South Africa Cardiac Resynchronization Therapy Market

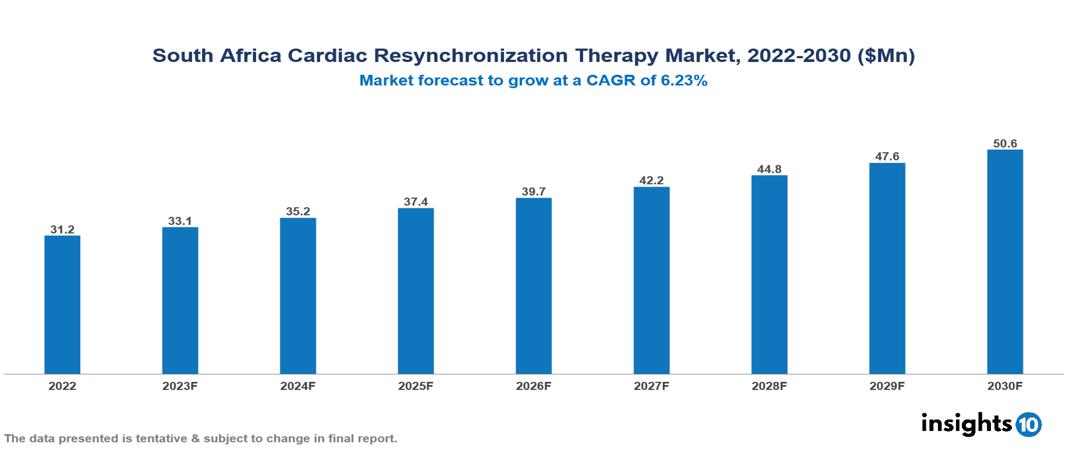

South Africa Cardiac Resynchronization Therapy Market valued at $31 Mn in 2022, projected to reach $51 Mn by 2030 with a 6.23% CAGR. The significant rise in global heart failure instances, linked to the aging population and cardiovascular issues related to lifestyle, plays a crucial role in propelling the expansion of the Cardiac Resynchronization Therapy (CRT) market. Currently, major players in this market include Abbott, Boston Scientific, Medtronic, Biotronik, Siemens Healthineers, St. Jude Medical, LivaNova, Sorin Group, Oscor, and Lepu Medical Technology.

Buy Now

South Africa Cardiac Resynchronization Therapy Market Executive Summary

South Africa Cardiac Resynchronization Therapy Market valued at $31 Mn in 2022, projected to reach $51 Mn by 2030 with a 6.23% CAGR.

Cardiac resynchronization therapy (CRT) is a medical procedure utilizing a pacemaker to correct the heart's rhythm through a minimally invasive surgical approach. Implanted beneath the skin, the CRT pacemaker works to synchronize the timing between the upper and lower heart chambers, promoting coordination between the left and right sides of the heart. This intervention proves particularly advantageous for individuals experiencing heart failure, effectively addressing issues such as inadequate pumping and fluid retention in the lungs and legs resulting from the asynchronous beating of the heart's lower chambers. In instances of severe heart rhythm irregularities, the CRT therapy may be complemented by the addition of an implantable cardioverter-defibrillator (ICD). The CRT device connects wires from the pacemaker to both sides of the heart, employing biventricular pacing to ensure synchronized contractions and optimize overall heart function.

Cardiovascular disease (CVD), including heart attacks and strokes, is the second leading cause of death in South Africa. Five people experience a heart attack every hour, resulting in ten fatalities, while high blood pressure affects one in three South Africans over 15. Heart attacks lead to approximately 33 daily deaths, and strokes contribute to 60 fatalities. High blood pressure is the leading risk factor for heart attacks, accounting for 42% of cases, alongside other major risk factors such as an unhealthy diet, physical inactivity, smoking, obesity, and diabetes. Societal factors like poverty, limited healthcare access, and unhealthy living environments exacerbate the problem, emphasizing the urgent need for comprehensive strategies to address these challenges and reduce the impact of CVD on the population.

In South Africa, a multicenter study is comparing the effectiveness of CRT-defibrillators (CRT-Ds) versus CRT-pacemakers (CRT-Ps) in preventing heart failure hospitalizations to inform treatment guidelines and resource allocation decisions. Additionally, there's a growing interest in using telehealth technologies for remote monitoring of patients with CRT devices to improve outcomes and reduce healthcare costs. Pilot studies are underway to assess the feasibility and effectiveness of implementing remote monitoring in South Africa, collectively advancing cardiovascular care and optimizing healthcare resource allocation.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Cardiovascular Diseases: cardiovascular disease (CVD), encompassing heart attacks and strokes, stands as the second most prevalent cause of mortality in South Africa. Every hour, 5 individuals in the country suffer a heart attack, leading to 10 fatalities. The increasing incidence of cardiovascular disease (CVD) serves as a significant driver for the growth of the CRT market in South Africa.

Technological Advancements: In South Africa, Abbott introduced the Encora III CRT-P device, incorporating Bluetooth connectivity and remote monitoring capabilities. The latest generation of CRT devices is characterized by a more compact size, enhanced efficiency, and added features such as remote monitoring. These technological advancements not only contribute to improved patient outcomes but also play a pivotal role in propelling market growth.

Rising Investments and Support: Recognizing the significance of enhancing cardiac care accessibility, particularly in the realm of CRT, the National Department of Health (NDoH) in South Africa acknowledges the need for comprehensive efforts. The anticipated boost in the CRT market in the country is attributed to the presence of local distributors and the expanding initiatives aimed at raising public awareness about heart diseases.

Market Restraints

Elevated Expense of Devices and Procedures: The exorbitant costs associated with CRT devices and their implantation procedures frequently surpass the financial means of many South Africans, particularly those residing in disadvantaged communities. This creates a substantial obstacle to accessibility, exacerbating healthcare disparities.

Disparities in Healthcare Access: Discrepancies in geographical locations and socioeconomic status contribute to uneven access to quality healthcare, including specialized cardiac care and CRT procedures. Individuals in rural areas and lower-income brackets often encounter significant difficulties in obtaining this life-saving therapy.

Insufficient Availability of Trained Professionals: A shortage of proficient cardiologists and technicians with expertise in CRT procedures remains a critical bottleneck. This shortage restricts the number of patients who can receive treatment and impedes the broader implementation of this technology.

Healthcare Policies and Regulatory Landscape

In South Africa, the oversight of healthcare policies and regulations for therapeutic drugs falls under the jurisdiction of the South African Health Products Regulatory Authority (SAHPRA). SAHPRA is responsible for the registration, licensing, and post-market surveillance of various health products, with a particular focus on pharmaceuticals. The Department of Health (DoH) plays a pivotal role in shaping healthcare policies, and adherence to Good Manufacturing Practice (GMP) standards is essential for pharmaceutical manufacturers to guarantee the quality and safety of therapeutic drugs. SAHPRA regulates clinical trials, and the ongoing implementation of the National Health Insurance (NHI) in South Africa has the potential to impact the financing and reimbursement policies associated with specific drugs.

Competitive Landscape

Key Players

- Abbott

- Boston Scientific

- Medtronic

- Biotronik

- Siemens Healthineers

- St. Jude Medical

- LivaNova

- Sorin Group

- Oscor

- Lepu Medical Technology

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Cardiac Resynchronization Therapy Market Segmentation

By Product

- CRT-Defibrillator

- CRT-Pacemaker

By Age

- Below 44 years

- 45-64 years

- 65-84 years

- Above 85 years

By End-Users

- Hospitals

- Cardiac care Centres

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.