South Africa Cardiac Arrhythmia Therapeutics Market Analysis

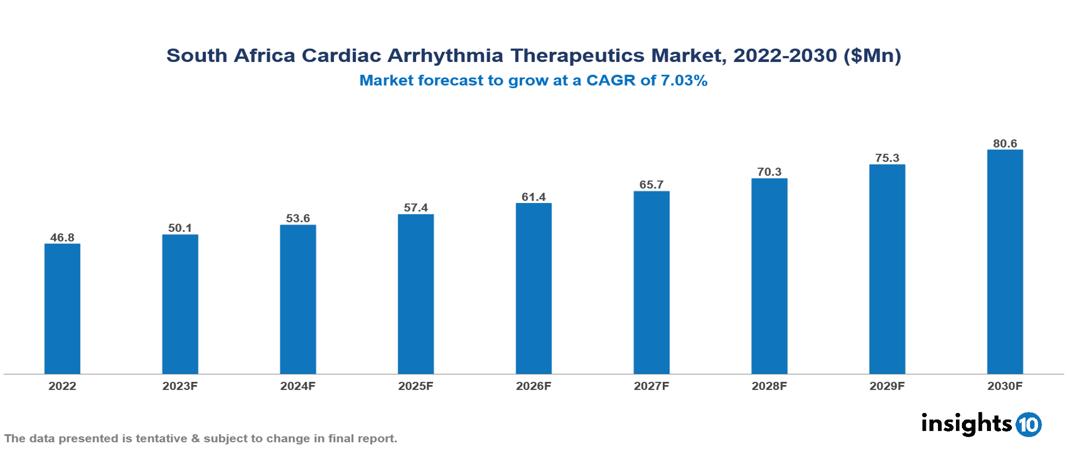

South Africa Cardiac Arrhythmia Therapeutics Market valued at $47 Mn in 2022, projected to reach $81 Mn by 2030 with a 7.03% CAGR. The key drivers of this industry include the rising burden of cardiovascular diseases, technological advancements, and supportive government policies. The industry is primarily dominated by players such as Abbott, Pfizer, MediRite, Clicks Group, Ascendis, Dis-Chem, and Medtronic among others.

Buy Now

South Africa Cardiac Arrhythmia Therapeutics Market Analysis: Executive Summary

South Africa Cardiac Arrhythmia Therapeutics Market valued at $47 Mn in 2022, projected to reach $81 Mn by 2030 with a 7.03% CAGR.

Cardiac arrhythmia denotes an irregular heartbeat, characterized by the heart beating too rapidly, too slowly, or in an irregular pattern. This condition can disrupt the heart's normal functioning, impacting its efficiency in pumping blood. Common triggers for cardiac arrhythmias encompass underlying heart conditions like coronary artery disease, heart valve disorders, high blood pressure, diabetes, smoking, alcohol consumption, and stress. Symptoms may manifest as palpitations, chest discomfort, dizziness, fainting, and fatigue, typically diagnosed through ECG or EKG tests. Various treatments, including anti-arrhythmic drugs, beta-blockers, and calcium channel blockers, aim to regulate heart rhythm and rate. Additionally, implantable devices such as pacemakers or defibrillators are employed. Leading companies in the development of treatments for cardiac arrhythmias include Medtronic, Boston Scientific, Abbott Laboratories, and Johnson & Johnson, all actively contributing to the advancement of innovative medical devices and pharmaceuticals.

Cardiovascular diseases pose a significant public health burden with atrial fibrillation affecting around 0.6% of the South African population. The market is being fuelled by significant factors such as the rising prevalence of cardiac arrhythmias, technological advancements, and supportive government policies. However, conditions such as high costs of treatment for the South African population, disparities in the health system, and limited coverage restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising burden of CVDs: South Africa is experiencing a demographic shift towards an older population, and it is anticipated that the percentage of people aged 60 and above will rise in the forecasted period. This aging demographic is particularly vulnerable to cardiovascular diseases, including arrhythmias. The estimated prevalence of atrial fibrillation is around 0.6%. The growing prevalence of factors such as obesity, smoking, alcohol use, and lack of physical activity in South Africa is also exacerbating the risks associated with cardiovascular diseases and arrhythmias.

Technological advancements: The progress in developing novel medications such as antiarrhythmics with reduced side effects, along with the advancement of minimally invasive ablation procedures, is enhancing treatment choices and may appeal to a broader patient base. Additionally, technological breakthroughs in telehealth and remote monitoring have the potential to improve the accessibility and affordability of arrhythmia management, especially in rural areas.

Supportive government policies: The South African authorities are directing additional resources towards the healthcare sector, with the potential to enhance accessibility to diagnostic tools and treatments for arrhythmia. Efforts to broaden the scope of health insurance, such as the National Health Insurance Scheme (NHIS), may contribute to making arrhythmia therapies more affordable for a larger segment of the population.

Market Restraints

High costs of treatment: Medications, specific medical tools, and treatments designed for arrhythmias can incur high costs, making them inaccessible to a considerable portion of the population. This challenge is particularly pronounced for individuals lacking health insurance or dealing with financial limitations.

Healthcare disparities: A shortage of cardiologists and electrophysiologists with expertise in managing arrhythmias is evident, especially in rural areas, resulting in limited availability of specialized care. Urban areas have greater access to specialists, advanced diagnostic tools, and treatment alternatives, creating geographical discrepancies in healthcare provision.

Limited coverage: The National Health Insurance (NHI) program provides only partial coverage for treatments related to arrhythmia, resulting in substantial expenses for patients. The absence of well-defined and uniform reimbursement protocols for arrhythmia treatments introduces uncertainty, affecting both patients and healthcare providers and impeding the accessibility of necessary care.

Healthcare Policies and Regulatory Landscape

The regulatory authority for therapeutics in South Africa is the South African Health Products Regulatory Authority (SAHPRA). SAHPRA is responsible for ensuring the safety, efficacy, and quality of health products, including pharmaceuticals and medical devices, in the country. The authority was established to replace the Medicines Control Council (MCC) and operates independently to regulate and monitor the entire life cycle of health products, from preclinical development to post-market surveillance.

To obtain licensure for therapeutics in South Africa, pharmaceutical companies must follow a rigorous process outlined by SAHPRA. SAHPRA assesses the documentation to evaluate the safety and efficacy of the therapeutic product. If the product meets the required standards, SAHPRA grants marketing authorization.

For new entrants into the therapeutic market in South Africa, the regulatory environment is stringent but transparent. Companies must adhere to international standards and provide thorough documentation to meet SAHPRA's requirements. While this can pose challenges for new players, it also ensures a level playing field and maintains the integrity of the pharmaceutical market.

Competitive Landscape

Key Players

- Abbott Laboratories

- Pfizer

- Merck

- Boston Scientific

- Johnson & Johnson

- AstraZeneca

- MediRite

- Dis-Chem Pharmacies

- Ascendis Health

- Clicks Group

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Cardiac Arrhythmia Therapeutics Market Segmentation

By Test Equipment

- Electrocardiogram (ECG)

- Holter monitor

- Others

By Site of Origin

- Atrial Fibrillation

- Sinus Bradycardia

- Atrial Tachycardia

- Atrial Flutter

- Premature Atrial Contractions (PACS)

- Others

By Type

- Supraventricular Tachycardias

- Ventricular Arrhythmias

- Bradyarrhythmia’s

By Drug Type

- Antiarrhythmic drugs

- Calcium channel blockers

- Beta blockers

- Anticoagulants

- Others

By Mode of Administration

- Injectable

- Oral

- Others

By Distribution channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.