South Africa Depression Therapeutics Market Analysis

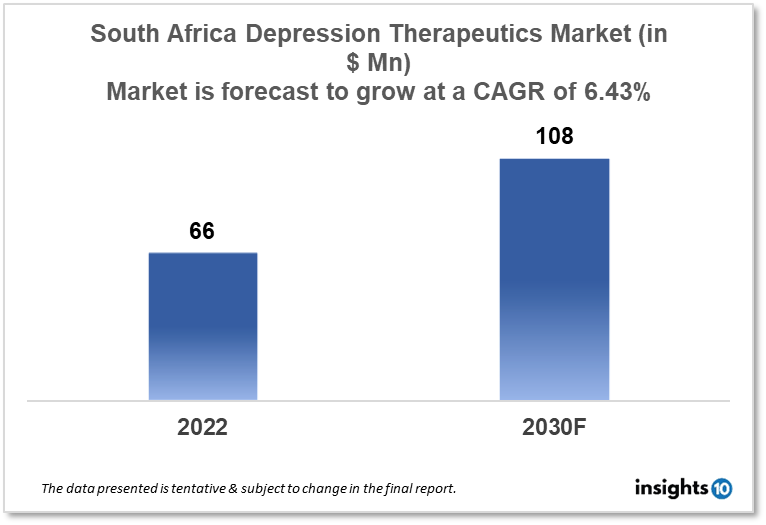

South Africa's depression therapeutics market is expected to grow from $66 Mn in 2022 to $108 Mn in 2030 with a CAGR of 6.43% for the forecasted year 2022-30. The development of new and innovative drugs for depression and the increase in awareness about depression and its treatment options are the major factors responsible for the growth of the market. The South African depression therapeutics market is segmented by drug type, therapies, indication, and by end users. Pharmafrica, Afriplex, and AbbVie are the major players in the South African depression therapeutics market.

Buy Now

South Africa Depression Therapeutics Market Executive Analysis

South Africa's depression therapeutics market is expected to grow from $66 Mn in 2022 to $108 Mn in 2030 with a CAGR of 6.43% for the forecasted year 2022-30. According to a recent study, South Africa's investment in each citizen's health has been stagnant for more than a decade, despite opportunities to increase funding. After Nigeria, the nation has the second-largest economy in Africa, with a GDP of $349.3 Bn. In terms of per capita GDP, South Africa, however, far outperforms its most populous African rival. South Africa's healthcare budget has grown by an average of 2.5 % per year since 1995-96. Public sector healthcare spending per capita has also risen to around $210 from $110.

Adverse childhood experiences, socioeconomic position, geographic location, age, marital status, and education levels all influence the prevalence of mental illness in South Africa. 25.7% of South Africans are undoubtedly depressed, with more than a quarter reporting moderate to severe depression symptoms. However, the prevalence of mental illness varied by region, with higher rates in the Northern Cape, Eastern Cape, Western Cape, Gauteng, and Mpumalanga.

Newer antidepressants with better tolerability and evidence-based collaborative care strategies are examples of advances in the treatment of depression in primary care. Collaborative care is defined as two or more practitioners from various health disciplines working together to diagnose and/or treat an individual patient. These advancements are critical in South Africa which lacks basic care for mental health workers. The South African National Drug Policy (1996) advises the use of generics to reduce drug costs and expenditures. This adds to a complete system of drug procurement, distribution, drug information, and rational use at all levels of South Africa's healthcare system. Selective serotonin reuptake inhibitors (SSRIs) selectively and potently inhibit serotonin re-uptake, resulting in a potentiation of serotonergic neurotransmission and therapeutic action in depression, anxiety, obsessional, and impulse control disorders.

Market Dynamics

Market Growth Drivers

Depression is a prevalent mental health condition in South Africa, and its incidence has been escalating in recent years. As a result, there is a rising demand for depression medicines. Significant progress has been made in the treatment of depression, including the development of innovative drugs and therapies. This has enhanced treatment effectiveness and improved patient results, which contribute to the South Africa's depression therapeutics market development. In South Africa, there is increasing awareness of mental health problems which has led to a greater acceptance of depression as a legitimate medical condition. This has reduced the stigma connected with the illness and encouraged more individuals to seek treatment.

Market Restraints

Mental disorders contribute considerably to disease burden but remain mainly undiagnosed and untreated in low- and middle-income countries (LMICs) such as South Africa. Only about a quarter of people suffering from depression receive therapy. South Africa's healthcare system is not as developed as in other countries, which can restrict the availability and accessibility of depression therapeutics. Patients may struggle to receive timely and effective therapy as a result of this. Depression treatments can be costly, making it difficult for some patients to obtain care. This is especially true for those who do not have health insurance. South Africa has faced economic challenges in recent years, which can restrict access to resources for healthcare services. This may impact patients' capacity to acquire and afford depression treatment.

Competitive Landscape

Key Players

- Sonke Pharmaceuticals (ZAF)

- Equity Pharmaceuticals (ZAF)

- Genop Healthcare (ZAF)

- Pharmafrica (ZAF)

- Afriplex (ZAF)

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Cipla

- Eli Lily

- GlaxoSmithKline

- Johnson & Johnson

Healthcare Policies and Regulatory Landscape

The National Health Insurance (NHI) system is a health financing system that aims to pool funds in order to provide all South Africans with access to quality, affordable personal health services based on their health requirements, regardless of socioeconomic status. NHI is intended to guarantee that individuals and their families do not face financial hardship as a result of using health care services. The formative phase of South Africa's Programme for Improving Mental Health Care (PRIME) aimed to develop a mental healthcare plan (MHCP) tailored to local conditions at the district level that provides acceptable and feasible collaborative care packages for depression, alcohol use disorders, and schizophrenia and can be integrated into existing service delivery platforms; and identify the human resource mix needed to deliver the MHCP and develop implementation strategies. The emphasis on these conditions is due to their relatively high disease and disability burdens, as well as evidence of cost-effective interventions for their treatment.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Pharmafrica, Afriplex, and AbbVie are the major players in the South Africa depression therapeutics market.

The South Africa depression therapeutics market is expected to grow from $66 Mn in 2022 to $108 Mn in 2030 with a CAGR of 6.43% for the forecasted year 2022-2030.

The South Africa depression therapeutics market is segmented by drug type, therapies, indication, and by end users.