South Africa Blood Disorder Therapeutics Market

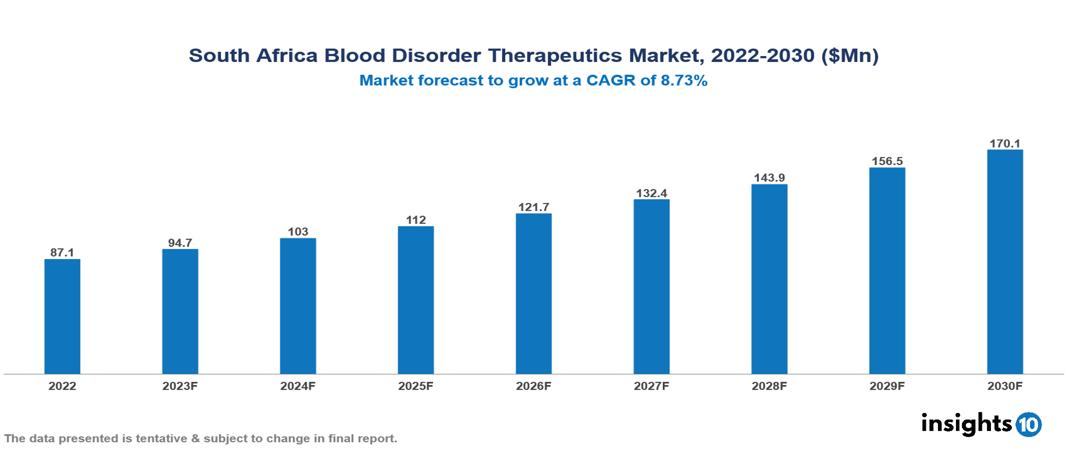

South Africa Blood Disorder Therapeutics Market valued at $87 Mn in 2022, projected to reach $170 Mn by 2030 with a 8.37% CAGR. The key drivers include the implementation of initiatives like collaborative efforts between government agencies, NGOs, and pharmaceutical businesses, demographic factors influencing blood disorders prevalence, and the anticipation of introducing novel therapies, leading to increased research, development, and infrastructure investments in the field. The South Africa Blood Disorder Therapeutics Market encompasses various players across different segments, including Takeda, Pfizer, AstraZeneca, Sanofi, Aspen, Adcock Ingram, Eisai, BGM, Gilead Sciences, Sunrise Pharmaceuticals etc, among various others.

Buy Now

South Africa Blood Disorder Therapeutics Market Executive Summary

South Africa Blood Disorder Therapeutics Market valued at $87 Mn in 2022, projected to reach $170 Mn by 2030 with a 8.37% CAGR.

Blood diseases comprise a wide spectrum of illnesses that impact the various components of blood, such as platelets, plasma, white blood cells, and red blood cells. These illnesses result in abnormalities in blood composition and function and can be caused by genetic causes, environmental factors, or underlying medical problems. One of the most prevalent blood conditions, anemia, is caused by a lack of red blood cells, or hemoglobin, which reduces the blood's capacity to deliver oxygen to tissues and organs. Leukemia is a kind of cancer in which white blood cells proliferate abnormally, weakening the immune system and displacing healthy blood cells. Thrombocytopenia, a condition marked by a low platelet count, raises the possibility of severe bleeding and bruises. Among the noteworthy advancements were gene treatments, which target the underlying genetic origins of some blood illnesses like hemophilia and may provide long-term cures. Furthermore, improvements in precision medicine have produced more individualized treatment plans that take into account a patient's unique genetic composition as well as the particulars of their blood condition.

Hemoglobin disorders, including thalassemia and sickle cell disease, are prevalent in the area, accounting for about 70% of all hemoglobinopathies. The trait genes for these disorders are carried by around 5% of the global population. Furthermore, anemia is quite prevalent in South Africa, affecting 17% of men and 31% of women.

