pharmacy Automation Device Market Analysis

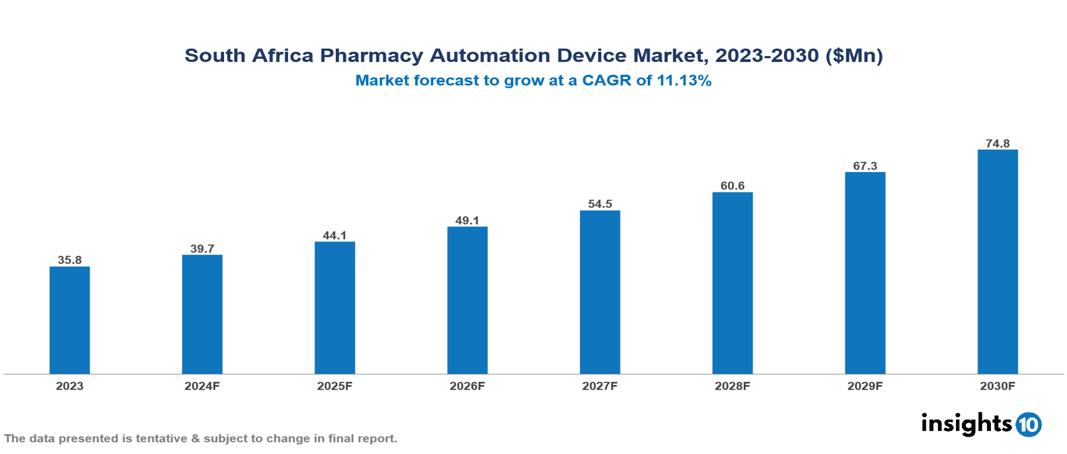

The South Africa Pharmacy Automation Device Market was valued at $35.8 Mn in 2023 and is predicted to grow at a CAGR of 11.13% from 2023 to 2030, to $74.8 Mn by 2030. South Africa Pharmacy Automation Device Market is growing due to Growing Need to Minimize Medication Errors, Increasing Healthcare Expenditure, and Advancing Technology. The market is primarily dominated by players such as Cerner Corporation, Capsa Healthcare, ScriptPro LLC, RxSafe, LLC., MedAvail Technologies, Amerisource Bergen Corporation, and Omnicell, Inc.

Buy Now

South Africa Pharmacy Automation Device Market Executive Summary

South Africa Pharmacy Automation Device Market is at around $35.8 Mn in 2023 and is projected to reach $74.8 Mn in 2030, exhibiting a CAGR of 11.13% during the forecast period.

The Pharmacy Automation market is a subset of the larger E-Healthcare industry. It focuses on the automation of pharmacy processes, such as the filling of prescriptions, inventory management, and drug dispensing. Automation of these processes can help reduce costs, improve accuracy, and increase efficiency. It can also help reduce the risk of medication errors, which can have serious consequences for patients. For this reason, the pharmacy automation system plays a crucial role in reducing errors related to storage, inventory, usage, and retrieval. Pharmacy automation is a perfectly acceptable and helpful way to improve the accuracy and efficiency of pharmacies.

Penetration rate of pharmacy automation devices in South Africa is currently moderate, driven by a growing demand to improve efficiency and reduce medication errors in healthcare settings. Automation in pharmacies is projected to significantly enhance efficiency and effectiveness by up to 30-40%, mainly by reducing human error, optimizing inventory management, and improving patient safety. The market in South Africa includes several established companies and startups, contributing to the expansion of these technologies. Key players in the broader medical device market in South Africa include Abbott, Medtronic, and GE Healthcare. The market, therefore, is driven by significant factors like Growing Need to Minimize Medication Errors, Increasing Healthcare Expenditure, and Advancing Technology. However, High Costs, Resistance to Change, Complexity, and Integration Issues restrict the growth and potential of the market.

AmerisourceBergen Corporation announced the completion of its acquisition of PharmaLex Holding GmbH. The acquisition of PharmaLex enhances AmerisourceBergen Corporation’s growth strategy by advancing its leadership in specialty services and Middle East and Africa platform of pharma manufacturer services capabilities.

Market Dynamics

Market Growth Drivers

Growing Need to Minimize Medication Errors: Drug errors can result from a variety of circumstances, including as inadequate order coordination between the pharmacist and physician, improper pharmacy storage practices, and misinterpretations caused by using identical labels. Discrepancies or deviations from the prescribed regimen are called dispensing errors. Pharmacies are expected to see a 30–40% increase in efficiency and efficacy as a result of automation, mostly due to lower human error, better inventory management, and increased patient safety. Inadequate or deceptive usage instructions are another common cause of drug errors, as is improper medication preparation, packaging, or storage before distribution.

