South Africa Diabetes Devices Market Analysis

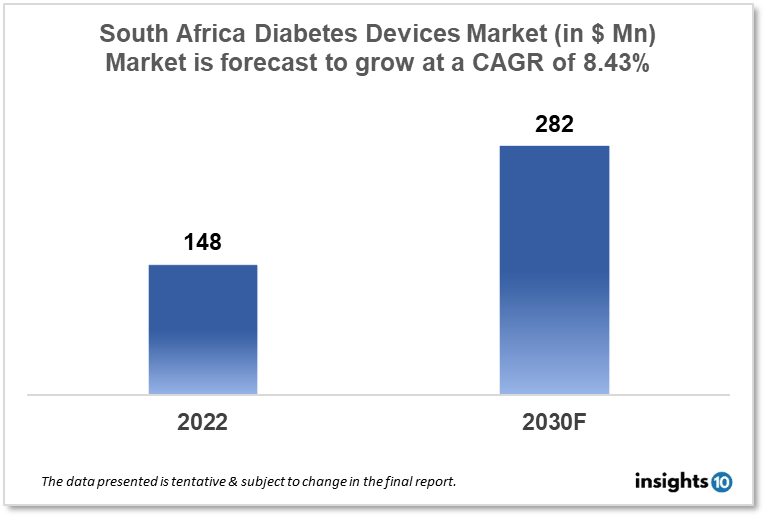

South Africa's Diabetes Devices Market is expected to grow from $148 Mn in 2022 to $282 Mn in 2030 with a CAGR of 8.43% for the forecasted year 2022-30. Diabetes is a severe health issue in South Africa, affecting 9.2% of the adult population. To meet the rising demand for diabetes devices. The market is segmented by type and by the end user. Some key players in this market include Gabler Medical, MediQ SHS, Johnson & Johnson, Philipps Healthcare, Medtronic, Roche and Dexcom.

Buy Now

South Africa Diabetes Devices Healthcare Market Executive Analysis

South Africa's Diabetes Devices Market is expected to grow from $148 Mn in 2022 to $282 Mn in 2030 with a CAGR of 8.43% for the forecasted year 2022-30. In South Africa, health spending totals $15.03 Bn, outperforming the updated projection of $14.87 Bn in 2021. This includes $6.12 Bn for district health services, $2.98 Bn for other health services, $2.56 Bn for hospital services at the central campus, $2.21 Bn for hospital services at the provincial campus and $0.56 billion for facility administration and upkeep.

Diabetes is highly prevalent in South Africa, where 4.5 million individuals will have the disease by 2022. In adults aged 20 to 79, this amounts to about 9.2% of the total adult population. Compared to rural areas, South Africa's cities have a greater prevalence of diabetes. The prevalence of diabetes is also significant in South Africa, with an estimated 692,000 new cases expected to be identified in 2022. In South Africa, type 2 diabetes accounts for 90–95% of all instances and is the most prevalent type of the disease. People with diabetes can examine their blood glucose levels at home or while on the go by using blood glucose monitoring devices. This enables them to better control their blood sugar levels and make the required dietary, exercise, and medication changes. People with diabetes can give insulin more precisely and conveniently with the aid of insulin delivery tools like pens, pumps, and syringes. This can enhance glycemic regulation and lower the danger of complications brought on by inadequate blood sugar management.

Market Dynamics

Market Growth Drivers

Diabetes is a serious health issue in South Africa, and it affects 9.2% of the adult population. To meet the rising demand for diabetes devices, manufacturers now have an opportunity to create and sell cutting-edge diabetes devices. Spending on healthcare in South Africa has increased recently, with an emphasis on expanding access to high-quality medical treatment. This includes financial support for initiatives aimed at managing and preventing diabetes, which is advantageous for producers of diabetes equipment. In South Africa, attention is being paid more to diabetes prevention and control through public health campaigns, educational initiatives, and community outreach programmes. Due to the rise in demand for diabetes devices and associated healthcare services, there are now business possibilities for diabetes device manufacturers.

Market Restraints

The diabetes device industry in South Africa is extremely competitive, with several well-established players vying for market share. Due to this, it may be challenging for new and up-and-coming manufacturers to establish themselves in the market and fight on both price and quality. In many areas of South Africa, especially in low-income communities, awareness and instruction about diabetes and diabetes management can be lacking. It may also have an adverse effect on sales for manufacturers by reducing the market for diabetes devices and associated healthcare services.

Competitive Landscape

Key Players

- Gabler medical (SA)

- MediQ SHS (SA)

- Johnson & Johnson

- DarioHealth

- Medtronic

- Philipps Healthcare

- Dexcom

Healthcare Policies and Regulatory Landscape

The South African Health Products Regulatory Authority (SAHPRA) is in charge of regulating diabetes equipment in South Africa. The goal of South Africa's regulatory framework is to guarantee the quality, efficacy, and safety of medical equipment for patients and healthcare professionals. Before being marketed and distributed in South Africa, diabetes devices must be registered with SAHPRA. To acquire registration, manufacturers must provide proof of the security, effectiveness, and calibre of their goods. The labelling and packaging of medical devices must comply with SAHPRA regulations, which include giving plain and accurate information about the device and its use. After their products have been given the go-ahead to go on sale, diabetes device manufacturers in South Africa are expected to keep an eye on the performance and safety of their products. This entails disclosing unfavourable incidents and acting appropriately to resolve any safety issues. The import and export of diabetes devices must adhere to SAHPRA regulations, which include getting the required permits and meeting customs and other legal requirements.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Devices Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into blood glucose monitoring systems, insulin delivery systems, and mobile applications for managing diabetes within the type segment. Due to its convenience, ease of use, and usefulness in providing patients and healthcare professionals with real-time insights regarding diabetic conditions for integrated diabetes management, the segment for diabetes management mobile applications is anticipated to grow at the highest rate during the forecast period. Bare-metal Stents

- Blood glucose monitoring systems

- Self-monitoring blood glucose monitoring systems

- Continuous glucose monitoring systems

- Test strips/Test papers

- Lancets/Lancing Devices

- Insulin delivery Devices

- Insulin pumps

- Insulin pens

- Insulin syringes and needles

- Diabetes management mobile applications

By End User (Revenue, USD Billion):

The diabetes market is divided into hospitals & specialty clinics and self & home care, based on the end user.

- Hospitals & Specialty Clinics

- Self & Home Care

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.