South Africa Cardiovascular Diseases Therapeutics Market Analysis

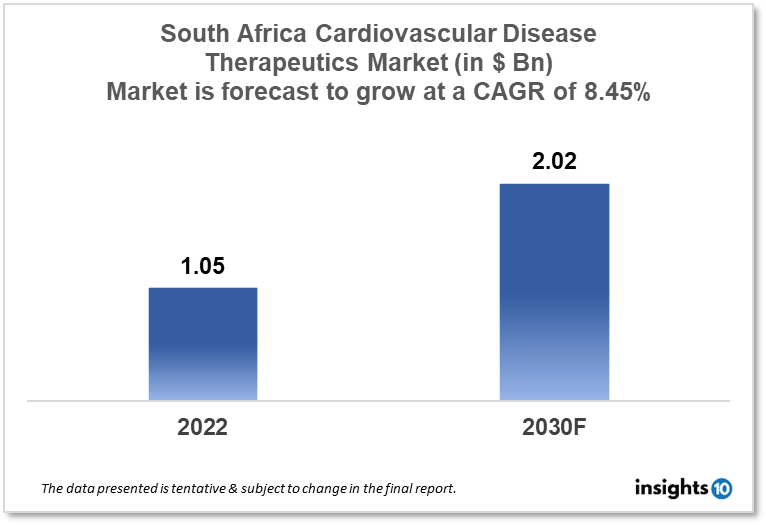

The South African cardiovascular disease therapeutics market is projected to grow from $1.05 Bn in 2022 to $2.02 Bn in 2030 with a CAGR of 8.45% for the year 2022-2030. The rising elderly population leading to the increasing incidence of cardiovascular diseases in South Africa is responsible for the growth of the market. The South African cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by the end user. Wraps, Afriplex, and Daiichi Sankyo are the major players in the South African cardiovascular disease therapeutics market.

Buy Now

South Africa Cardiovascular Disease Therapeutics Market Executive Analysis

The South African cardiovascular disease therapeutics market is at around $1.05 Bn in 2022 and is projected to reach $2.02 Bn in 2030, exhibiting a CAGR of 8.45% during the forecast period. According to budget documents from the National Treasury, the government of South Africa will allot at least $44 Bn to health over the course of the three-year Medium Term Expenditure Framework (MTEF), to support the supply of and equitable access to healthcare services. The documentation states that the allocation will enable the health sector to concentrate on clearing the backlog in essential health services. Additional money for the health function totalling $0.41 Bn in 2023–24, $0.42 Bn in 2024–25, and $0.44 Bn in 2025–26 is included in the budget for 2023.

According to recent research, when compared to the 4.29% reported for stroke, South Africa's overall national prevalence of coronary heart disease (CHD) is still relatively low at 1.29%.African ancestry hypertensive patients are a distinct patient group that exhibits some distinctive characteristics, according to Rizos and Elisaf. These patients frequently have early onset, increased incidence, and poor blood pressure management. They frequently have additional concurrent cardiovascular disease (CVD) risk factors when they appear at medical facilities. Drug classes that have been shown to lower cardiovascular events in people with diabetes should be used in the treatment of hypertension. (ACE inhibitors, angiotensin receptor blockers, thiazide-like diuretics, or dihydropyridine calcium channel blockers). In most cases, multiple drug treatment is necessary to reach blood pressure goals. However, it's not a good idea to combine ACE inhibitors with angiotensin receptor blockers or ACE inhibitors or angiotensin receptor blockers with straight renin inhibitors.

Market Dynamics

Market Growth Drivers

Cardiovascular diseases, such as hypertension, coronary artery disease, and stroke, are very prevalent in South Africa. As a result, therapeutics to manage and cure these conditions are in high demand. Since older people are more likely to acquire cardiovascular diseases, the ageing population in South Africa is driving the South Africa cardiovascular disease therapeutics market.

Market Restraints

One of the main obstacles to having an integrated healthcare system with an efficient data flow is the lack of resources required to track the treatment of CVDs in South Africa. These resources include physical, financial, and technological infrastructure. These elements impede market expansion. For many patients, especially those without health insurance or with limited financial means, the cost of cardiovascular disease therapeutics in South Africa can be unaffordable. This restricts the population's access to care and prevents South Africa's cardiovascular disease therapeutics market expansion.

Competitive Landscape

Key Players

- Clinigen (ZAF)

- Sonke Pharmaceuticals (ZAF)

- Specpharm (ZAF)

- Wrapsa (ZAF)

- Afriplex (ZAF)

- Daiichi Sankyo

- Johnson & Johnson

- Gilead Sciences

- Par Pharmaceutical

- United Therapeutics

- Nippon Shinyaku

- Lupin

- Silvergate Pharmaceuticals

Healthcare Policies and Regulatory Landscape

The National Health Insurance (NHI) plan, which aims to give all South Africans access to universal health coverage, is one of the main policies in this respect. All citizens should have access to high-quality healthcare services, including those required to avoid and manage CVD, according to the NHI. A number of provinces are presently running pilot programs as part of the scheme's gradual implementation. The South African government has put in place a number of reimbursement policies in addition to the NHI with the goal of enhancing access to CVD therapies. For instance, certain CVD treatments, such as medication, surgery, and rehabilitation services, must be covered by the nation's medical assistance schemes (private health insurance companies). To guarantee that CVD treatments are accessible to those who cannot afford private healthcare, the government also funds public hospitals. Furthermore, the South African government has implemented a number of public health interventions targeted at preventing CVD. These include programs that encourage healthy behaviours and lower risk factors like tobacco use, poor diets, and inactivity. As a high salt intake is a significant risk factor for CVD, the government has also enacted policies targeted at reducing the salt content in food products.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.