South Africa Clinical Nutrition Market Analysis

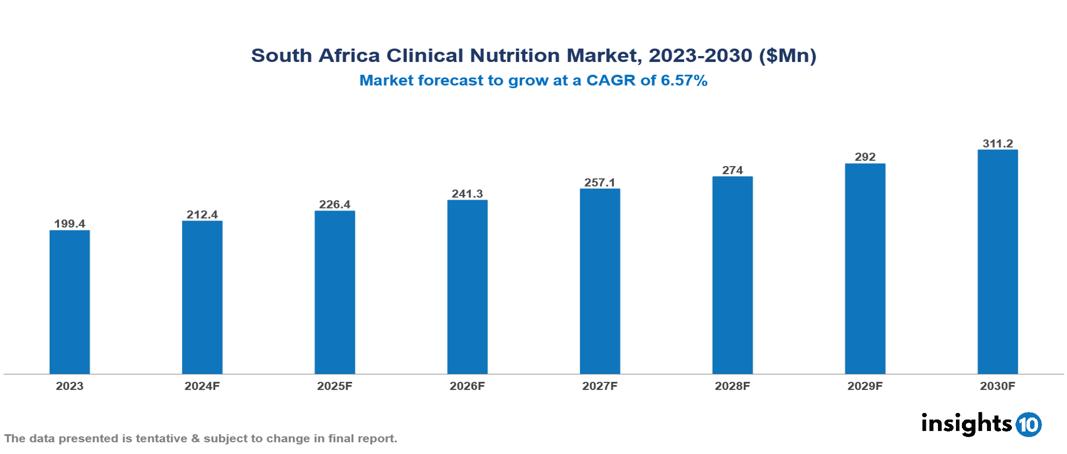

The South Africa Clinical Nutrition Market was valued at $199.4 Mn in 2023 and is projected to grow at a CAGR of 6.57% from 2023 to 2023, to $311.2 Mn by 2030. The key drivers of this industry are increasing prevalence of chronic diseases and metabolic disorders, aging population, increasing awareness of the importance of nutrition for health, product innovations and technological advancements, government initiatives and rising healthcare expenditure, rising incidence of malnutrition especially in paediatric patients which has contributed to market growth. The industry is primarily dominated by players such as Herbalife Nutrition, Optimum Nutrition, Abbott Nutrition, Pfizer Inc, Nestle, Mead Johnson & Company, LLC among others.

Buy Now

South Africa Clinical Nutrition Market Executive Summary

The South Africa Clinical Nutrition Market is at around $199.4 Mn in 2023 and is projected to reach $311.2 Mn in 2030, exhibiting a CAGR of 6.57% during the forecast period 2023-2030.

Clinical malnutrition refers to a condition that can be treated with clinical intervention by using specialized nutrients that are considered proper medications rather than as supplements. Clinical nutrition products are useful in maintaining the patient's health and enable the improvement of the body's metabolic system by providing adequate supplements, such as minerals, vitamins, and other supplements. The clinical nutrition sector is undergoing a transformation fuelled by progress in medical research and technology. Key trends such as innovative formulations, personalized nutrition solutions, and the use of bioactive ingredients are emerging. Manufacturers are dedicating resources to R&D to produce products that not only fulfil fundamental nutritional requirements but also provide added health advantages. This emphasis on innovation is fostering competition among industry participants, resulting in a constant flow of new products and therapies tailored to various patient demographics.

Clinical nutritionists or registered dietitians work in hospitals, clinics, and other healthcare facilities to, assess patients' nutritional status, develop personalized nutrition plans, provide nutrition education, manage nutrition-related diseases like diabetes, malnutrition etc, support optimal health and well-being. Some areas of focus in clinical nutrition include, critical care nutrition, paediatric nutrition, oncology nutrition, gastrointestinal nutrition, sports nutrition etc.

South Africa has seen a significant rise in the prevalence of non-communicable diseases (NCDs) in recent years. The prevalence of diabetes among adults in South Africa was 12.1% in 2021, up from 9.3% in 2010. The major drivers of Clinical Nutrition industry in South Africa are, increasing prevalence of chronic diseases and metabolic disorders, aging population, increasing awareness of the importance of nutrition for health, product innovations and technological advancements, government initiatives and rising healthcare expenditure, rising incidence of malnutrition especially in paediatric patients.