Increasing Healthcare Expenditure: The investments made in clinics, hospitals, and other services are what are driving this increase. The healthcare system must expand in step with the population. A secret to effectiveness and financial savings is automation in pharmacies. These tools reduce mistakes, maximize inventory, and expedite the distribution of medications. Better patient care with fewer errors and lower expenses for pharmacies in the face of competition are the two gains. The march toward automation benefits Malaysia's healthcare sector.

Advancing Technology: Robotics, artificial intelligence (AI), and the Internet of Things (IoT) are enabling more and more sophisticated automation systems. These cutting-edge tools have two benefits: they improve drug management accuracy and efficiency by streamlining pharmacy processes. This gives pharmacies a competitive edge that enables them to adhere to tighter guidelines and provide patients with the safe, high-quality treatment they deserve.

Market Restraints

High Cost: Studies show that around 70% of pharmacists cite cost as a major barrier to adopting automation. This financial burden extends beyond the initial purchase, as ongoing maintenance and potential upgrades add to the long-term expense. For instance, a recent survey found that over 65% of pharmacies struggle to justify the ROI (Return on Investment) of automation within the first 5 years. This high initial investment can be a major disincentive, slowing down the spread of automation technology. In regions with tight healthcare budgets or economic limitations, the cost of automation might be simply out of reach, further limiting its adoption.

Resistance to Change: Pharmacy staff, accustomed to traditional workflows, may resist transitioning to automated systems. This resistance can stem from a fear of job loss, unfamiliarity with new technologies, or skepticism about the reliability and benefits of automation. Effective change management and training programs are essential to overcome this barrier, but they require time and resources. Without the full support and confidence of the pharmacy staff, the implementation of automation systems can face significant hurdles. The cultural shift required within the pharmacy environment can thus be a substantial barrier to adoption.

Complexity and Integration Issues: The different systems, like pharmacy software and patient records, need to be compatible and talk to each other seamlessly. Many pharmacies simply don't have the tech whizzes on hand to handle it, and the worry of glitches or the whole system grinding to a halt during the process can be enough to scare them away from automation altogether. On top of that, keeping all these integrated systems running smoothly adds another layer of complexity, potentially slowing down wider adoption.

Regulatory Landscape

The regulatory landscape for pharmacy automation devices in South Africa is governed by the South African Health Products Regulatory Authority (SAHPRA). SAHPRA oversees the registration, importation, and distribution of medical devices, ensuring compliance with the Medicines and Related Substances Act, of 1965. Additionally, pharmacy automation devices must adhere to the guidelines set by the Pharmacy Act and the South African Pharmacy Council (SAPC), which regulate pharmacy practices. Compliance with the Medical Devices Regulations (2016) is essential for market entry, emphasizing safety, quality, and efficacy. These regulatory frameworks aim to ensure that pharmacy automation devices contribute effectively to healthcare delivery while maintaining high standards of patient safety and device reliability.

Competitive Landscape

Key Players

Here are some of the major key players in South Africa Pharmacy Automation Device Market:

- Cerner Corporation

- Capsa Healthcare

- ScriptPro LLC

- RxSafe, LLC

- MedAvail Technologies

- Amerisource Bergen Corporation

- Accu-Chart Plus Healthcare Systems, Inc.

- Omnicell, Inc.

- McKesson Corporation

- Pearson Medical Technologies

- Baxter

- Talyst, LLC

- Scriptpro LLC

- Becton Dickinson and Company

- Fulcrum Pharmacy Management, Inc.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Pharmacy Automation Device Market Segmentation

Based on Product

- Automated Medication Dispensing Systems

- Automated Packaging and Labeling Systems

- Automated Table-Top Counters

- Automated Storage and Retrieval Systems

- Other Pharmacy Automation Systems

Based on Pharmacy Type

- Independent

- Chain

- Federal

Based on Pharmacy Size

- Large Size Pharmacy

- Medium Size Pharmacy

- Small Size Pharmacy

Based on Application

- Drug Dispensing and Packaging

- Drug Storage

- Inventory Management

Based on End-user

- Retail Pharmacy

- Inpatient Pharmacies

- Outpatient Pharmacies

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.