South Africa Cardiac Surgery Instruments Market Analysis

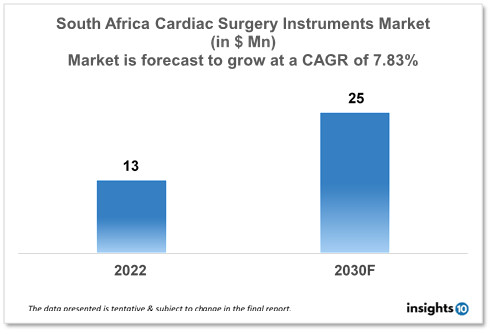

The South Africa Cardiac Surgery Instruments Market is expected to witness growth from $13 Mn in 2022 to $25 Mn in 2030 with a CAGR of 7.83% for the forecasted year 2022-2030. Increase in the prevalence of Coronary Artery Disease (CAG) in South Africa. As more patients need surgical procedures to control their conditions, this is increasing demand for cardiac surgery instruments. The market is segmented by type, application and by end user. Some key players in this market include SSEM Mthembu Medical, NuAngle Medical, LivaNova, B. Braun, Medline Industries, KLS Martin, and STILLE.

Buy Now

South Africa Cardiac Surgery Instruments Healthcare Market Executive Analysis

The South Africa Cardiac Surgery Instruments Market size is at around $13 Mn in 2022 and is projected to reach $25 Mn in 2030, exhibiting a CAGR of 7.83% during the forecast period. South Africa spends more on healthcare (14% as opposed to 11%) than other nations. The current administration has been working to enlarge the health expenditure line item. It will be challenging to execute National Health Insurance (NHI) because of the high cost, which is predicted to be $16.5 Bn annually by 2025. $16.4 billion, or 1.1% more than the previous year, was allocated to healthcare in the South African health budget.

In South Africa, Cardiovascular Disease (CVD) is a serious public health concern that accounts for a large number of fatalities and disabilities. Heart illness is the primary cause of death for about 225 South Africans each day. A 5.5 million case projection, or 10% of the population, was made for South Africa's CVD prevalence in 2020. In South Africa, where roughly 6 million people are affected, hypertension (high blood pressure) is a significant CVD risk factor. In South Africa, cardiac surgery instruments are essential tools used in surgical operations involving the heart and blood vessels. In open-heart surgeries, where the chest cavity must be opened to reach the heart, cardiac surgery equipment is crucial. Scalpels, clamps, retractors, and cannulas are some of the tools used in these operations. They help control bleeding, conduct operations on the heart and blood vessels, and aid in ventilation.

In South Africa, CABG surgery is a common cardiac procedure that includes rerouting blood flow around obstructed or constrictive coronary arteries. Blood vessels are harvested and the grafting process is carried out using cardiac surgery tools like clamps, scissors, and grafting devices. In South Africa, pacemakers and defibrillators are implanted via operation using cardiac surgery tools. These gadgets control heart rhythm and guard against unexpected cardiac death. Over the past few years, minimally invasive cardiac procedures have become more common in South Africa because they are associated with smaller incisions and less bodily trauma. During these procedures, the heart and blood vessels are seen using minimally invasive surgical tools, endoscopes, and catheters, which help doctors deliver treatments more accurately. During operations to replace or repair damaged heart valves, cardiovascular surgery equipment is used in South Africa. The removal and replacement of injured valves, as well as the repair of the valve to stop regurgitation, are all done with the aid of valve holders, sutures, and annuloplasty rings.

Market Dynamics

Market Growth Drivers

Changing lifestyles, an ageing population, and a high incidence of risk factors like smoking, obesity, and diabetes are all contributing to an increase in the prevalence of coronary artery disease in South Africa. As more patients need surgical procedures to control their conditions, this is increasing demand for cardiac surgery instruments. Significant technological developments, such as the creation of new surgical instruments and devices that give greater precision and efficiency during surgical operations, are being seen in South Africa's market for cardiac surgery instruments. Market growth is anticipated to be driven by manufacturers who can provide cutting-edge, innovative products that address unmet clinical requirements. The expanding middle class in South Africa has more disposable money and is prepared to spend more on healthcare options. This is increasing demand for more complex and cutting-edge cardiac surgery tools, which benefit patients more. Particularly in the field of cardiac surgery, South Africa is fast growing as a popular location for medical travellers. Patients from both domestic and foreign countries are drawn to the nation because it provides high-quality, affordable healthcare services, including heart surgery, which is boosting demand for cardiac surgery equipment.

Market Restraints

The regulatory environment in South Africa can be complicated and difficult for manufacturers, especially for those looking to launch novel products. Smaller manufacturers' ability to expand their markets may be constrained by the time and expense required to obtain regulatory clearance. The high price of cardiac surgery tools could prevent widespread use, especially in low-income areas where patients might not be able to afford more costly surgical procedures. For producers of more sophisticated, cutting-edge cardiac surgery tools, this might restrict market expansion.

Competitive Landscape

Key Players

- SSEM Mthembu Medical (SA)

- NuAngle Medical (SA)

- Tekmed (SA)

- LivaNova

- B. Braun

- KLS Martin

- Medline Industries

- STILLE

Healthcare Policies and Regulatory Landscape

The South African government has made healthcare a top priority, and policies targeted at enhancing access to medical services—including cardiac surgery—reflect this. For instance, the National Health Insurance (NHI) scheme seeks to give all South Africans access to healthcare services, including those who need cardiac surgery. The regulatory environment in South Africa's cardiac surgery instruments industry is overseen by the South African Health Products Regulatory Authority (SAHPRA). The production, import, export, and distribution of medical devices, including tools used in cardiac surgery, are subject to SAHPRA regulation. Medical equipment needs to adhere to SAHPRA's safety and efficacy requirements in order to be authorized for use in South Africa. The market for cardiac surgery instruments in South Africa is governed by worldwide standards in addition to regional laws. Medical device standards have been created by the International Organization for Standardization (ISO), including ISO 13485, which specifies the requirements for quality management systems in the South African cardiac surgery instruments market.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiac Surgery Instruments Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into segments in this study based on the goods, applications, end users, and geographical areas. The market is divided into forceps, scissors, needle holders, clamps, and other cardiac surgery instruments based on the product. In 2017 the forceps category led the market, and it is anticipated that it will increase at the fastest rate going forward. The rise in heart surgeries and the frequent usage of forceps in most cardiac procedures are credited with the segment's strong growth.

- Forceps

- Vascular Forceps

- Grasping Forceps

- Other Forceps

- Needle Holders

- Scissors

- Clamps

- Other Cardiac Surgical Instruments

By Application (Revenue, USD Billion):

The market is further segmented by application into paediatric cardiac surgery, heart valve surgery, coronary artery bypass graft (CABG), and other applications. The South Africa market's largest and fastest-growing application segment is CABG. This is mostly explained by the increased prevalence of heart illnesses and the consequent rise in surgical treatments. The second-largest category is heart valve surgery.

- Coronary Artery Bypass Graft (CABG)

- Heart Valve Surgery

- Pediatric Cardiac Surgery

- Other Applications

By End User (Revenue, USD Billion):

Based on the end user, the market is segmented into hospitals and cardiac centers, and ambulatory surgery centers. The hospitals and cardiac centers segment is expected to dominate the market for cardiac surgery instruments. Growth in this end-user segment can be attributed to the increasing incidence of cardiac and heart valve diseases and the subsequent increase in the number of cardiac surgery procedures.

- Hospitals and Cardiac Centers

- Ambulatory Surgery Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.