South Africa Chronic Pain Therapeutics Market Analysis

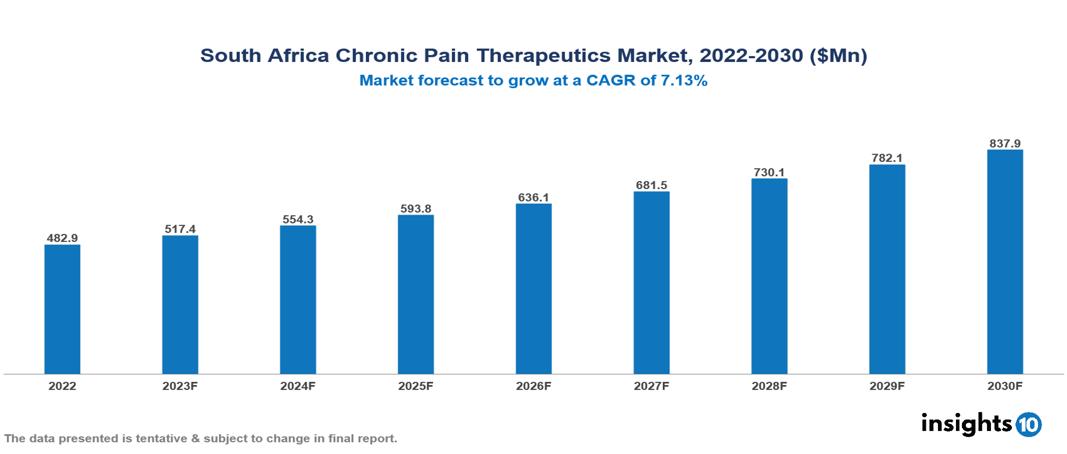

The South Africa Chronic Pain Therapeutics Market is anticipated to experience a growth from $483 Mn in 2022 to $838 Mn by 2030, with a CAGR of 7.13% during the forecast period of 2022-2030. The key drivers of the chronic pain therapeutics market include the increasing prevalence of chronic pain conditions, the continual progress in medical technology leading to innovative solutions, and heightened public awareness and education. The South Africa Chronic Pain Therapeutics Market encompasses various players across different segments, including Pfizer, GlaxoSmithKline, Novartis, Sanofi, AstraZeneca, Merck, Johnson and Johnson, Teva, Cipla, Mankind Pharma, etc., among various others.

Buy Now

South Africa Chronic Pain Therapeutics Market Analysis Executive Summary

The South Africa Chronic Pain Therapeutics Market is anticipated to experience a growth from $483 Mn in 2022 to $838 Mn by 2030, with a CAGR of 7.13% during the forecast period of 2022-2030.

Chronic pain refers to persistent discomfort that extends beyond the typical healing period, originating from various sources such as arthritis, fibromyalgia, nerve damage, or previous injuries. Its causes range from physical trauma and inflammation to neurological disorders, and psychological factors like stress and depression can exacerbate it. Treatment strategies focus on managing symptoms and improving quality of life, including the use of medications such as pain relievers, anti-inflammatories, and antidepressants to alleviate discomfort and address mood-related issues. Physical therapy aims to enhance mobility and functionality, while alternative therapies like acupuncture and massage provide additional relief. Cognitive-behavioral therapy helps individuals cope with pain and develop healthier coping mechanisms. In some cases, interventions like nerve blocks or spinal cord stimulation may be considered. A multidisciplinary approach tailored to individual needs, combining medical, psychological, and lifestyle interventions, often yields optimal results in reducing chronic pain and promoting overall well-being.

About 18.3% of persons in South Africa who are 15 years of age or older report having chronic pain. In comparison to males, women are more likely than men to endure chronic pain (20.1% vs. 15.8%). Furthermore, it is shown that as people age, chronic pain becomes more common in South Africa.

The key drivers of the chronic pain therapeutics market include the increasing prevalence of chronic pain conditions, the continual progress in medical technology leading to innovative solutions, and heightened public awareness and education.

Large multinational corporations: Novartis, Pfizer, Sanofi, AstraZeneca, and GlaxoSmithKline (GSK) probably have the largest market shares because of their well-known brands, wide range of product offerings, and established presence. The generic medication users are the target market for the local manufacturers, who specialize in particular market categories.

Market Dynamics

Market Growth Drivers

Prevalence of Chronic Pain Conditions: The frequency of chronic pain conditions, such as arthritis, fibromyalgia, and neuropathy, plays a pivotal role in shaping the demand for pain management medications and therapies. As these conditions become more widespread, there is a subsequent escalation in the need for effective treatment options to address the diverse range of chronic pain experiences.

Technological Advancements: The continual progress in medical technology introduces innovative solutions to the chronic pain therapeutics landscape. This includes the development of new drug formulations, advanced delivery systems, and non-pharmacological interventions. These technological breakthroughs not only enhance the efficacy of existing treatments but also open avenues for novel approaches to pain management, offering patients more diverse and sophisticated options.

Awareness and Education: Public awareness and education initiatives focusing on chronic pain conditions and available treatment modalities play a crucial role in driving demand for therapeutics. As individuals become more informed about the complexities of chronic pain and the array of interventions at their disposal, there is a heightened likelihood of seeking and advocating for comprehensive and tailored solutions. Increased awareness also contributes to reducing the stigma associated with chronic pain, fostering a more supportive environment for those seeking help.

Market Restraints

Affordability and Accessibility: Economic factors and disparities in healthcare access stand as significant hurdles, constraining the affordability and availability of pain therapeutics for specific segments of the population. As financial barriers persist, individuals facing economic challenges may encounter difficulties in obtaining and adhering to prescribed pain management medications, thereby impacting their overall health outcomes.

Alternative Therapies: The growing popularity and acceptance of alternative or complementary therapies present a potential challenge to the conventional pain therapeutics market. Modalities such as acupuncture, herbal remedies, or holistic approaches may attract attention and demand, diverting focus from traditional pharmaceutical solutions. This shift in patient preferences and treatment choices may influence the market dynamics and necessitate a broader, more inclusive approach to pain management strategies.

Healthcare Infrastructure: Insufficient healthcare infrastructure, characterized by a shortage of specialized pain management clinics or professionals, poses a formidable obstacle. The lack of dedicated resources and expertise may impede the effective delivery of pain therapeutics.

Healthcare Policies and Regulatory Landscape

The Department of Health in South Africa is responsible for formulating and implementing healthcare policies aimed at ensuring equitable access to quality healthcare services for all citizens. These policies address various aspects of healthcare, including disease prevention, health promotion, and the management of medical conditions. The South African Health Products Regulatory Authority (SAHPRA) plays a pivotal role in overseeing the regulation of drugs and medical devices in the country. Formerly known as the Medicines Control Council, SAHPRA was established to enhance regulatory efficiency and align with international standards. SAHPRA evaluates the safety, efficacy, and quality of pharmaceutical products and medical devices before they are approved for use in the country. The regulatory body is committed to ensuring that healthcare products meet the necessary standards and adhere to ethical practices.

Competitive Landscape

Key Players:

- Pfizer

- GlaxoSmithKline

- Novartis

- Sanofi

- AstraZeneca

- Merck

- Johnson and Johnson

- Teva

- Cipla

- Mankind Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Chronic Pain Therapeutics Market Segmentation

By Indication

- Neuropathic Pain

- Back Pain

- Headaches

- Arthritis Pain

- Muscular Pain

- Idiopathic Pain

- Others

By Drug Class

- Analgesics

- Opioids

- NSAIDs

- Anaesthetics

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.