The key drivers include the implementation of initiatives like collaborative efforts between government agencies, NGOs, and pharmaceutical businesses, demographic factors influencing blood disorders prevalence, and the anticipation of introducing novel therapies, leading to increased research, development, and infrastructure investments in the field.

Pfizer has successfully acquired Global Blood Therapeutics, Inc. (GBT), a firm that specializes in the treatment of sickle cell disease. Pfizer's position in South Africa has improved as a result of this purchase, especially in the area of sickle cell disease therapy. Other notable participants include Novartis, which has a substantial market share in thalassemia therapies, and Roche, which is frequently mentioned as the industry leader in hemophilia treatments.

Market Dynamics

Market Growth Drivers

Expanding Healthcare Access and Investment: The goal of initiatives like the National Health Insurance (NHI) is to increase access to necessary medications, such as those for blood disorders. Research and development efforts and access to novel medications are enhanced when government agencies, non-governmental organizations, and pharmaceutical businesses collaborate. Treatment accessibility is improved by investments in clinics, hospitals, and skilled medical workers, especially in underprivileged regions.

Demographics Particular to the Country: An elevated risk of blood illnesses such as immune thrombocytopenic purpura (ITP) is associated with a high incidence of HIV. In South Africa, some ethnic groups are more prone to certain blood illnesses, such as thalassemia. Blood problems can be made worse by poverty, hunger, and restricted access to clean water and sanitary facilities.

No Authorized Innovative Therapeutics: Although there is presently no approved novel therapy, such as gene therapies, there is enthusiasm and expectation surrounding its possible introduction. Research, development, and infrastructure preparation for potential adoption are sparked by this, and investments in these areas are made. The lack of direct rivalry creates opportunities for global cooperation and joint ventures with well-established global producers. This can expedite local development initiatives by bringing in resources, technological transfer, and experience.

Market Restraints

Healthcare System Difficulties: Inadequate infrastructure and uneven distribution of healthcare facilities make it difficult for people to receive diagnosis and treatment, especially in rural regions. Hematologists, nurses, and other experts in short supply put a burden on the system and restrict patient treatment. Particularly in isolated areas, ineffective cold chain equipment and distribution networks make it difficult to consistently get necessary prescription drugs.

Affordability and Budgetary Restrictions: A sizable fraction of the population that depends on out-of-pocket payments cannot afford the cost of several key blood condition medicines. Many people are left susceptible to the cost of treatment due to inadequate health insurance coverage.

Stigma and Discrimination: Reluctance to reveal a diagnosis or seek medical attention out of fear of discrimination or judgment. Some blood illnesses, such as sickle cell disease, are stigmatized, which makes people less likely to get treatment and stick with it.

Healthcare Policies and Regulatory Landscape

The South African Health Products Regulatory Authority (SAHPRA), the nation's drug regulatory authority, is essential to maintaining public health since it manages the quality, safety, and registration of medications and medical equipment in South Africa. Before new drugs are put on the market, the organization is entrusted with assessing and approving them to make sure they are safe, effective, and of high quality. SAHPRA is responsible for overseeing the safety and quality of goods throughout their lifespan, even after they have been initially approved. To keep up to date with worldwide advances and improvements in the pharmaceutical business, the regulatory body works in partnership with a range of stakeholders, such as pharmaceutical firms, healthcare professionals, and foreign regulatory organizations. Furthermore, SAHPRA actively participates in post-marketing surveillance, swiftly attending to any unfavorable occurrences or safety issues with pharmaceutical goods. SAHPRA ensures that people in South Africa have access to safe and effective drugs and creates a climate that is supportive of medical innovation by maintaining strict regulatory requirements.

Competitive Landscape

Key Players:

- Takeda

- Pfizer

- AstraZeneca

- Sanofi

- Aspen

- Adcock Ingram

- Eisai

- BGM

- Gilead Sciences

- Sunrise Pharmaceutical

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.