The industry is primarily dominated by players such as Herbalife Nutrition, Optimum Nutrition, Abbott Nutrition, Pfizer Inc, Nestle, Cipla Nutrition, Mead Johnson & Company, LLC among others.

Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Diseases: South Africa has seen a significant rise in the prevalence of non-communicable diseases (NCDs) in recent years. The prevalence of diabetes among adults in South Africa was 12.1% in 2021, up from 9.3% in 2010. The age-standardized prevalence of hypertension was 46.6% in 2021. The growing burden of these chronic conditions is driving the demand for specialized clinical nutrition products for management and treatment.

Malnutrition Burden: South Africa faces a dual burden of malnutrition, with both undernutrition and overnutrition prevalent. Around 27% of children under the age of 5 in South Africa are stunted, a sign of chronic undernutrition. At the same time, the prevalence of overweight and obesity among adults is 68% for women and 31% for men. The need to address this public health issue is a major driver for the clinical nutrition market in the country.

Aging Population: South Africa's population is aging, with the proportion of individuals aged 60 and above expected to increase from 8.1% in 2020 to 10.2% by 2030. The growing geriatric population has higher nutritional needs, fuelling the growth of the clinical nutrition market.

Market Revised

Uneven Distribution of Healthcare Resources: Only 16% of South Africans have access to private healthcare, while the majority rely on the public healthcare system. The distribution of healthcare facilities and resources is skewed, with rural and underserved areas often lacking access to specialized clinical nutrition services, which is hindering the growth of Clinical Nutrition market.

Limited Reimbursement Coverage: Clinical nutrition products and services are not always covered by medical aid schemes or government healthcare programs in South Africa. Only about 16% of the population has private medical aid coverage, limiting the affordability and accessibility of these products for a significant portion of the population. Thus, limiting it’s market growth.

Lack of Healthcare Professional Training: There is a shortage of healthcare professionals, such as dietitians and nutritionists, who are trained and equipped to provide comprehensive clinical nutrition services in South Africa. In 2020, there were only around 3,000 registered dietitians in the country, which is insufficient to meet the growing demand.

Regulatory Landscape and Reimbursement Scenario

Clinical nutrition regulation and reimbursement in South Africa are managed through a complex system involving several governmental bodies and regulatory frameworks. The primary regulatory authority is the South African Health Products Regulatory Authority (SAHPRA), which operates under the National Department of Health. SAHPRA is responsible for regulating medicines, medical devices, and complementary medicines, including many clinical nutrition products. The Department of Health also plays a crucial role in setting overall health policies and standards.

In South Africa, clinical nutrition products may be classified as medicines, medical devices, or foodstuffs, depending on their composition and intended use. Products classified as medicines undergo a more rigorous registration process, requiring clinical trial data and comprehensive safety and efficacy evaluations. The Foodstuffs, Cosmetics and Disinfectants Act governs the regulation of food products, including some nutritional supplements.

Reimbursement for clinical nutrition in South Africa is managed through a dual healthcare system comprising public and private sectors. The public sector, which serves the majority of the population, operates under the National Health Insurance (NHI) scheme, currently in the process of implementation. In the public sector, coverage for clinical nutrition products is limited and often restricted to essential nutritional support for hospitalized patients. The private sector, accessed by a smaller portion of the population with private health insurance, generally offers more comprehensive coverage for clinical nutrition interventions. However, the extent of coverage varies among different medical aid schemes.

Competitive Landscape

Key Players

Here are some of the major key players in the South Africa Clinical Nutrition Market:

- Herbalife Nutrition

- Optimum Nutrition

- Kellanova

- Aspen Nutritionals

- Nativa

- Amway

- Cipla Nutrition

- Abbott Nutrition

- Pfizer Inc.

- Nestle

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Clinical Nutrition Market Segmentation

By Product

- Oral Clinical Nutrition

- Parenteral Nutrition

- Carbohydrates

- Parenteral Lipid Emulsion

- Single Dose Amino Acid Solutions

- Trace Elements

- Vitamins & Minerals

- Enteral Feeding Formulas

- Standard Formula

- Disease-specific Formulas

- Others

By Application

- Alzheimer’s Disease

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By Sales Channel

- Retail Sales Channels

- Online Sales Channels

- Institutional Sales Channels

- Others

End Users

- Geriatric

- Adults

- Paediatric

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.