South Africa Neurology Devices Market Analysis

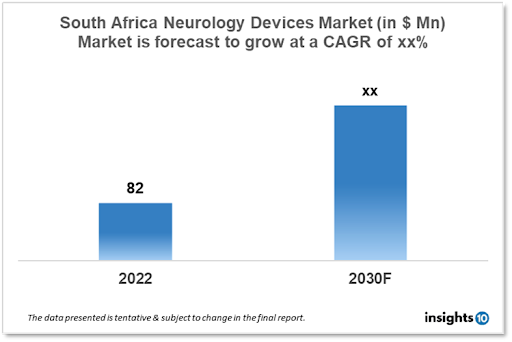

The South Africa Neurology Devices Market size was valued at $82 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of xx% from 2022 to 2030 and will reach $xx Mn in 2030. The South Africa devices market has recently been growing as a result of an aging population and an increase in the demand for better healthcare services, due to factors such as an increase in the prevalence of neurological diseases, rising disposable incomes, and a stronger emphasis on healthcare infrastructure and research, it is projected that the market will grow over the coming years. The market is segmented by product type and by the end user. Some key players in this market include Medtronic, Johnson and Johnson, Stryker, Abbott Laboratories, Smith and Nephew, B. Braun Melsungen AG, and Integra Lifesciences.

Buy Now

South Africa Neurology Device Market Executive Analysis

The South Africa Neurology Devices market is at around $82 Mn in 2022 and is projected to reach $ $xx Mn in 2030, exhibiting a CAGR of xx% during the forecast period. South Africa's government devotes a greater amount of funding to health (14% as opposed to 11%). The administration has been attempting to increase the size of the budget line item for health. Due to the high cost, which is anticipated to reach US$16.5 Bn year by 2025, implementing National Health Insurance (NHI) will be difficult. In the South Africa Health budget, $16.4 billion was allotted for healthcare, a 1.1% increase over the year before. The cost of the COVID-19 vaccine doses and their delivery is included in this number along with an additional $100 Mn, of which $83 Mn is a tentative amount. As the pandemic draws to a close, it is important to notice that government health spending growth momentum is now moving in the opposite direction. Health spending is expected to cost $15.4 billion and $15.7 billion respectively in the budgets for 2023 and 2024.

In South Africa, neurology devices are crucial for enhancing neurological disorder diagnosis and treatment and for delivering high-quality patient care. The market for neurological devices in South Africa is expanding as a result of a growing need for better healthcare services, an aging population, and a rising incidence of neurological disorders. South Africa has 3.171 million (5.4%) people aged 65 or over in 2019, and by 2030, this number is expected to rise to 4.404 million (6.7%), according to the World Population Ageing 2019 study. As a result, existing investors will be more motivated to make more investments in this nation as the population of people with dementia is predicted to steadily rise. Neurological devices help with the diagnosis, prognosis, and treatment of a variety of neurological disorders and ailments, such as traumatic brain injury, Alzheimer's disease, Parkinson's disease, and significant depression.

Market Dynamics

Market Growth Drivers

The South Africa devices market has recently been growing as a result of an aging population and an increase in the demand for better healthcare services, due to factors such as an increase in the prevalence of neurological diseases, rising disposable incomes, and a stronger emphasis on healthcare infrastructure and research, it is projected that the market will grow over the coming years. In South Africa, the prevalence of neurological conditions such as stroke, Parkinson's disease, Alzheimer's disease, and epilepsy is rising, which is fueling demand for neurology devices. The primary drivers influencing the growth of the neurology devices market are an increase in the prevalence of neurological illnesses, sizable private sector investments in neurology devices, and increased research and development in the area of Neurotherapy. The South African government is making substantial investments in the healthcare industry, which is promoting the market for neurology devices.

Market Restraints

South Africa's regulatory framework can be convoluted and challenging. and the import and sale of medical devices are subject to a number of laws and certifications. For businesses in the South Africa neurology devices market, this may mean considerable delays and extra expenses. The South African neurology device market is competitively fragmented. Market players are engaged in R&D to provide sophisticated neuromodulation and stimulation techniques with less invasive treatments that are more palatable to patients. In addition, numerous commercial firms are very interested in creating revolutionary neurological devices in order to make big profits. Few new players are anticipated to enter the market in the upcoming years.

Competitive Landscape

Key Players

- B. Braun Melsungen AG

- Stryker

- Medtronic

- Johnson and Johnson

- Integra Lifesciences

- Smith & Nephew

- Abbott Laboratories

Notable Recent Deals

2022: The acquisition of South African medical device manufacturer Tendron Systems by the French company Bertin Technologies is one recent development in the South African neurology devices market. Tendron Systems is an industry leader in the design and manufacture of electromyography (EMG) and EEG systems, among other neurology devices.

Healthcare Policies and Regulatory Landscape

The South African National Department of Health and the South African Health Products Regulatory Authority (SAHPRA) are in charge of enforcing the country's healthcare laws and rules, which also apply to the neurological devices industry. For South Africa's healthcare system, including the purchase, use, and disposal of neurology devices, the National Department of Health establishes the policies and regulations. The South African National Department of Health and the South African Health Products Regulatory Authority (SAHPRA), on the other hand, are in charge of registering and licensing neurology devices, including those used in neurology, and assuring their efficacy, quality, and safety. A neurology device must meet all relevant South African and international standards, including the International Electrotechnical Commission (IEC) 60601 series of standards for medical electrical equipment, in order to be marketed and sold in South Africa. It must also be registered with the South African National Department of Health and the South African Health Products Regulatory Authority (SAHPRA). In South Africa, the regulatory landscape for neurology devices is continually changing and tightening up to protect patient safety and raise the standard of care.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Neurology Device Market Segmentation

The Neurology Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Neurostimulation

- ?Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Gastric Electric Stimulation

- Interventional Neurology

- Aneurysm Coiling & Embolization

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting

- Carotid Artery Stents

- Filter Devices

- Balloon Occlusion Devices

- Neurothrombectomy

- Clot Retriever

- Suction Aspiration Devices

- Snares

- CSF Management

- CSF Shunts

- CSF Drainage

- Neurosurgery Devices

- Ultrasonic Aspirators

- Stereotactic Systems

- Neuroendoscopes

- Aneurysm Clips

By End User (Revenue, USD Billion):

- ??Hospitals and Clinics

- Specialty Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.